Question: Please help me with question 3 iii. 2018 0.45 2017 0.4 42.42 2016 0.35 62.65 32.25 Ratio Long Term Debt Ratio Inventory Turnover Depreciation to

Please help me with question 3 iii.

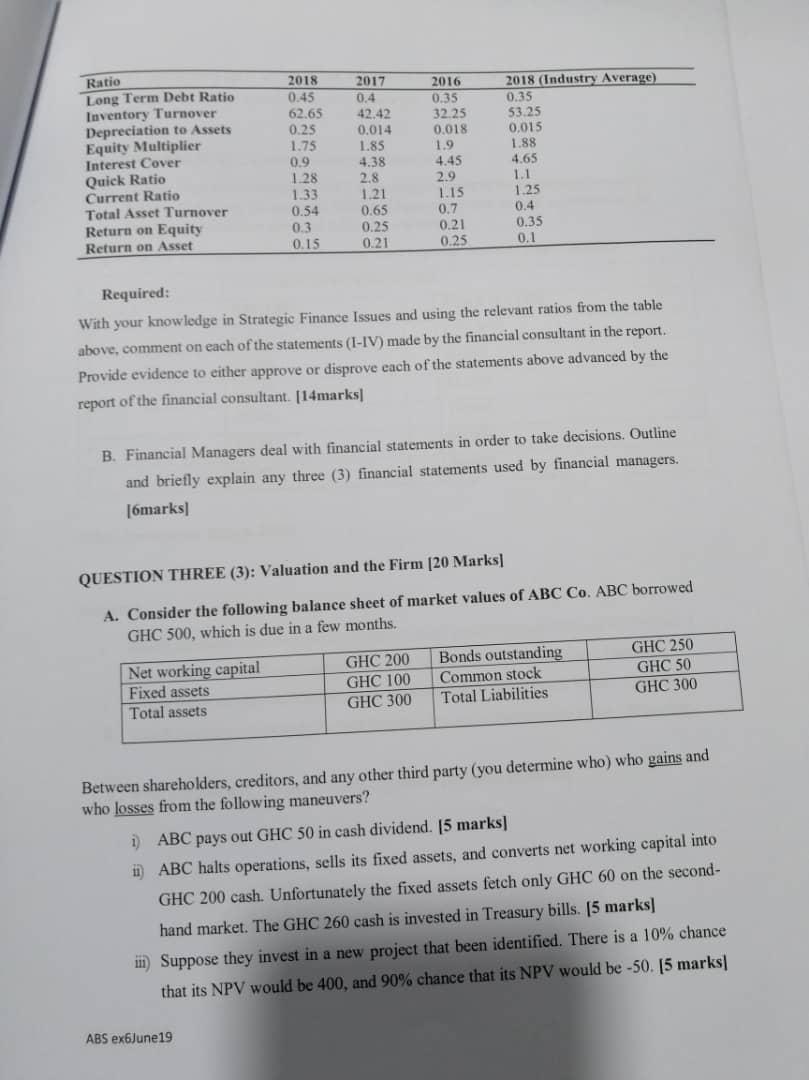

2018 0.45 2017 0.4 42.42 2016 0.35 62.65 32.25 Ratio Long Term Debt Ratio Inventory Turnover Depreciation to Assets Equity Multiplier Interest Cover 0.25 0.014 1.85 0.018 1.9 4.38 4.45 2018 (Industry Average) 0.35 53.25 0,015 1.88 4.65 1.1 1.25 0.4 0.35 0.1 29 2. Quick Ratio 175 1.75 0.9 1.28 1.33 0.54 0.3 0.15 Current Ratio Total Asset Turnover Return on Equity Return on Asset 2.8 1.21 0.65 0.25 0.21 1.15 0.7 0.21 0.25 Required: With your knowledge in Strategic Finance Issues and using the relevant ratios from the table above, comment on each of the statements (I-IV) made by the financial consultant in the report Provide evidence to either approve or disprove each of the statements above advanced by the report of the financial consultant. [14marks B. Financial Managers deal with financial statements in order to take decisions. Outline and briefly explain any three (3) financial statements used by financial managers. 16marks QUESTION THREE (3): Valuation and the Firm [20 Marks] A. Consider the following balance sheet of market values of ABC CO. ABC borrowed GHC 500, which is due in a few months. Net working capital Fixed assets Total assets GHC 200 GHC 100 GHC 300 Bonds outstanding Common stock Total Liabilities GHC 250 GHC 50 GHC 300 Between shareholders, creditors, and any other third party (you determine who) who gains and who losses from the following maneuvers? i) ABC pays out GHC 50 in cash dividend. 15 marks ii) ABC halts operations, sells its fixed assets, and converts net working capital into GHC 200 cash. Unfortunately the fixed assets fetch only GHC 60 on the second- hand market. The GHC 260 cash is invested in Treasury bills. (5 marks] iii) Suppose they invest in a new project that been identified. There is a 10% chance that its NPV would be 400, and 90% chance that its NPV would be -50. 15 marks ABS ex6June 19 2018 0.45 2017 0.4 42.42 2016 0.35 62.65 32.25 Ratio Long Term Debt Ratio Inventory Turnover Depreciation to Assets Equity Multiplier Interest Cover 0.25 0.014 1.85 0.018 1.9 4.38 4.45 2018 (Industry Average) 0.35 53.25 0,015 1.88 4.65 1.1 1.25 0.4 0.35 0.1 29 2. Quick Ratio 175 1.75 0.9 1.28 1.33 0.54 0.3 0.15 Current Ratio Total Asset Turnover Return on Equity Return on Asset 2.8 1.21 0.65 0.25 0.21 1.15 0.7 0.21 0.25 Required: With your knowledge in Strategic Finance Issues and using the relevant ratios from the table above, comment on each of the statements (I-IV) made by the financial consultant in the report Provide evidence to either approve or disprove each of the statements above advanced by the report of the financial consultant. [14marks B. Financial Managers deal with financial statements in order to take decisions. Outline and briefly explain any three (3) financial statements used by financial managers. 16marks QUESTION THREE (3): Valuation and the Firm [20 Marks] A. Consider the following balance sheet of market values of ABC CO. ABC borrowed GHC 500, which is due in a few months. Net working capital Fixed assets Total assets GHC 200 GHC 100 GHC 300 Bonds outstanding Common stock Total Liabilities GHC 250 GHC 50 GHC 300 Between shareholders, creditors, and any other third party (you determine who) who gains and who losses from the following maneuvers? i) ABC pays out GHC 50 in cash dividend. 15 marks ii) ABC halts operations, sells its fixed assets, and converts net working capital into GHC 200 cash. Unfortunately the fixed assets fetch only GHC 60 on the second- hand market. The GHC 260 cash is invested in Treasury bills. (5 marks] iii) Suppose they invest in a new project that been identified. There is a 10% chance that its NPV would be 400, and 90% chance that its NPV would be -50. 15 marks ABS ex6June 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts