Question: Please help me with part D, all answers from (a) to (c) are correct, please feel free to use. 2. A one year bond is

Please help me with part D, all answers from (a) to (c) are correct, please feel free to use.

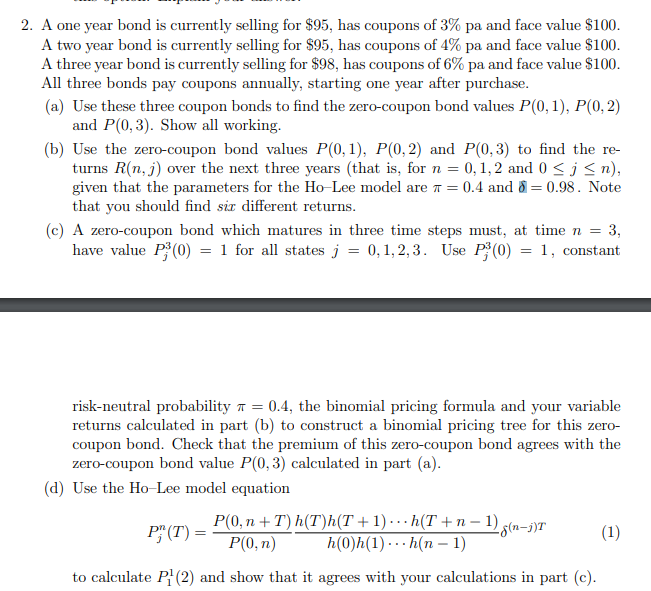

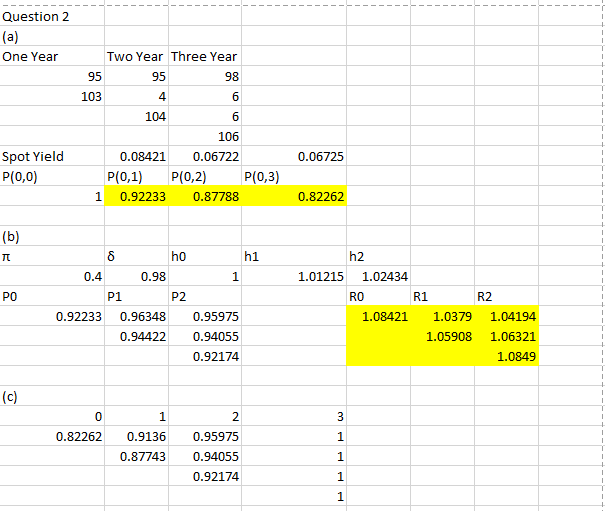

2. A one year bond is currently selling for $95, has coupons of 3% pa and face value $100. A two year bond is currently selling for $95, has coupons of 4% pa and face value $100. A three year bond is currently selling for $98, has coupons of 6% pa and face value $100. All three bonds pay coupons annually, starting one year after purchase. (a) Use these three coupon bonds to find the zero-coupon bond values P(0,1), P(0,2) and P(0,3). Show all working. (b) Use the zero-coupon bond values P(0,1), P(0, 2) and P(0, 3) to find the re- turns R(n,j) over the next three years (that is, for n = 0,1, 2 and 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts