Question: please help me with problem 7-17 Activity-Based Costing: A Tool to Aid Decision Making Ii iek produced and sold 70,000 units of B300 at a

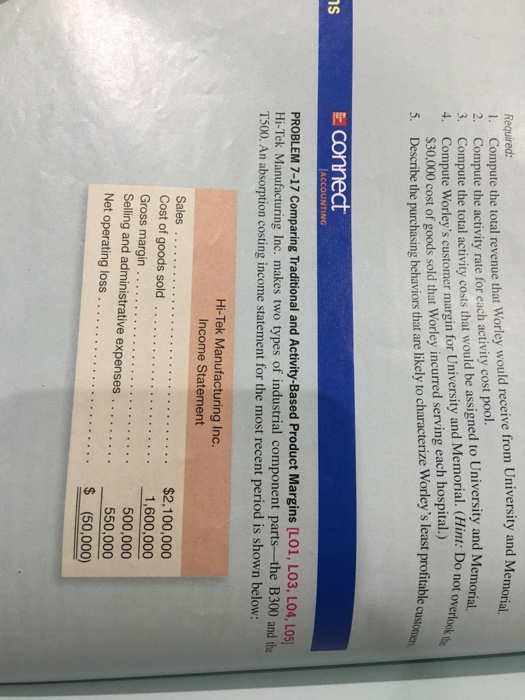

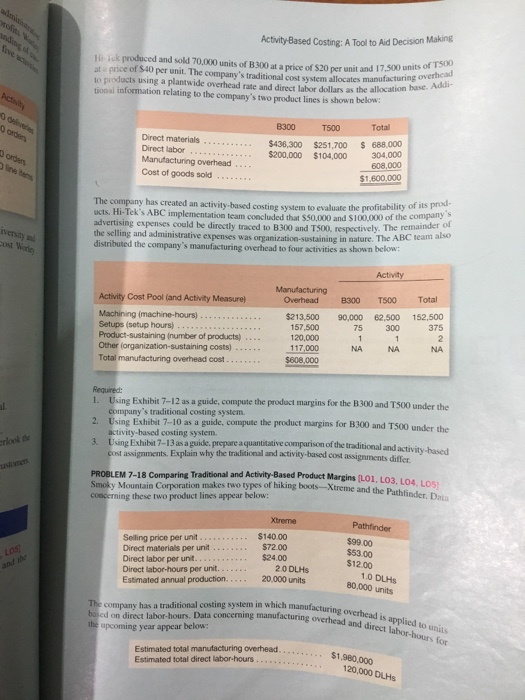

Activity-Based Costing: A Tool to Aid Decision Making Ii iek produced and sold 70,000 units of B300 at a price of $20 per unit and 17,00itcad at price of S40 per unit The company's traditional cost system allocates to products using a plantwide overhead rate and direct labor dollars as the allocation tiooal information relating to the company's two product lines is shown below: manufacturing ove Total T500 Direct materials Direct labor Manufacturing overhead Cost of goods sold $436,300 $251,700 688,000 304,000 608,000 $1,600,000 $200,000 $104,000 The company has created an activity-based costing system to evaluate the ucts. Hi-Tek's ABC implementation team concluded that $50,000 and $100,000 of the compy profitability of its p sing expenses could be directly traced to B300 and T500, respectively. The remaindkr o strative expenses was organization-sustaining in nature. The ABC team also the selling and administrative distributed the company's manufacturing overhead to four activities as shown below: Cost Pool (and Activity Measure) Overhead B300 T500 Total $213,500 90,000 62,500 152,500 75 300 375 Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) . .. Total manufacturing overhead cost 157,500 120,000 117.000 NA NA NA Using Exhibit 7-12 as a guide, compute the product margins for the B300 and TS00 under the company's I. traditional costing system. 2. Using Exhibit 7-10 as a guide, compute the product margins for B300 and T500 under 3 Using Exhibit 7-13as a guide prepare a quantitative comparison of the traditional and activity-based activity-based costing system. why the traditional and activity-based cost assignments differ PROBLEM 7-18 Comparing Traditional and Activity-Based Product Margins [LO1, LO3,L Smoky Mountain Corporation makes two types of hiking boots-Xtreme conderning these two product lines appear below and the Pathfinder. Data Xtreme $140.00 $72.00 $24.00 Selling price per unit Direct materials per unit Direct labor per unit Direct labor-hours per unit. Estimated annual production. $99.00 $53.00 $12.00 20 DLHs 20,000 units 1.0 DLHs The company has a traditional costing system in which manufactu on direct labor-hours. Data concerning manufactu ring overhead and direct la upcoming year appear below Estimated total manufacturing overhead Estimated total direct labor-hours

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts