Question: Please help me with determining the depreciation for the second year using the double-declining-balance method for a Kubota tractor. I keep coming up with the

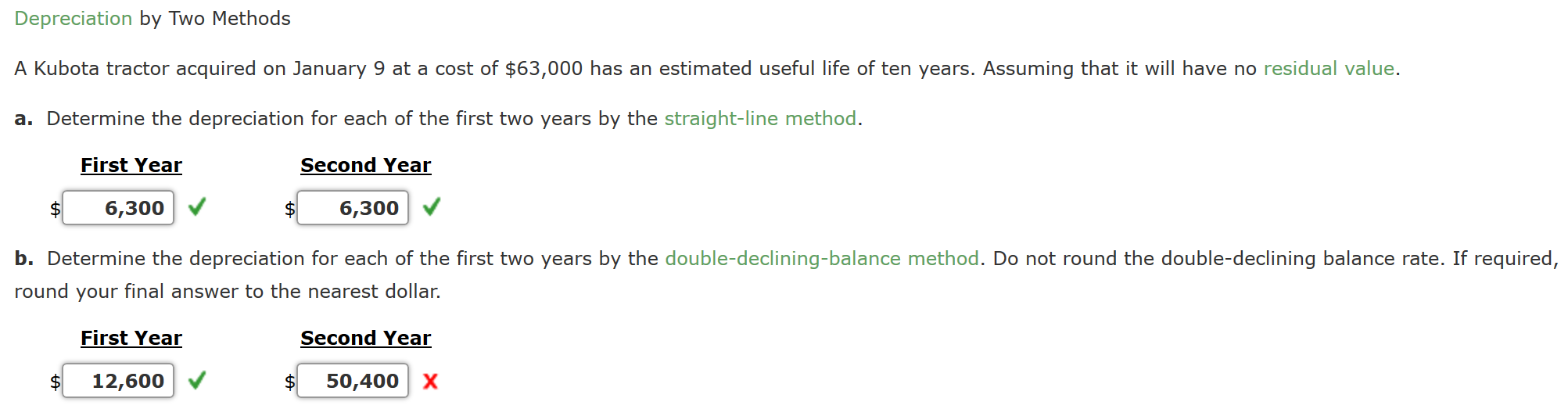

Please help me with determining the depreciation for the second year using the double-declining-balance method for a Kubota tractor. I keep coming up with the wrong answer and I am unsure of what I am doing wrong. Thanks.

Depreciation by Two Methods A Kubota tractor acquired on January 9 at a cost of $63,000 has an estimated useful life of ten years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. First Year Second Year 6,300 6,300 b. Determine the depreciation for each of the first two years by the double-declining-balance method. Do not round the double-declining balance rate. If required, round your final answer to the nearest dollar. First Year Second Year $ 12,600 $ 50,400 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts