Question: please help me with problem 6-8 step by step number 6 number 7 a - c bonds solving number 8 bond valuation quarterly interest Bond

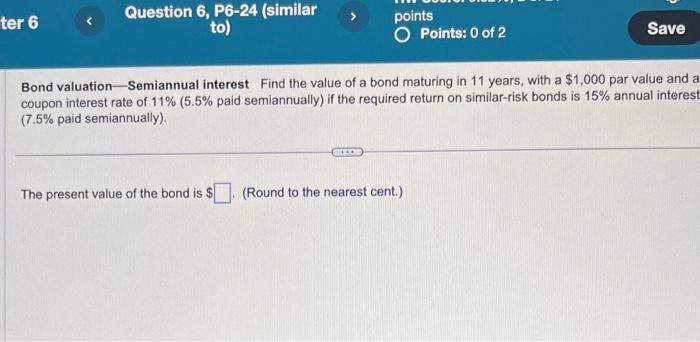

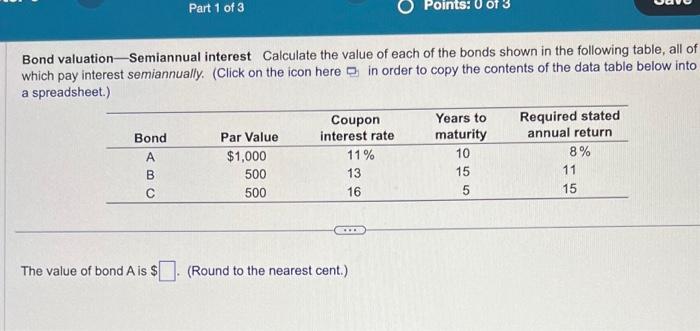

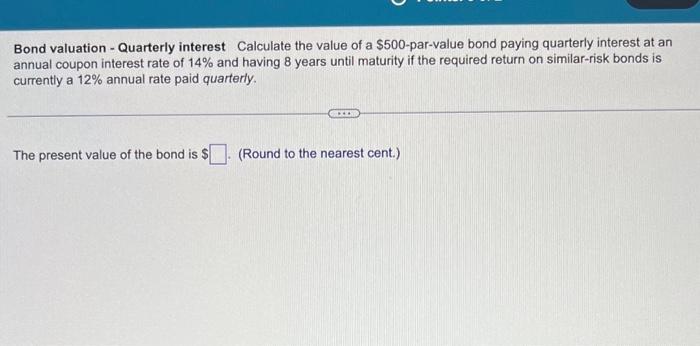

Bond valuation-Semiannual interest Find the value of a bond maturing in 11 years, with a $1,000 par value and coupon interest rate of 11% (5.5\% paid semiannually) if the required return on similar-risk bonds is 15% annual interes (7.5% paid semiannually) The present value of the bond is $ (Round to the nearest cent.) Bond valuation-Semiannual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually. (Click on the icon here p in order to copy the contents of the data table below into a spreadsheet.) The value of bond A is $ (Round to the nearest cent.) Bond valuation - Quarterly interest Calculate the value of a $500-par-value bond paying quarterly interest at an annual coupon interest rate of 14% and having 8 years until maturity if the required return on similar-risk bonds is currently a 12% annual rate paid quarterly. The present value of the bond is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts