Question: Please help me with question 1,2. Thanks! io.edu/webapps/blackboard/execute/content/file?cmd-view&content id 9069692 1&course id 5006721 Numerical Practice Questions Suppose you run a small business and need $40,000

Please help me with question 1,2. Thanks!

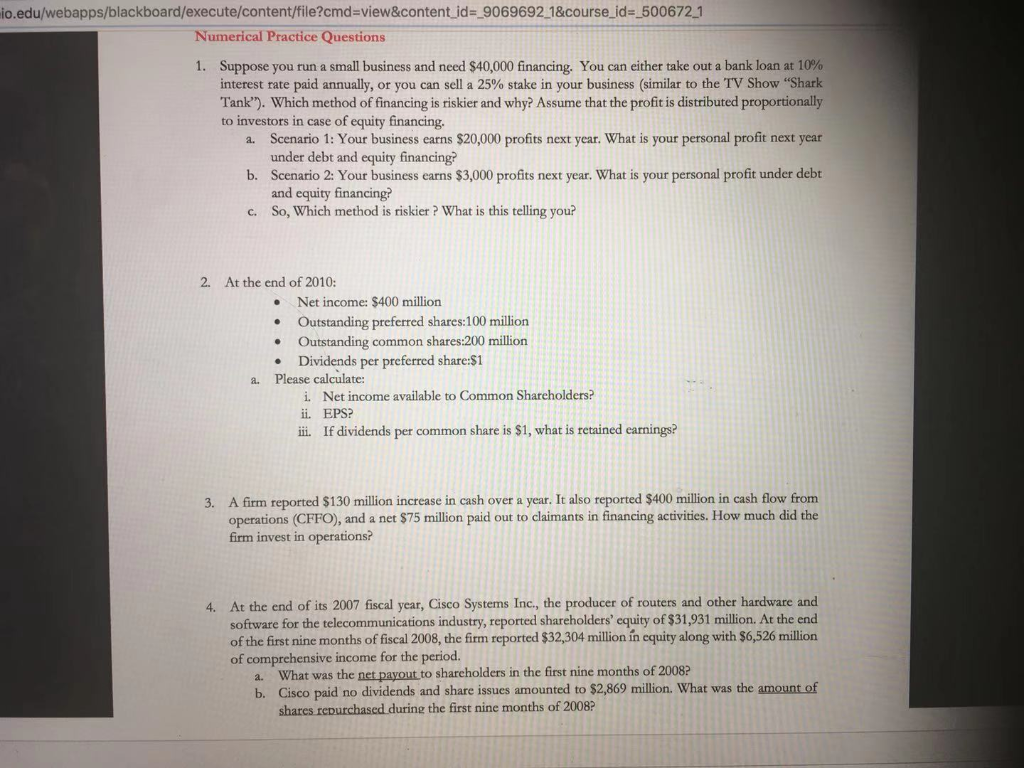

io.edu/webapps/blackboard/execute/content/file?cmd-view&content id 9069692 1&course id 5006721 Numerical Practice Questions Suppose you run a small business and need $40,000 financing. You can either take out a bank loan at 10% interest rate paid annually, or you can sell a 25% stake in your business (similar to the TV Show "Shark Tank'). Which method of financing is riskier and why? Assume that the profit is distributed proportionally I. to investors in case of equity financing Scenario 1: Your business earns $20,000 profits next year. What is your personal profit next year a. under debt and equity financing? b. Scenario 2: Your business earns $3,000 profits next year. What is your personal profit under debt and equity financing? So, Which method is riskier? What is this telling you? c. 2. At the end of 2010: . Net income: $400 million Outstanding preferred shares:100 million Outstanding common shares:200 million .Dividends per preferred share:$1 a. Please calculate: i. Net income available to Common Shareholders? ii. EPS? ii. If dividends per common share is $1, what is retained earnings? A firm reported $130 million increase in cash over a year. It also reported $400 million in cash flow from operations (CFFO), and a net $75 million paid out to claimants in financing activities. How much did the firm invest in operations? 3. 4. At the end of its 2007 fiscal year, Cisco Systems Inc, the producer of routers and other hardware and software for the telecommunications industry, reported shareholders' equity of $31,931 million. At the end of the first nine months of fiscal 2008, the firm reported $32,304 million in equity along with $6,526 million of comprehensive income for the period a. Wha t was the net payout to shareholders in the first nine months of 2008? b. Cisco paid no dividends and share issues amounted to $2,869 million. What was the amount of shares repurchased during the first nine months of 2008

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts