Question: Please help me with PART C ( questions 5, 6 and 7 ) Swiss Supplies showed the following selected adjusted balances at its December 31,2019

Please help me with PART C ( questions 5, 6 and 7 )

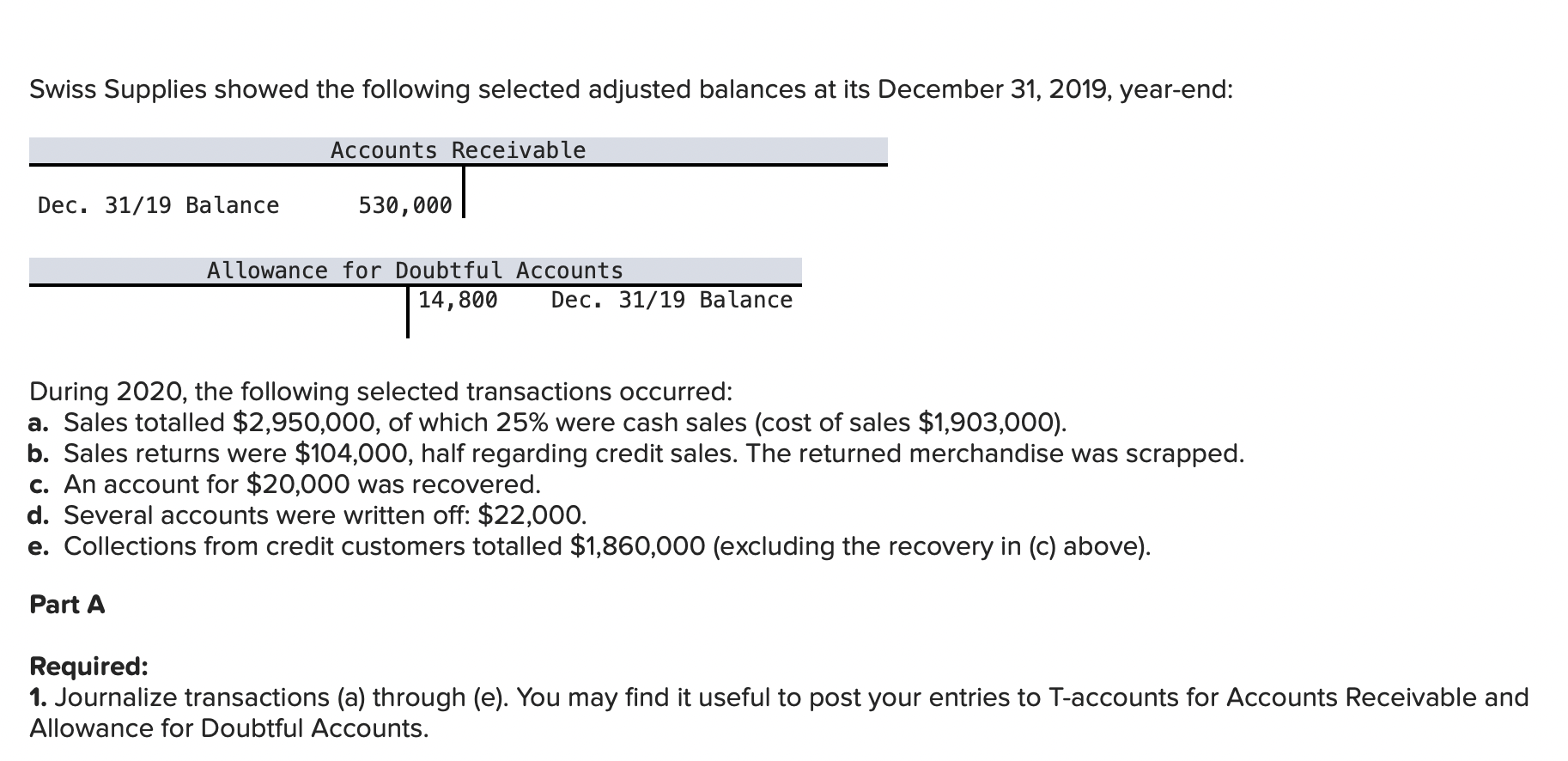

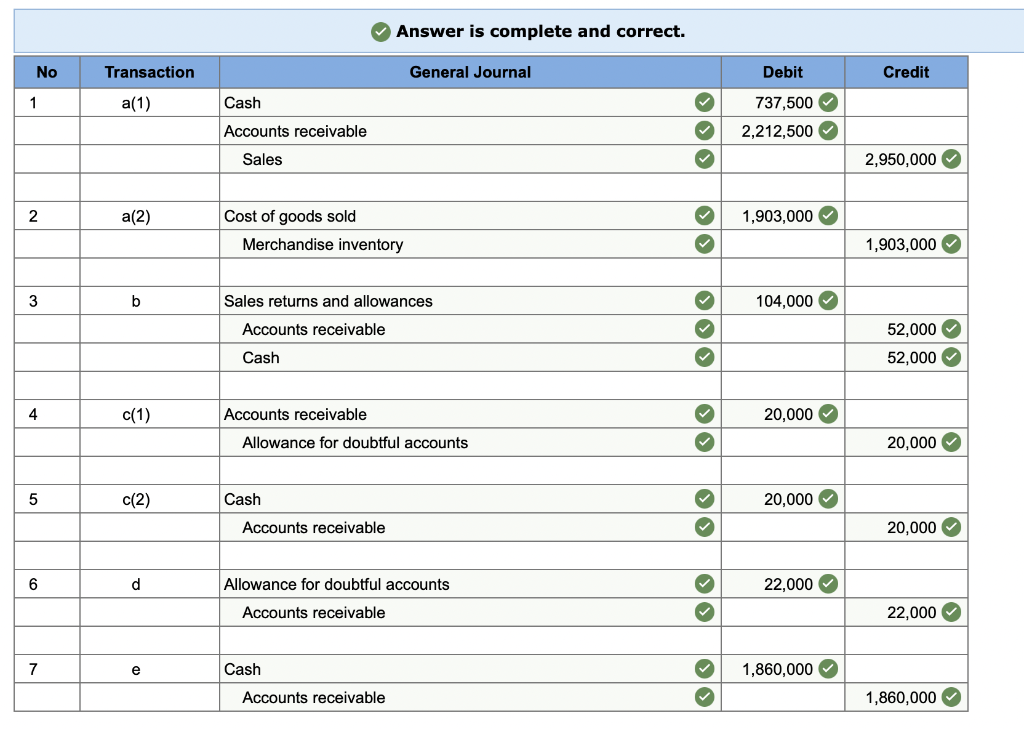

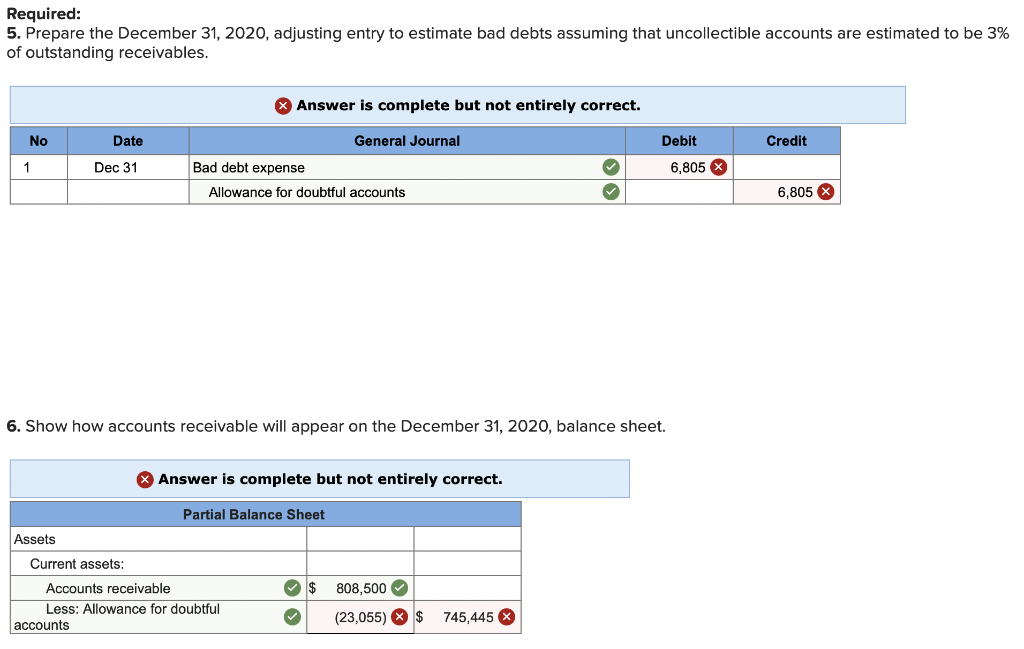

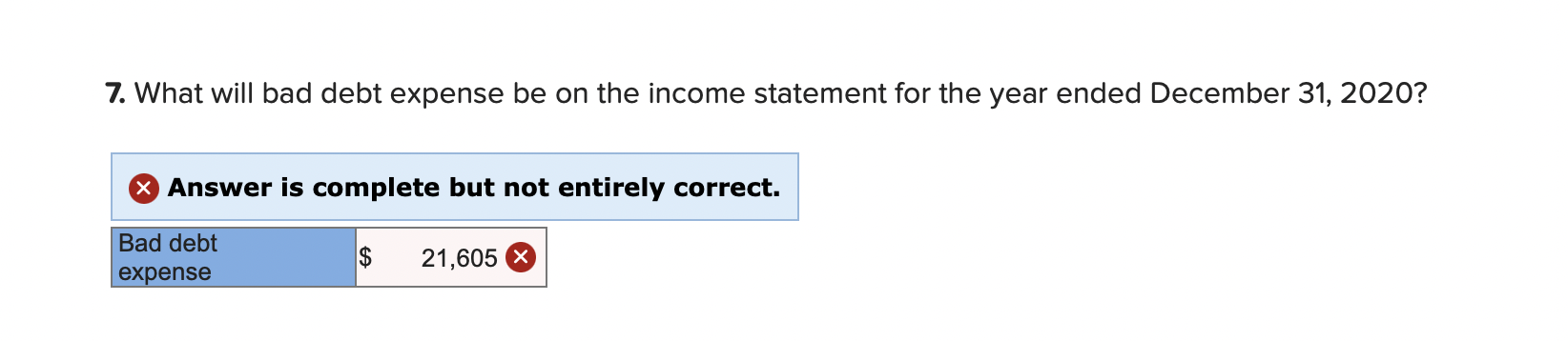

Swiss Supplies showed the following selected adjusted balances at its December 31,2019 , year-end: During 2020 , the following selected transactions occurred: a. Sales totalled $2,950,000, of which 25% were cash sales (cost of sales $1,903,000 ). b. Sales returns were $104,000, half regarding credit sales. The returned merchandise was scrapped. c. An account for $20,000 was recovered. d. Several accounts were written off: $22,000. e. Collections from credit customers totalled $1,860,000 (excluding the recovery in (c) above). Part A Required: 1. Journalize transactions (a) through (e). You may find it useful to post your entries to T-accounts for Accounts Receivable and Allowance for Doubtful Accounts. Answer is complete and correct. Required: 5. Prepare the December 31,2020 , adjusting entry to estimate bad debts assuming that uncollectible accounts are estimated to be 3% of outstanding receivables. 6. Show how accounts receivable will appear on the December 31,2020 , balance sheet. 7. What will bad debt expense be on the income statement for the year ended December 31,2020 ? Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts