Question: Please help me with exercise 3-1 and 3-2 thank you Exerci EXERCISES Mean Exercise 3-1 Recognizing revenue LO3 financi The following are independent situations. Based

Please help me with exercise 3-1 and 3-2 thank you

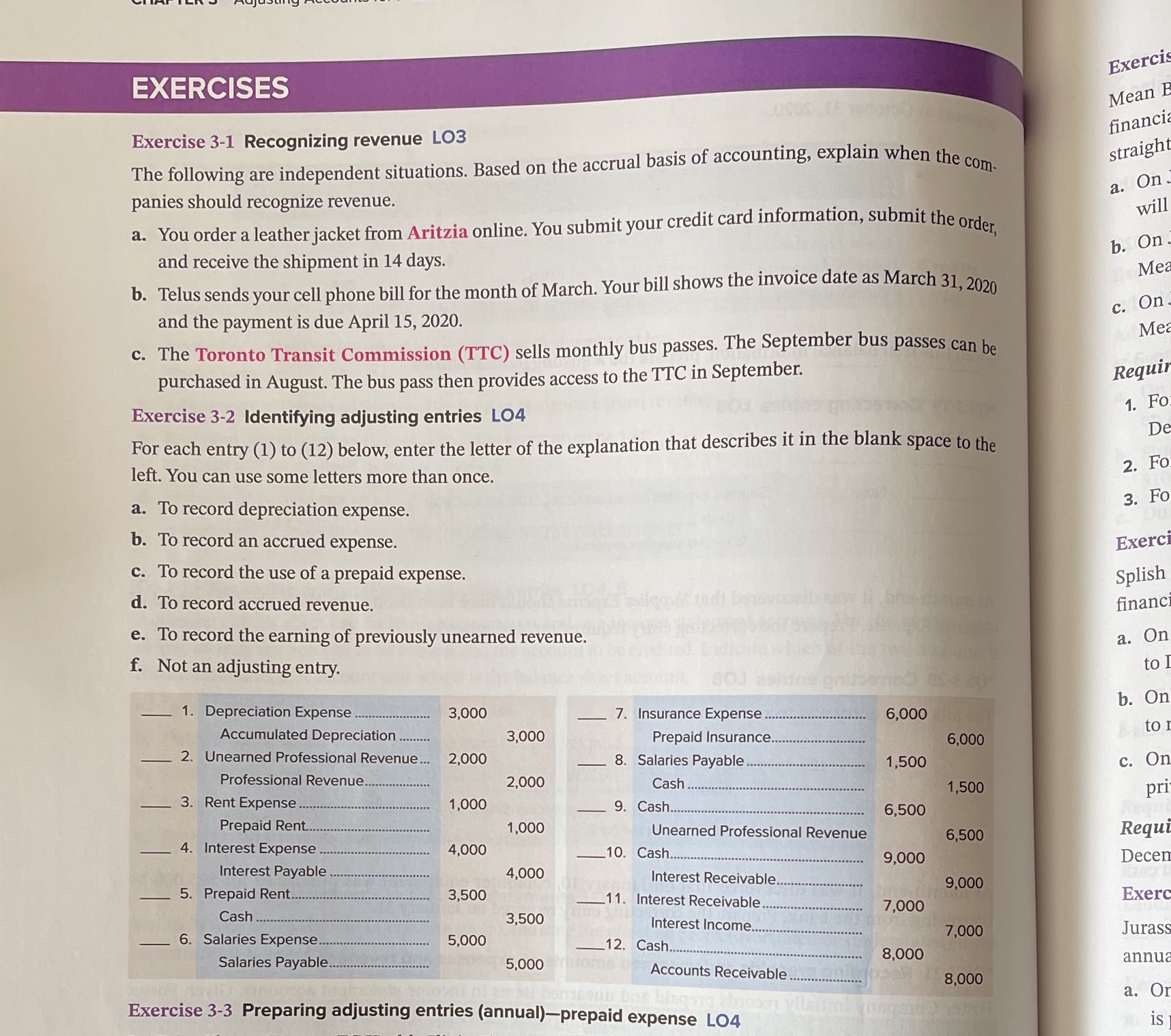

Exerci EXERCISES Mean Exercise 3-1 Recognizing revenue LO3 financi The following are independent situations. Based on the accrual basis of accounting, explain when the com. straight a. On panies should recognize revenue. will a. You order a leather jacket from Aritzia online. You submit your credit card information, submit the order b. On and receive the shipment in 14 days. Me b. Telus sends your cell phone bill for the month of March. Your bill shows the invoice date as March 31, 2020 c. On. and the payment is due April 15, 2020. Me c. The Toronto Transit Commission (TTC) sells monthly bus passes. The September bus passes can be purchased in August. The bus pass then provides access to the TTC in September. Requir Exercise 3-2 Identifying adjusting entries LO4 1. Fo De For each entry (1) to (12) below, enter the letter of the explanation that describes it in the blank space to the left. You can use some letters more than once. 2. FO a. To record depreciation expense. 3. FO b. To record an accrued expense. Exerc c. To record the use of a prepaid expense. Splish d. To record accrued revenue. financ e. To record the earning of previously unearned revenue. a. On f. Not an adjusting entry. to 1. Depreciation Expense ..... b. On 3,000 7. Insurance Expense ........ 6,000 Accumulated Depreciation ..... 3,000 to Prepaid Insurance.. 6,000 2. Unearned Professional Revenue... 2,000 . Salaries Payable ...... 1,500 c. On Professional Revenue ...... 2,000 Cash .... 1,500 3. Rent Expense .. pri 1,000 9. Cash... 6,500 Prepaid Rent.... 1,000 Unearned Professional Revenue 4. Interest Expense 6,500 Requ 4,000 10. Cash. 9,000 Decer Interest Payable 1,000 Interest Receivable..... 5. Prepaid Rent.. 9,000 3,500 11. Interest Receivable Exer Cash .... 7,000 3,500 Interest Income... 6. Salaries Expense 5,000 7,000 Jurass 12. Cash... Salaries Payable..... 8,000 5,000 annu Accounts Receivable .................... 8,000 Or Exercise 3-3 Preparing adjusting entries (annual)-prepaid expense LO4 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts