Question: Please help me with the decision part: Please help me with Requirement 2 Preston Company sells both designer and moderately priced fashion accessories. Top management

Please help me with the "decision" part:

Please help me with "Requirement 2"

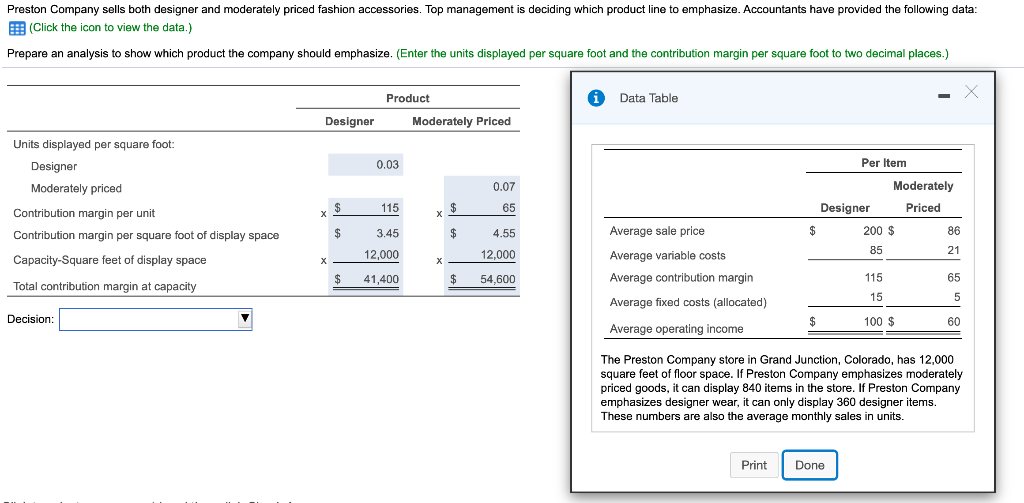

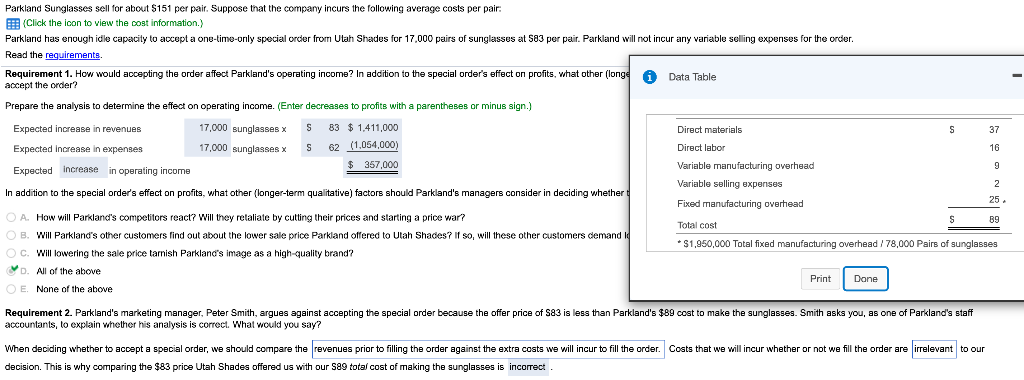

Preston Company sells both designer and moderately priced fashion accessories. Top management is deciding which product line to emphasize. Accountants have provided the following data: (Click the icon to view the data.) Prepare an analysis to show which product the company should emphasize. (Enter the units displayed per square foot and the contribution margin per square foot to two decimal places.) i Data Table Product Moderately Priced Designer Units displayed per square foot: Designer Moderately priced 0.03 Per item Contribution margin per unit Contribution margin per square foot of display space $ x $ $ x $ 0.07 65 4.55 12,000 54,600 115 3.45 12,000 41,400 Moderately Designer Priced 200 $ 85 Average sale price Capacity-Square feet of display space Average variable costs $ Average contribution margin Total contribution margin at capacity 115 Average fixed costs (allocated) 15 Decision: 100 $ Average operating income The Preston Company store in Grand Junction, Colorado, has 12,000 square feet of floor space. If Preston Company emphasizes moderately priced goods, it can display 840 items in the store. If Preston Company emphasizes designer wear, it can only display 360 designer items. These numbers are also the average monthly sales in units. Print Done Parkland Sunglasses sell for about $151 per pair. Suppose that the company incurs the following average costs per pair (Click the icon to view the cost information.) Parkland has enough idle capacity to accept a one-time-only special order from Utah Shades for 17.000 pairs of sunglasses at 583 per pair. Parkland will not incur any variable selling expenses for the order. Read the requirements. Requirement 1. How would accepting the order affect Parkland's operating income? In addition to the special order's effect on profits, what other (longe i Data Table accept the order? Prepare the analysis to determine the effect on operating income. (Enter decreases to profits with a parentheses or minus sign.) Expected increase in revenues 17,000 sunglasses 17,000 sunglasses x S S Expected increase in expenses 83 $ 1,411,000 62 (1.054,000) $ 357,000 Expected increase in operating income Direct materials Direct labor Variable manufacturing overhead Variable selling expenses Fixed manufacturing overhead In addition to the special order's effect on profits, what other (longer-term qualitative) factors should Parkland's managers consider in deciding whether Total cost * $1,950,000 Total fixed manufacturing overhead / 78,000 Pairs of sunglasses O A How will Parkland's competitors react? Will they retaliate by cutting their prices and starting a price war? OB. Will Parkland's other customers find out about the lower sale price Parkland offered to Utah Shades? If so, will these other customers demand OC. Will lowering the sale price tarnish Parkland's image as a high-quality brand? D. All of the above O E. None of the above Print Done Requirement 2. Parkland's marketing manager, Peter Smith, argues against accepting the special order because the offer price of 583 is less than Parkland's $89 cost to make the sunglasses. Smith asks you, as one of Parkland's staff accountants, to explain whether his analysis is correct. What would you say? When deciding whether to accept a special order, we should compare the revenues prior to filling the order against the extra costs we will incur to fill the order. Costs that we will incur whether or not we fill the order are irrelevant to our decision. This is why comparing the $83 price Utah Shades offered us with our sag total cost of making the sunglasses is incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts