Question: Please help me with the correct excel function formula I understand how to do it manually, but I don't understand excel Only excel formula, please.

Please help me with the correct excel function formula I understand how to do it manually, but I don't understand excel

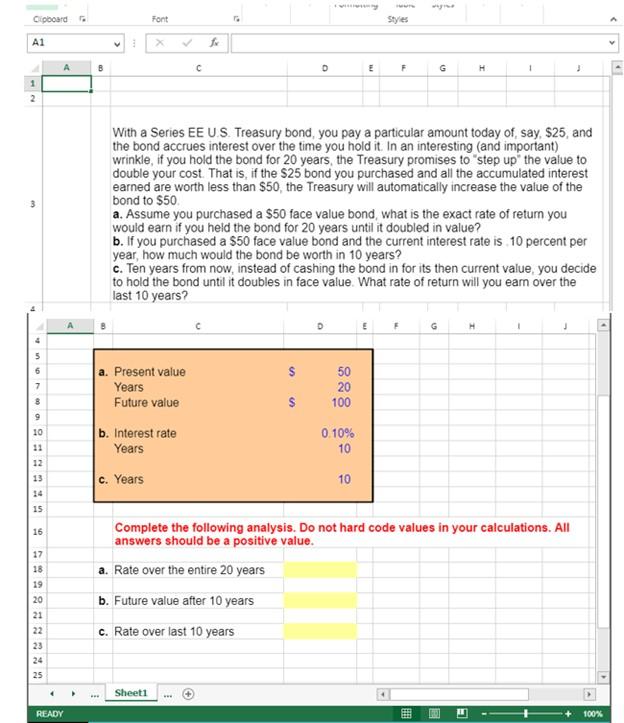

Only excel formula, please. For example = Rate(D8-D9 ,,D6,D7)

Please help me with the correct excel function formula I understand how to do it manually, but I don't understand excel

Only excel formula, please. For example = Rate(D8-D9 ,,D6,D7)

Clipboard Font A1 X B C D F G H 1 . 1 3 With a Series EE U.S. Treasury bond, you pay a particular amount today of, say, $25, and the bond accrues interest over the time you hold it. In an interesting and important) wrinkle, if you hold the bond for 20 years the Treasury promises to step up the value to double your cost. That is, if the S25 bond you purchased and all the accumulated interest earned are worth less than $50, the Treasury will automatically increase the value of the bond to $50 a. Assume you purchased a $50 face value bond what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? b. If you purchased a $50 face value bond and the current interest rate is 10 percent per year how much would the bond be worth in 10 years? C. Ten years from now, instead of cashing the bond in for its then current value you decide to hold the bond until it doubles in face value. What rate of return will you earn over the last 10 years? 4 5 6 7 8 a. Present value Years Future value $ $ 50 20 100 9 b. Interest rate Years 0.10% 10 10 11 12 13 14 15 c. Years 10 16 17 18 19 20 21 22 23 24 25 Complete the following analysis. Do not hard code values in your calculations. All answers should be a positive value. a. Rate over the entire 20 years b. Future value after 10 years c. Rate over last 10 years KON86 Sheet1 READY 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts