Question: please help me with correct answer Choice E #1-19 (57 points total; 3 points each) : Instructions: Select the best answer for each of the

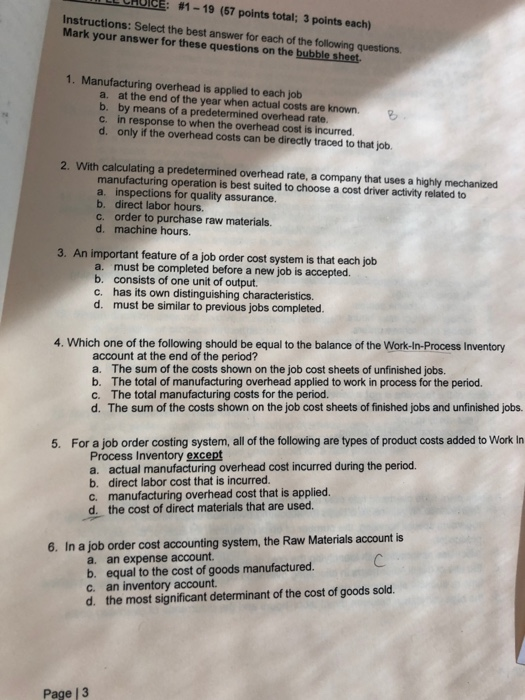

Choice E #1-19 (57 points total; 3 points each) : Instructions: Select the best answer for each of the following questions. Mark your answer for these questions on the bubble sheet. 1. Manufacturing overhead is applied to each job a. at the end of the year when actual costs are known. b. by means of a predetermined overhead rate. c. in response to when the overhead cost is incurred. d. only if the overhead costs can be directly traced to that job. 2. With calculating a predetermined overhead rate, a company that uses a highly mechanized manufacturing operation is best suited to choose a cost driver activity related to dualty assurance b. direct labor hours. c. order to purchase raw materials. d. machine hours. 3. An important feature of a job order cost system is that each job a. must be completed before a new job is accepted. b. consists of one unit of output. c. has its own distinguishing characteristics. d. must be similar to previous jobs completed. 4. Which one of the following should be equal to the balance of the Work-In-Process Inventory account at the end of the period? a. The sum of the costs shown on the job cost sheets of unfinished jobs. b. The total of manufacturing overhead applied to work in process for the period. c. The total manufacturing costs for the period. d. The sum of the costs shown on the job cost sheets of finished jobs and unfinished jobs. 5. For a job order costing system, all of the following are types of product costs added to Work in Process Inventory except a. actual manufacturing overhead cost incurred during the period. b. direct labor cost that is incurred c. manufacturing overhead cost that is applied. d. the cost of direct materials that are used. 6. In a job order cost accounting system, the Raw Materials account is a. an expense account. b. equal to the cost of goods manufactured. c. an inventory account. d. the most significant determinant of the cost of goods sold. Page |3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts