Question: Please help me with the following question and answer in EXCEL ==FORMULATEXT() for answers. Please show the process on each of the steps. I will

Please help me with the following question and answer in EXCEL ==FORMULATEXT() for answers. Please show the process on each of the steps. I will also attach a Google Sheet link in the comments for easier answers. Thank you for your help!

https://docs.google.com/spreadsheets/d/1TOKtK7AGPse9lAFa80XjZtI_lPH4yr-5oCwCSnjQMTs/edit?usp=sharing

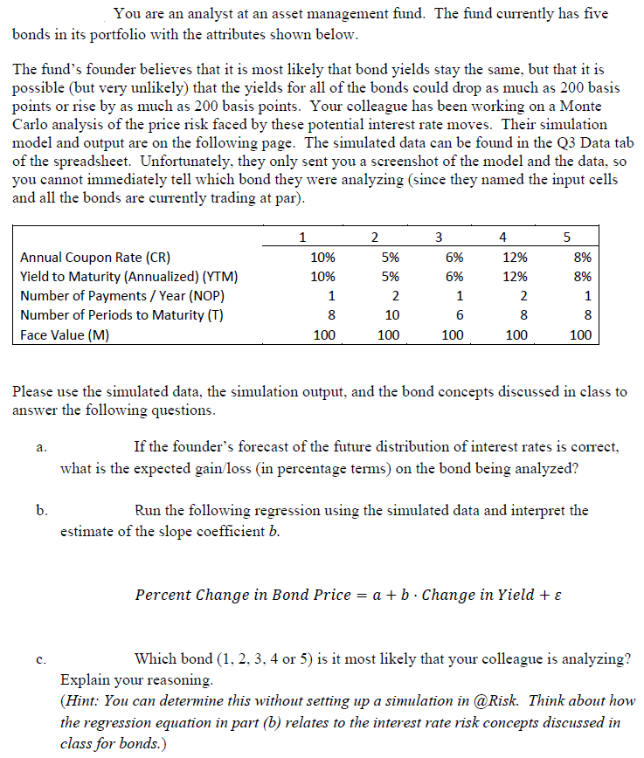

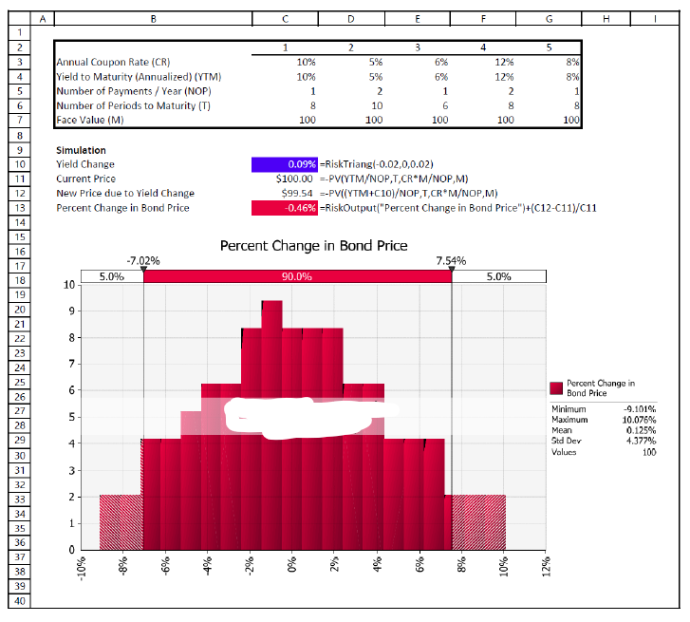

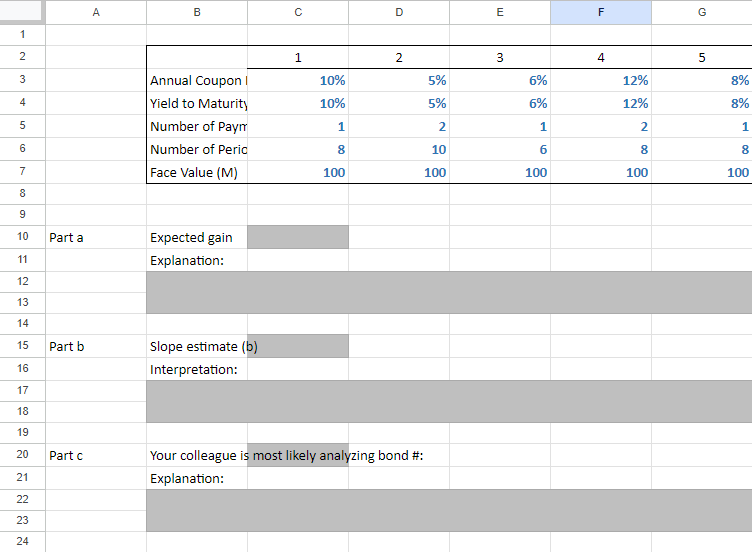

You are an analyst at an asset management fund. The fund currently has five bonds in its portfolio with the attributes shown below. The fund's founder believes that it 1s most likely that bond yields stay the same, but that it 1s possible (but very unlikely) that the yields for all of the bonds could drop as much as 200 basis points or rise by as much as 200 basis points. Your colleague has been working on a Monte Carlo analysis of the price risk faced by these potential interest rate moves. Their simulation model and output are on the following page. The sumulated data can be found in the Q3 Data tab of the spreadsheet. Unfortunately. they only sent you a screenshot of the model and the data. so you cannot immediately tell which bond they were analyzing (since they named the input cells and all the bonds are currently trading at par). Annual Coupon Rate (CR) Yield to Maturity (Annualized) (YTM) Number of Payments / Year (NOP) Number of Periods to Maturity (T) Face Value (M) Please use the simulated data, the simulation output, and the bond concepts discussed in class to answer the following questions. a. If the founder's forecast of the future distribution of interest rates i1s cormrect, what is the expected gain/loss (in percentage terms) on the bond being analyzed? b. Run the following regression using the simulated data and interpret the estimate of the slope coefficient b. Percent Change in Bond Price = a + b - Change in Yield + C. Which bond (1. 2. 3. 4 or 5) 1s it most likely that vour colleague 1s analyzing? Explain your reasoning. (Hint. You can determine this without setting up a simulation in @Risk. Think about how the regression equartion in part (b) relates to the interest rate risk concepts discussed in class for bonds.) B C D F F G H 1 2 3 4 5 Annual Coupon Rate (CR) 10% 5% 6 12% Yield to Maturity (Annualized) (YTM) 10% 59% 69% 12% 89% Number of Payments / Year (NOP) 1 1 Number of Periods to Maturity (T) 8 10 6 8 8 Face Value (M) 100 100 100 100 100 Simulation Yield Change 0.09% =RiskTriang(-0.02,0,0.02) Current Price $100.00 =-PVIYTM/NOP,T,CR*M/NOP,M) New Price due to Yield Change $99.54 =-PV((YTM+C10)/NOP,T,CR*M/NOP,M) 13 Percent Change in Bond Price -0.46% =RiskOutput["Percent Change in Bond Price")+(C12-C11)/C11 Percent Change in Bond Price 17 -7.02% 7.54% 18 5.0% 90.0% 5.0% 10 19 20 21 22 23 24 25 Percent Change in 26 Bond Price 27 Minimum 4.101% 28 Maximum 10.075%% Mean 0.125% 29 Stad Dev 4.377% 30 Values 100 31 W 32 N 33 34 35 36 6% 6% 0% 8% 2% 4% 8% -2% 10% 12% 38 -10% 39 40A B C D E F G 1 2 3 4 5 Annual Coupon | 10% 5% 6% 12% 8% 4 Yield to Maturity 10% 5% 6% 12% 8% Number of Paym 1 2 1 2 1 6 Number of Peric 10 6 8 Face Value (M) 100 100 100 100 100 8 9 10 Part a Expected gain 11 Explanation: 12 13 14 15 Part b Slope estimate (b) 16 Interpretation: 17 18 19 20 Part c Your colleague is most likely analyzing bond #: 21 Explanation: 22 23 24