Question: Please help me with task 6&7. You have identified some errors which GST paid on investing activities is incorrectly posted and categorised as a cash

Please help me with task 6&7.

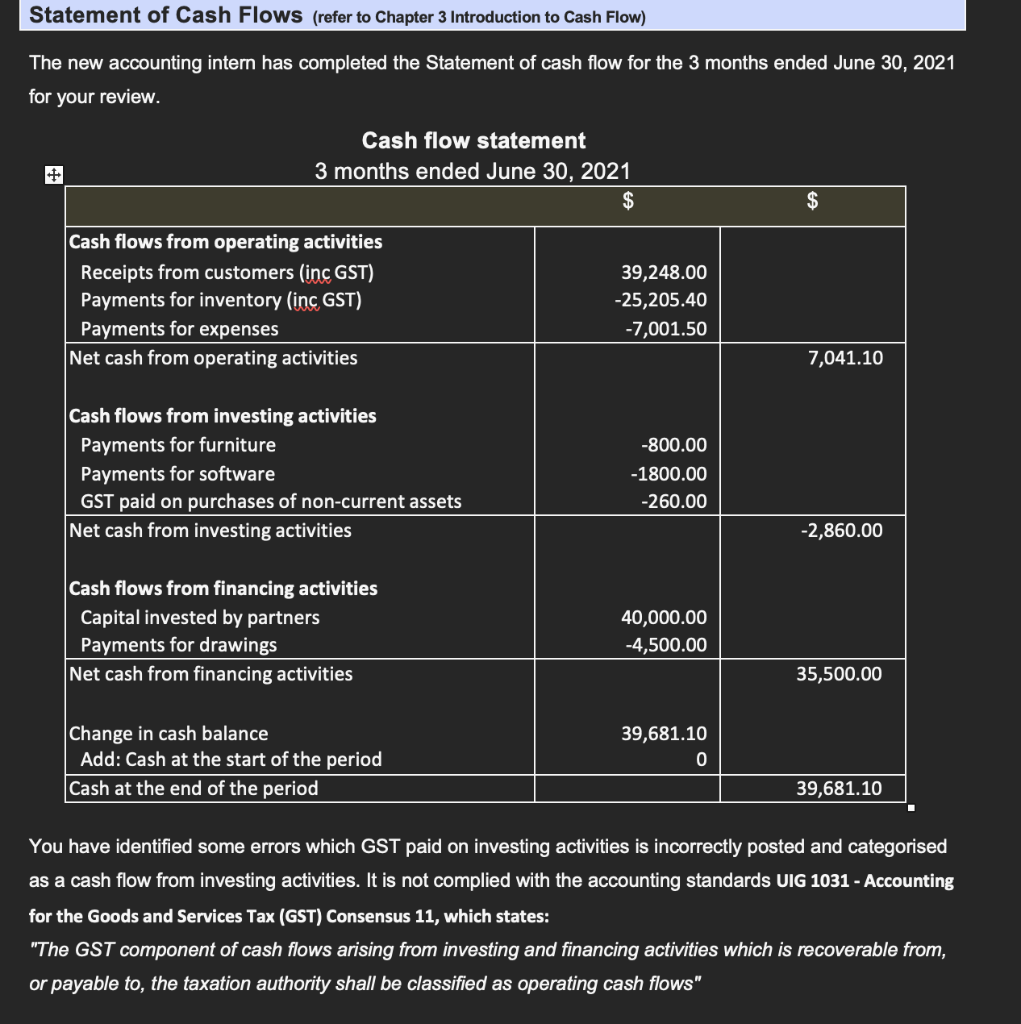

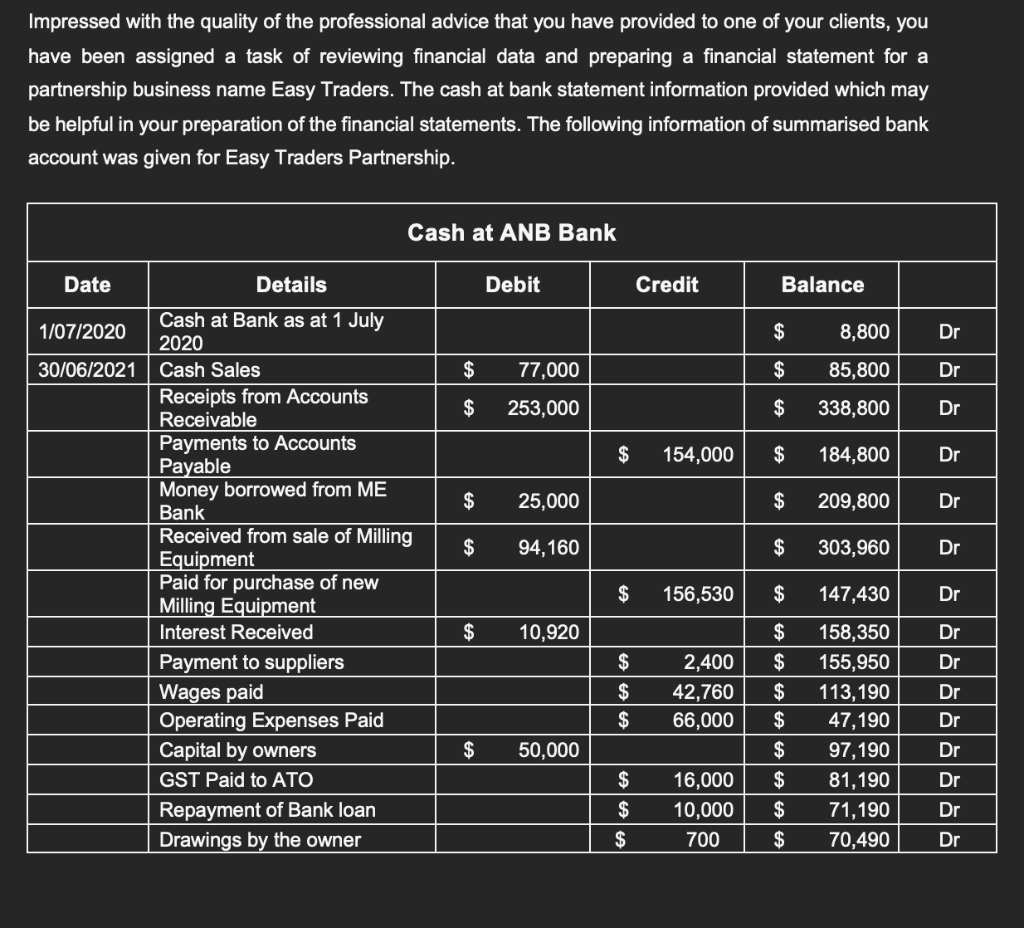

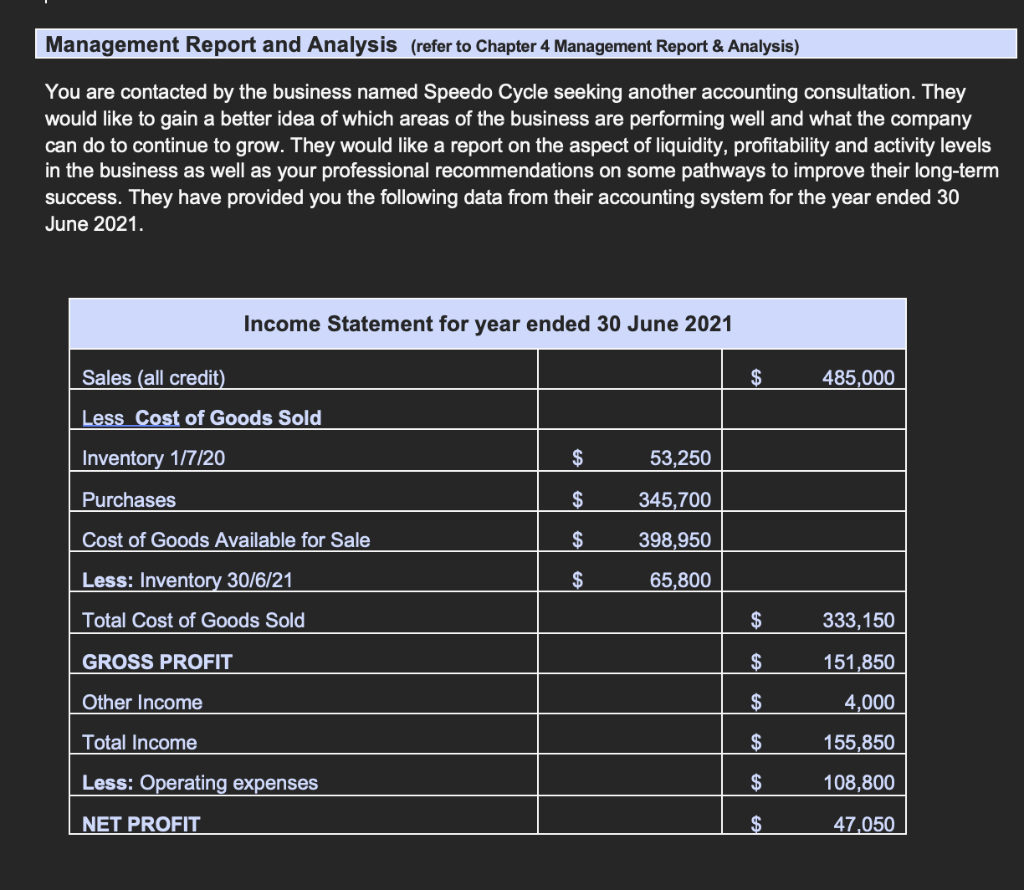

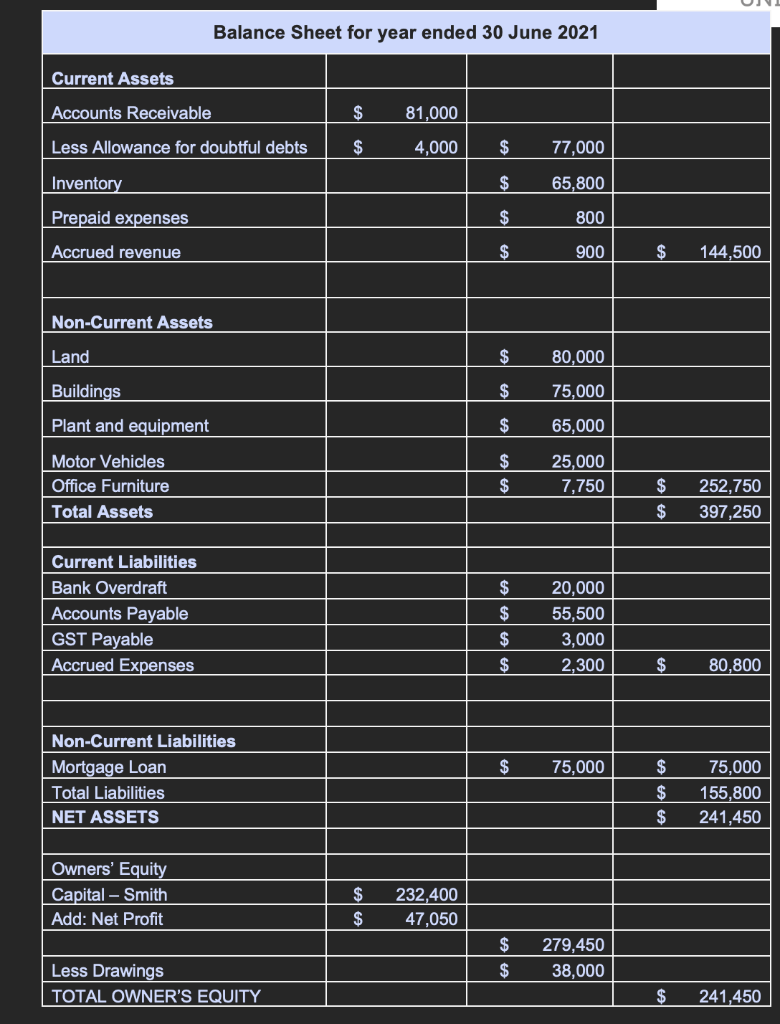

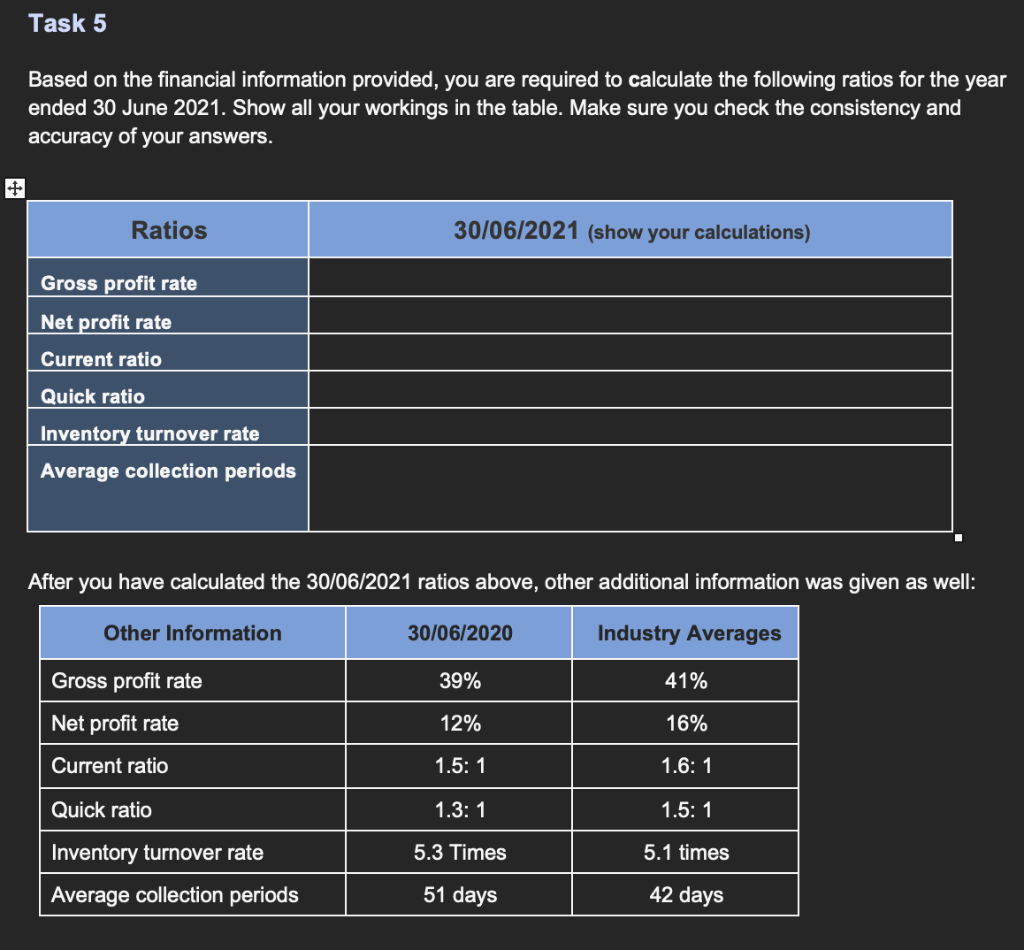

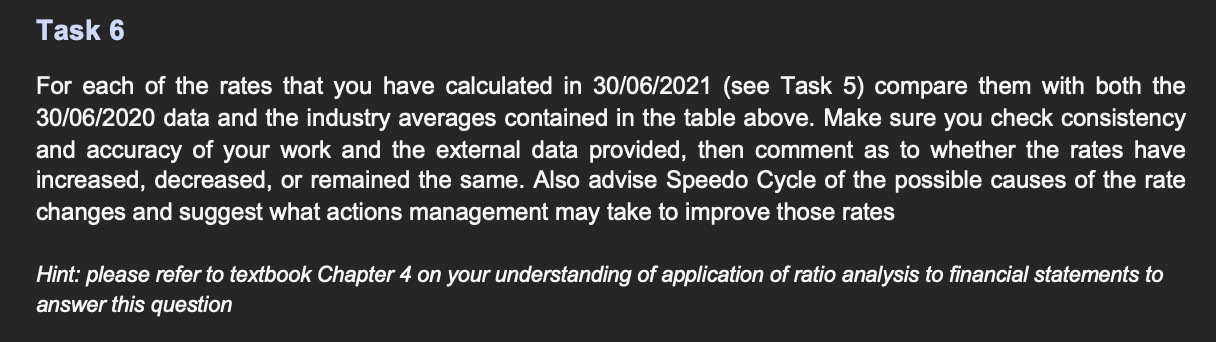

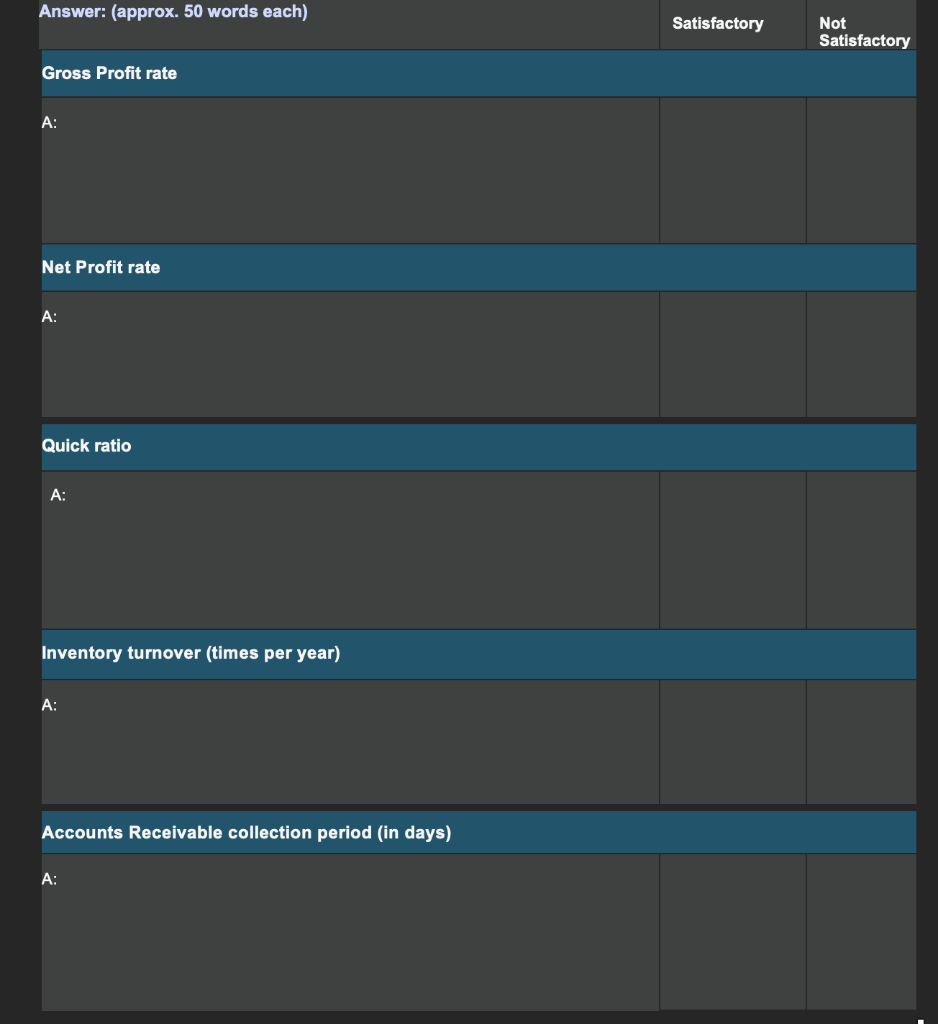

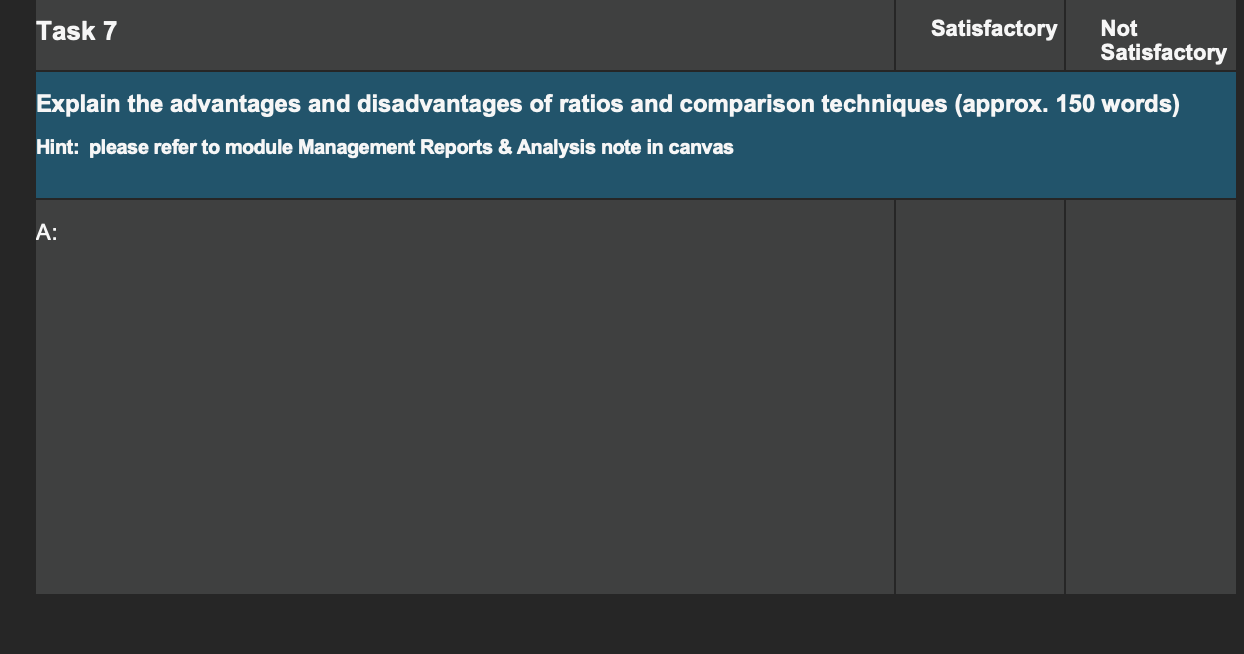

You have identified some errors which GST paid on investing activities is incorrectly posted and categorised as a cash flow from investing activities. It is not complied with the accounting standards UIG 1031 -Accounting for the Goods and Services Tax (GST) Consensus 11, which states: "The GST component of cash flows arising from investing and financing activities which is recoverable from, or payable to, the taxation authority shall be classified as operating cash flows" Check for consistency and accuracy of the cash flow data provided. Review the incorrect Cash Flow statement above for errors and non-compliance with the accounting standards and organisational procedures. Make the amendments and prepare the correct statement in the template provided. Cash flow statement for the 3 months ended June 302021 Impressed with the quality of the professional advice that you have provided to one of your clients, you have been assigned a task of reviewing financial data and preparing a financial statement for a partnership business name Easy Traders. The cash at bank statement information provided which may be helpful in your preparation of the financial statements. The following information of summarised bank account was given for Easy Traders Partnership. Based on the above information you need to complete a Statement of Cash Flows for the year ended 30/06/2021 using the structure and format given that comply with accounting standards in the template below. Check your answers for accuracy and show all your workings if necessary. Statement of Cash Flows of Easy Traders for the year ended 30 June 2021 Management Report and Analysis (refer to Chapter 4 Management Report \& Analysis) You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Based on the financial information provided, you are required to calculate the following ratios for the ye ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Inventory turnover (times per year) Accounts Receivable collection period (in days) Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports \& Analysis note in canvas You have identified some errors which GST paid on investing activities is incorrectly posted and categorised as a cash flow from investing activities. It is not complied with the accounting standards UIG 1031 -Accounting for the Goods and Services Tax (GST) Consensus 11, which states: "The GST component of cash flows arising from investing and financing activities which is recoverable from, or payable to, the taxation authority shall be classified as operating cash flows" Check for consistency and accuracy of the cash flow data provided. Review the incorrect Cash Flow statement above for errors and non-compliance with the accounting standards and organisational procedures. Make the amendments and prepare the correct statement in the template provided. Cash flow statement for the 3 months ended June 302021 Impressed with the quality of the professional advice that you have provided to one of your clients, you have been assigned a task of reviewing financial data and preparing a financial statement for a partnership business name Easy Traders. The cash at bank statement information provided which may be helpful in your preparation of the financial statements. The following information of summarised bank account was given for Easy Traders Partnership. Based on the above information you need to complete a Statement of Cash Flows for the year ended 30/06/2021 using the structure and format given that comply with accounting standards in the template below. Check your answers for accuracy and show all your workings if necessary. Statement of Cash Flows of Easy Traders for the year ended 30 June 2021 Management Report and Analysis (refer to Chapter 4 Management Report \& Analysis) You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Based on the financial information provided, you are required to calculate the following ratios for the ye ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Inventory turnover (times per year) Accounts Receivable collection period (in days) Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports \& Analysis note in canvas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts