Question: Please help me with filling the missing value (in Brown) ---- Thanks Calculate the Value of the Call Option using the Black Scholes Model and

Please help me with filling the missing value (in Brown) ---- Thanks

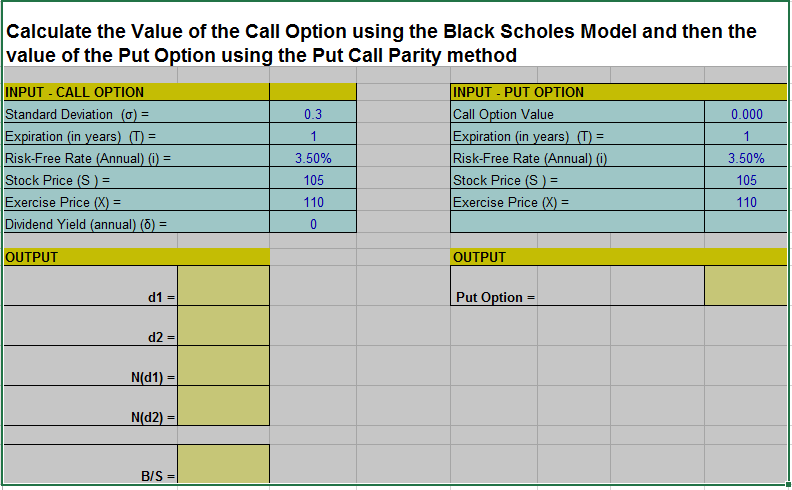

Calculate the Value of the Call Option using the Black Scholes Model and then the value of the Put Option using the Put Call Parity method

Calculate the Value of the Call Option using the Black Scholes Model and then the value of the Put Option using the Put Call Parity method INPUT CALL OPTION Standard Deviation ()= Expiration (in vears Risk-Free Rate (Annual) (i) = Stock Price (S ) = Exercise Price (X = Dividend Yield (annual) (6) = INPUT- PUT OPTION Call Option Value Expiration (in vears Risk-Free Rate (Annual Stock Price (S ) = Exercise Price (X = 0.3 0.000 3.50% 105 110 3.50% 105 110 OUTPUT OUTPUT Put Option = d2 = N(d1) = N(d2) = B/S =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts