Question: please help me with the first two questions Issuing Bonds at a Premium On the first day of the fiscal year, a company issues a

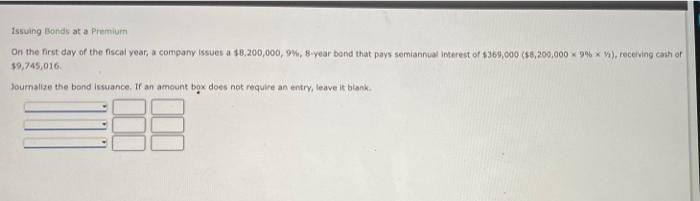

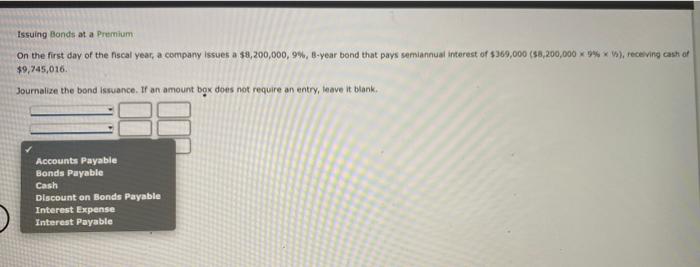

Issuing Bonds at a Premium On the first day of the fiscal year, a company issues a $8,200,000,9%, 8-year band that pays semiannual interest of 8369,000 ($5,200,000 x 94 x W), receiving cathor 39,745,016 Journalize the bond issuance. If an amount box does not require an entry, leave it blank Issuing Bonds at a Premium On the first day of the scal year, a company issues a $8,200,000, 9%, B-year bond that pays semiannual interest of $369,000 ($8,200,000 9%), receving cash of $9,745,016. Journalize the bond issuance. If an amount box does not require an entry, leave it blank Accounts Payable Bonds Payable Cash Discount on Bonds Payable Interest Expense Interest Payable When the corporation Issuing the bonds has the right to redeem the bonds prior to the maturity, the bonds are a unsecured bonds b. convertible bonds c. dcbenture bonds d. collable bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts