Question: Please help me with the following questions: Question 1 Question 2 a. This is the correct decision tree for this company. Question 3 Mariah Enterprises

Please help me with the following questions:

Question 1

Question 2

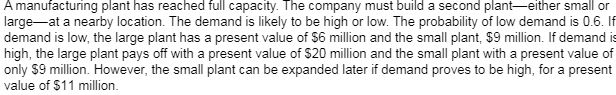

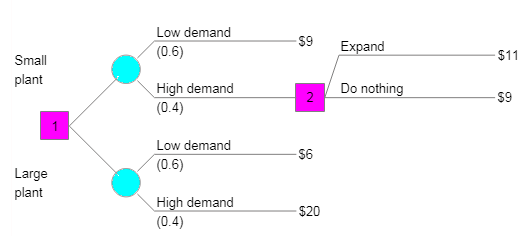

a. This is the correct decision tree for this company.

Question 3

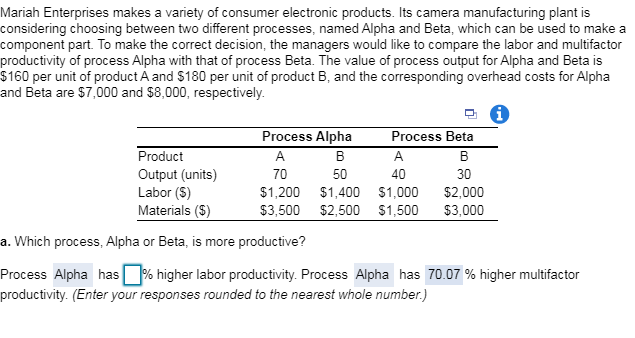

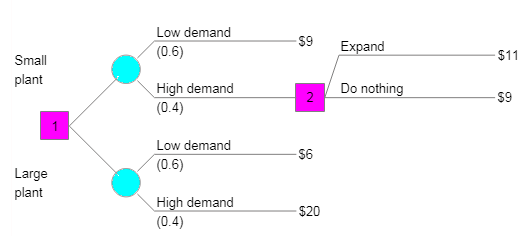

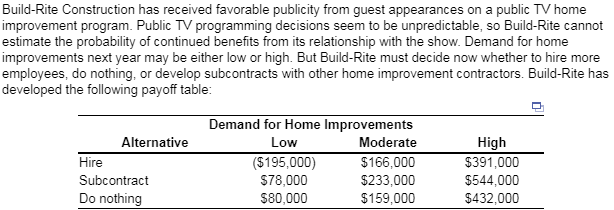

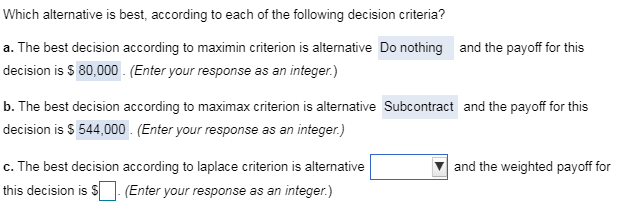

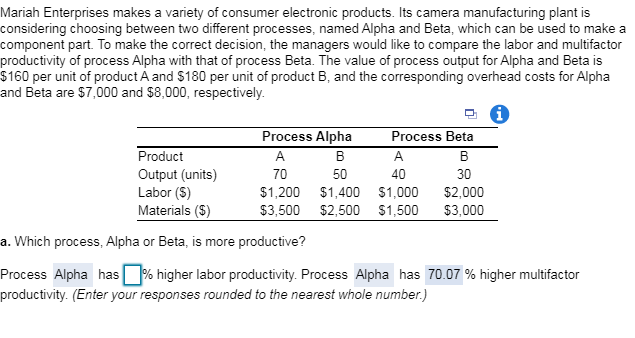

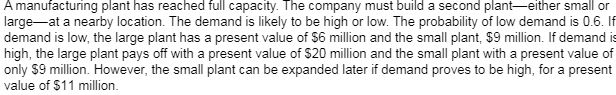

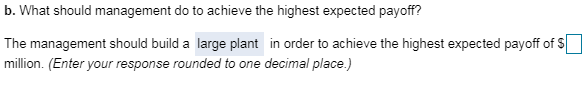

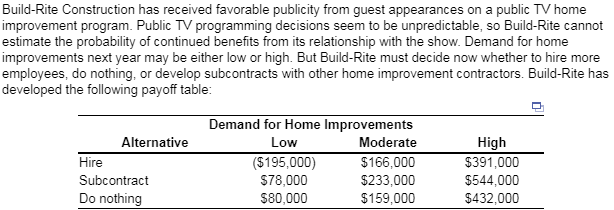

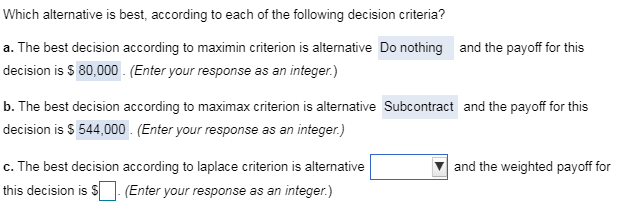

Mariah Enterprises makes a variety of consumer electronic products. Its camera manufacturing plant is considering choosing between two different processes, named Alpha and Beta, which can be used to make a component part. To make the correct decision, the managers would like to compare the labor and multifactor productivity of process Alpha with that of process Beta. The value of process output for Alpha and Beta is $160 per unit of product A and $180 per unit of product B, and the corresponding overhead costs for Alpha and Beta are $7,000 and $8,000, respectively. Product Output (units) Labor (S) Materials ($) Process Alpha A B 7050 $1,200 $1,400 $3,500 $2,500 Process Beta 40 30 $1,000 $2,000 $1,500 $3,000 a. Which process, Alpha or Beta, is more productive? Process Alpha has % higher labor productivity. Process Alpha has 70.07 % higher multifactor productivity. (Enter your responses rounded to the nearest whole number.) A manufacturing plant has reached full capacity. The company must build a second plant-either small or largeat a nearby location. The demand is likely to be high or low. The probability of low demand is 0.6. If demand is low, the large plant has a present value of $6 million and the small plant, $9 million. If demand is high, the large plant pays off with a present value of $20 million and the small plant with a present value of only $9 million. However, the small plant can be expanded later if demand proves to be high, for a present value of $11 million. Low demand (0.6) $9 Expand $11 Small plant Do nothing High demand (0.4) 59 Low demand (0.6) Large plant High demand (0.4) b. What should management do to achieve the highest expected payoff? The management should build a large plant in order to achieve the highest expected payoff of $ million. (Enter your response rounded to one decimal place.) Build-Rite Construction has received favorable publicity from guest appearances on a public TV home improvement program. Public TV programming decisions seem to be unpredictable, so Build-Rite cannot estimate the probability of continued benefits from its relationship with the show. Demand for home improvements next year may be either low or high. But Build-Rite must decide now whether to hire more employees, do nothing, or develop subcontracts with other home improvement contractors. Build-Rite has developed the following payoff table: Alternative Hire Subcontract Do nothing Demand for Home Improvements Low Moderate ($195,000) $166,000 $78,000 $233,000 $80,000 $159,000 High $391,000 $544,000 $432,000 Which alternative is best, according to each of the following decision criteria? and the payoff for this a. The best decision according to maximin criterion is alternative Do nothing decision is $ 80,000. (Enter your response as an integer.) b. The best decision according to maximax criterion is alternative Subcontract and the payoff for this decision is $ 544,000. (Enter your response as an integer.) and the weighted payoff for c. The best decision according to laplace criterion is alternative this decision is $ (Enter your response as an integer.)