Question: Please help me with question a and b A fixed income portfolio director manages 3 divisions each with its fixed income portfolio: A, B, and

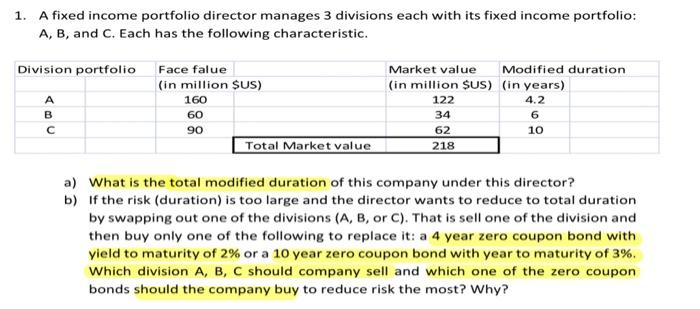

A fixed income portfolio director manages 3 divisions each with its fixed income portfolio: A, B, and C. Each has the following characteristic. a) What is the total modified duration of this company under this director? b) If the risk (duration) is too large and the director wants to reduce to total duration by swapping out one of the divisions (A, B, or C). That is sell one of the division and then buy only one of the following to replace it: a 4 year zero coupon bond with yield to maturity of 2% or a 10 year zero coupon bond with year to maturity of 3%. Which division A, B, C should company sell and which one of the zero coupon bonds should the company buy to reduce risk the most? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts