Question: Please help me with answer to all the questions Consider a six month call option written on a non-dividend paying stock with annual stock price

Please help me with answer to all the questions

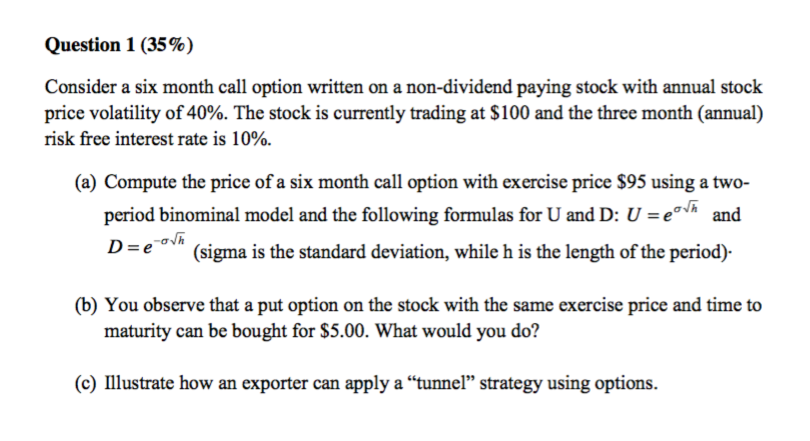

Consider a six month call option written on a non-dividend paying stock with annual stock price volatility of 40%. The stock is currently trading at $100 and the three month (annual) risk free interest rate is 10%. Compute the price of a six month call option with exercise price $95 using a two-period binominal model and the following formulas for U and D: U = e^sigma Squareroot h and D = e^-sigma Squareroot h (sigma is the standard deviation, while h is the length of the period). You observe that a put option on the stock with the same exercise price and time to maturity can be bought for $5.00. What would you do? Illustrate how an exporter can apply a "tunnel" strategy using options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts