Question: Please help me with the following errors. At year-end, there were no Intra-entity recelvables or payables. a. Compute the amount of goodwill recognized In Holland's

Please help me with the following errors.

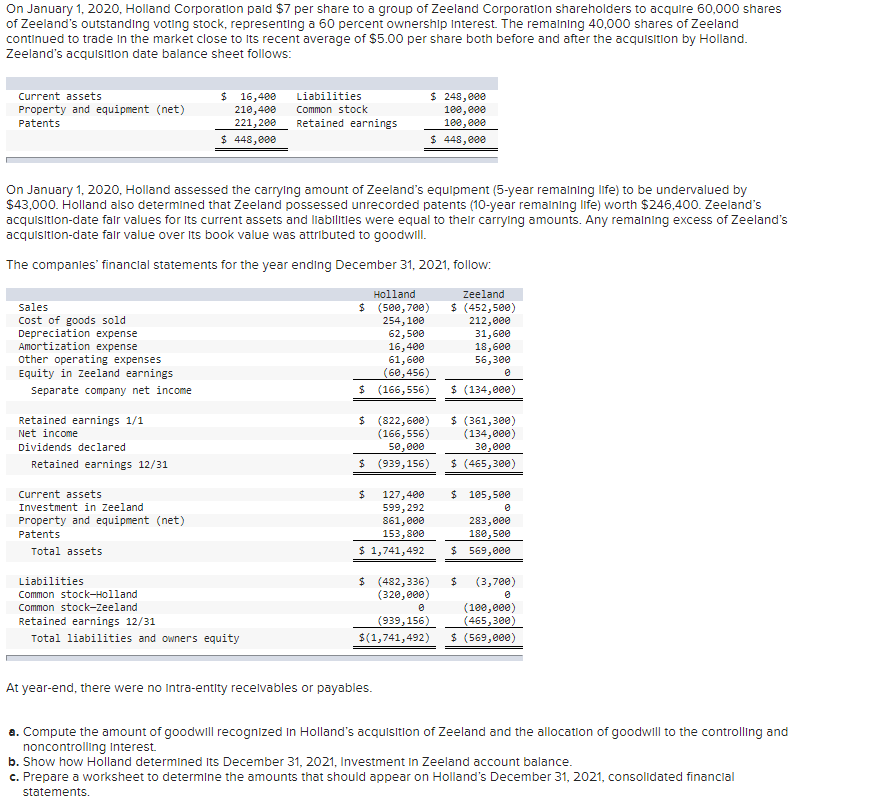

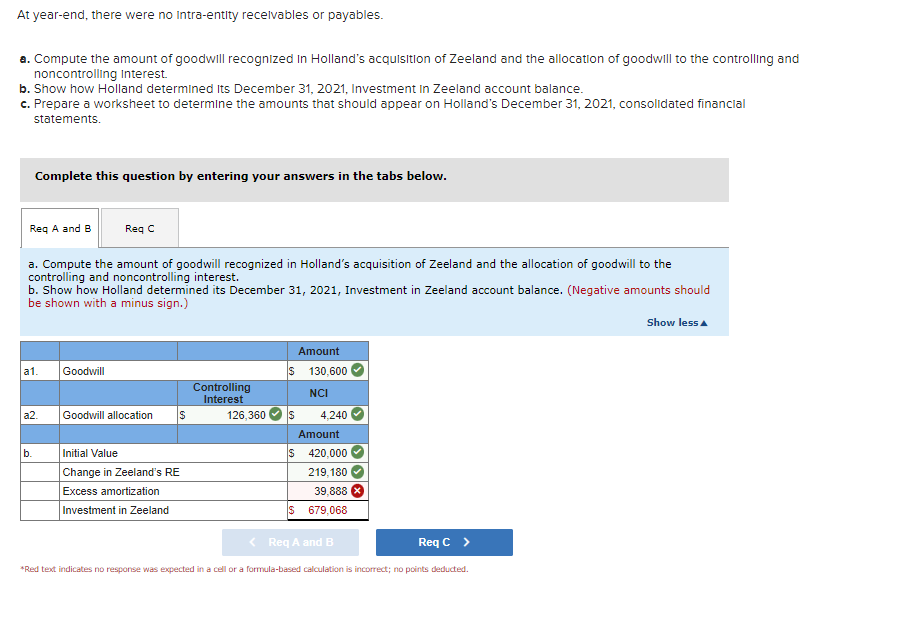

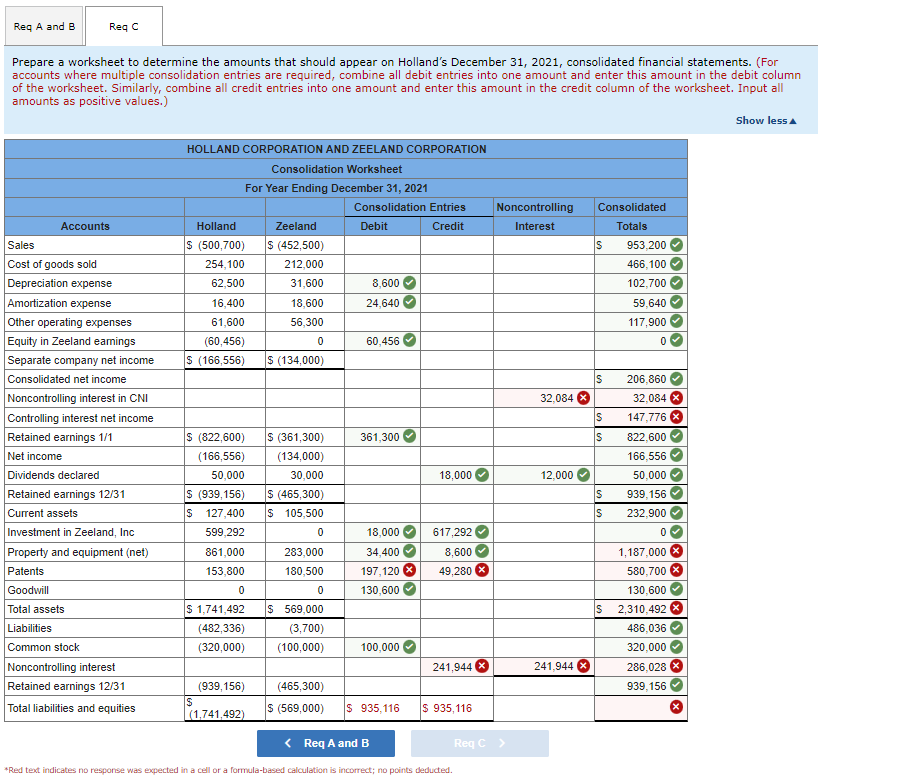

At year-end, there were no Intra-entity recelvables or payables. a. Compute the amount of goodwill recognized In Holland's acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling Interest. b. Show how Holland determined Its December 31, 2021, Investment In Zeeland account balance. c. Prepare a worksheet to determIne the amounts that should appear on Holland's December 31, 2021, consolidated financlal statements. Complete this question by entering your answers in the tabs below. a. Compute the amount of goodwill recognized in Holland's acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest. b. Show how Holland determined its December 31, 2021, Investment in Zeeland account balance. (Negative amounts should be shown with a minus sign.) Show less 4 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. On January 1,2020 , Holland Corporation pald $7 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding votIng stock, representing a 60 percent ownership Interest. The remalnIng 40,000 shares of Zeeland continued to trade in the market close to Its recent average of $5.00 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: On January 1, 2020, Holland assessed the carrying amount of Zeeland's equipment (5-year remalning life) to be undervalued by $43,000. Holland also determIned that Zeeland possessed unrecorded patents (10-year remainIng IIfe) worth $246,400. Zeeland's acquisition-date falr values for Its current assets and llabilitles were equal to thelr carrying amounts. Any remalning excess of Zeeland's acquisition-date falr value over Its book value was attributed to goodwill. The companles' financlal statements for the year ending December 31, 2021, follow: At year-end, there were no Intra-entity recelvables or payables. a. Compute the amount of goodwill recognized In Holland's acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest. b. Show how Holland determined Its December 31, 2021, Investment In Zeeland account balance. c. Prepare a worksheet to determIne the amounts that should appear on Holland's December 31, 2021, consolidated financlal statements. Prepare a worksheet to determine the amounts that should appear on Holland's December 31, 2021, consolidated financial statements. (For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.) Show less \begin{tabular}{|l} \hline S \\ \hline C \\ \hline D \\ \hline Al \\ \hline O \\ \hline E \\ \hline S \\ \hline C \\ \hline N \\ \hline C \\ \hline R \\ \hline N \\ \hline D \\ \hline R \\ \hline C \\ \hline In \\ \hline P \\ \hline P \\ \hline G \\ \hline TC \\ \hline Li \\ \hline C \\ \hline N \\ \hline R \\ \hline Tc \\ \hline \end{tabular} *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts