Question: please help me with the last three questions The adjusting entry to record the amortization of a discount on bonds payable is a. debit Interest

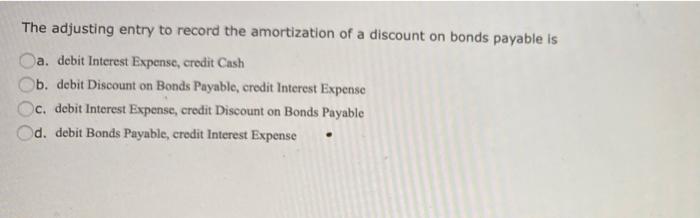

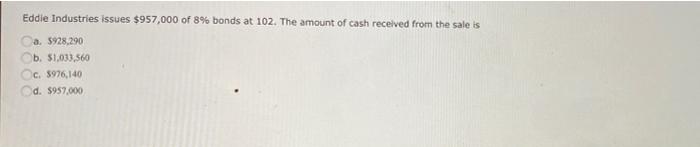

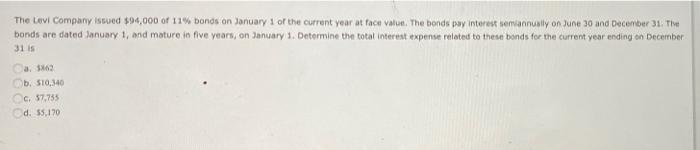

The adjusting entry to record the amortization of a discount on bonds payable is a. debit Interest Expense, credit Cash b. debit Discount on Bonds Payable, credit Interest Expense c. debit Interest Expense, credit Discount on Bonds Payable d. debit Bonds Payable, credit Interest Expense Eddie Industries issues $957,000 of 8% bonds at 102. The amount of cash received from the sale is Ca. 5928,290 b. 51,033,560 c. 3976,140 d. $959.000 The Love Company issued $94,000 of 11% bonds on January 1 of the current year at face value. The bonds pay interest semiannually on June 30 and December 31 bonds are dated January 1, and mature in five years, on January 1, Determine the total interest expense related to these bonds for the current year ending on December 31 is b. 510,340 c. 57,735 d. 55,170

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts