Question: Please help me with explaination. I'm really stuck with this class. An insurer issues a deferred annuity with a single premium to (x). The annuity

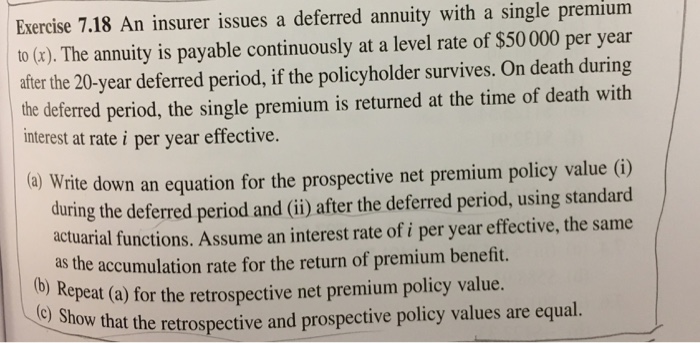

An insurer issues a deferred annuity with a single premium to (x). The annuity is payable continuously at a level rate of $50000 per year after the 20-year deferred period, if the policyholder survives. On death during the deferred period, the single premium is returned at the time of death with interest at rate i per year effective. Write down an equation for the prospective net premium policy value during the deferred period and after the deferred period, using standard actuarial functions. Assume an interest rate of i per year effective, the same as the accumulation rate for the return of premium benefit Repeat (a) for the retrospective net premium policy value. show that the retrospective and prospective policy values are equal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts