Question: please help me with part A 0.5/1 Question 4 View Policies Show Attempt History Current Attempt in Progress t Your answer is partially correct. The

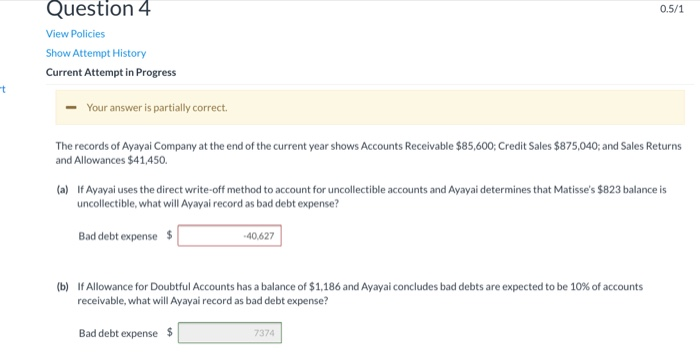

0.5/1 Question 4 View Policies Show Attempt History Current Attempt in Progress t Your answer is partially correct. The records of Ayayal Company at the end of the current year shows Accounts Receivable $85,600; Credit Sales $875,040; and Sales Returns and Allowances $41,450. (a) If Ayayai uses the direct write-off method to account for uncollectible accounts and Ayayai determines that Matisse's $823 balance is uncollectible, what will Ayayai record as bad debt expense? Bad debt expense $ -40.627 (b) If Allowance for Doubtful Accounts has a balance of $1,186 and Ayayai concludes bad debts are expected to be 10% of accounts receivable, what will Ayayai record as bad debt expense? Bad debt expense $ 7374

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts