Question: please help me with question 3 Differential Analysis involving Opportunity Costs On July 1, Matrix Stores Inc. is considering leasing a building and buying the

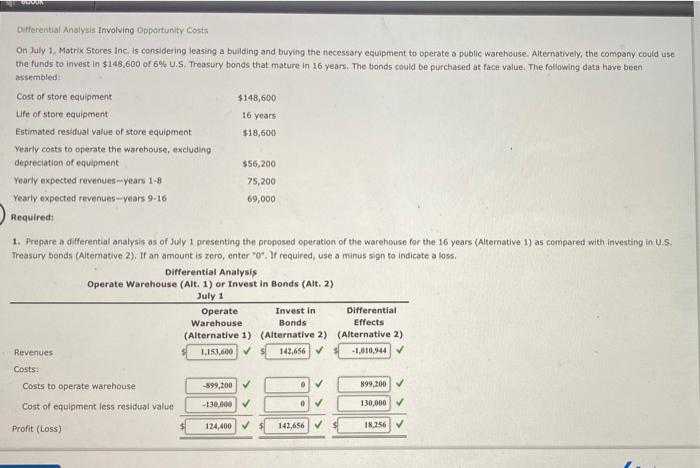

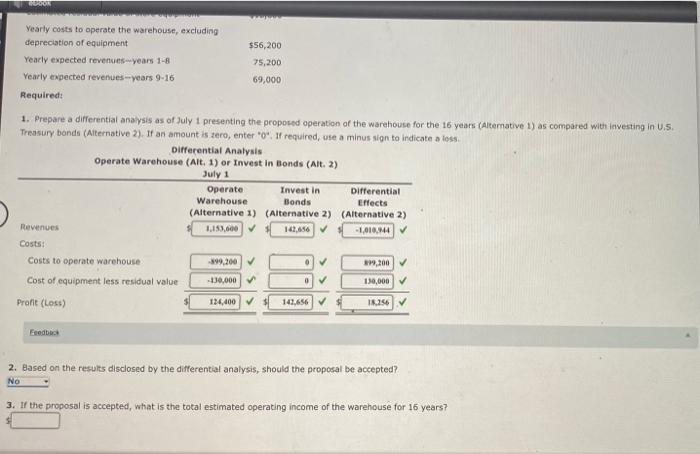

Differential Analysis involving Opportunity Costs On July 1, Matrix Stores Inc. is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternatively, the company could use the funds to invest in $148,600 of 6% U.S. Treasury bonds that mature in 16 years. The bonds could be purchased at face value. The following data have been assembled: Cost of store equipment $148,600 Life of store equipment 16 years Estimated residual value of store equipment $18,600 Yearly costs to operate the warehouse, excluding depreciation of equipment $56,200 Yearly expected revenues years 1-8 75,200 Yearly expected revenues-Years 9-16 69,000 Required: 1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss, Differential Analysis Operate Warehouse (Alt. 1) or Invest in Bonds (Alt. 2) July 1 Operate Invest in Differential Warehouse Bonds Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues 1.153,600 $ 142,656 -1,010,944 Costs: Costs to operate warehouse -899,200 0 899,200 Cost of equipment less residual value -130,000 130,000 Profit (Loss) 124,400 142.656 18,256 OUR Yearly costs to operate the warehouse, excluding depreciation of equipment Yearly expected revenues years 1-8 Yearly expected revenues--years 9-16 Required: $56,200 75,200 69,000 1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bands (Alternative 2). If an amount is zero, enter **". required, use a minus sign to indicate a loss. Differential Analysis Operate Warehouse (Alt. 1) or Invest in Bonds (Alt. 2) July 1 Operate Invest in Differential Warehouse Bonds Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues 10.6567 -1010,444 Costs: Costs to operate warehouse 399,200 0 2.300 Cost of equipment less residual value 130,000 0 Profit (Loss) 124,400 142.656 I.256 130,000 Feedba 2. Based on the results disclosed by the differential analysis, should the proposal be accepted? NO 3. If the proposal is accepted, what is the total estimated operating income of the warehouse for 16 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts