Question: please help me with the following; adjusted trial balance, post closing trial balance,income statement,statement of retained earnings,balance sheet,closing entry,financial statement using the datas in the

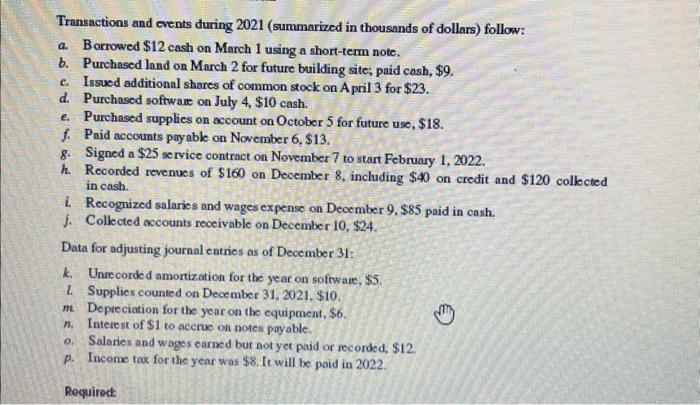

Transactions and events during 2021 (summarized in thousands of dollars) follow: a. Borrowed $12 cash on March 1 using a short-term note. b. Purchased land on March 2 for future building site; paid cash, $9. c. Issued additional shares of common stock on A pril 3 for $23. d. Purchased softwar on July 4, $10 cash. e. Purchased supplies on account on October 5 for future use, $18. f. Paid accounts payable on November 6,$13. 8. Signed a $25 service contract on November 7 to start February 1, 2022. h. Recorded revenues of $160 on December 8 , including $40 on credit and $120 collected in cash. i. Recognized salaries and wages expense on Deoember 9.$85 paid in cash. j. Collected accounts receivable on December 10,$24. Data for adjusting journal entries as of December 31: k. Unre corded amortization for the year on sottware, $5. L. Supplies counted on December 31, 2021, \$10. m. Depreciation for the year on the equipment, $6. n. Interest of $1 to acerue on notes payable. o. Salarien and wages caried but not yet puid or reconded, $12. p. Income tax for the year was $8. It will be poid in 2022 . Transactions and events during 2021 (summarized in thousands of dollars) follow: a. Borrowed $12 cash on March 1 using a short-term note. b. Purchased land on March 2 for future building site; paid cash, $9. c. Issued additional shares of common stock on A pril 3 for $23. d. Purchased softwar on July 4, $10 cash. e. Purchased supplies on account on October 5 for future use, $18. f. Paid accounts payable on November 6,$13. 8. Signed a $25 service contract on November 7 to start February 1, 2022. h. Recorded revenues of $160 on December 8 , including $40 on credit and $120 collected in cash. i. Recognized salaries and wages expense on Deoember 9.$85 paid in cash. j. Collected accounts receivable on December 10,$24. Data for adjusting journal entries as of December 31: k. Unre corded amortization for the year on sottware, $5. L. Supplies counted on December 31, 2021, \$10. m. Depreciation for the year on the equipment, $6. n. Interest of $1 to acerue on notes payable. o. Salarien and wages caried but not yet puid or reconded, $12. p. Income tax for the year was $8. It will be poid in 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts