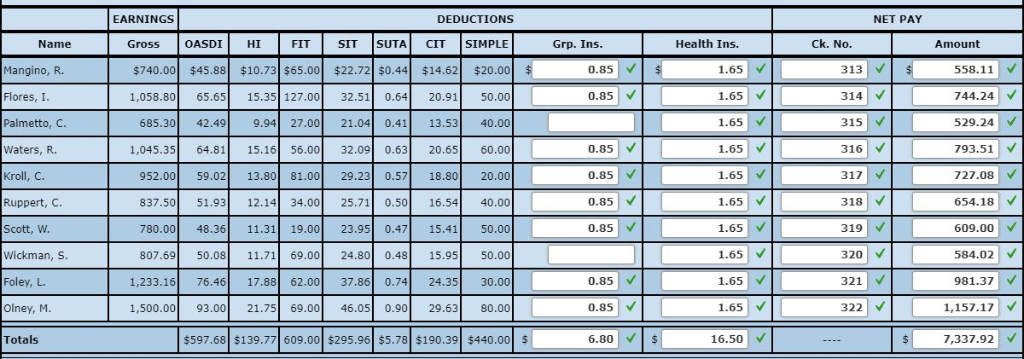

Question: Please help me with the one I have wrong. EARNINGS DEDUCTIONS NET PAY SUTA Grp. Ins SIMPLE Health Ins. Ck. No. Name Gross OASDI I

Please help me with the one I have wrong.

Please help me with the one I have wrong.

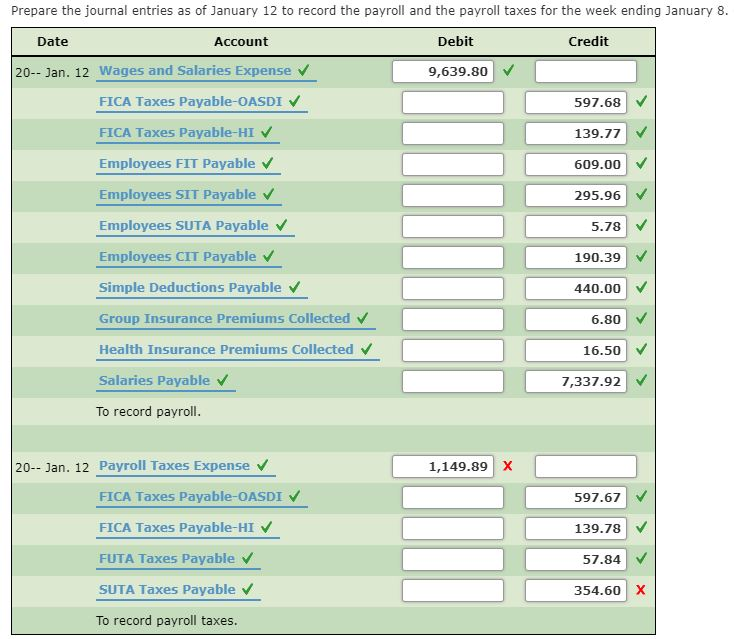

EARNINGS DEDUCTIONS NET PAY SUTA Grp. Ins SIMPLE Health Ins. Ck. No. Name Gross OASDI I FIT SIT CI Amount Mangino, R. $10.73 $65.00 $22.72 $0.44 $20.00 313 558.11 0.85 1.65 $ $740.00 $45.88 $14.62 Flores, I 15.35 127.00 0.85 1.65 314 744.24 1,058.80 65.65 32.51 0.64 20.91 50.00 529.24 Palmetto, C. 21.04 0.41 315 | 9.94 27.00 1.65 685.30 42.49 13.53 40.00 Waters, R. 0.85 1.65 316 793.51 1,045.35 64.81 15.16 56.00 32.09 0.63 20.65 60.00 317 Kroll, C. 0.85 1.65 727.08 952.00 59.02 13.80 81.00 29.23 0.57 18.80 20.00 40.00 Ruppert, C. 837.50 51.93 12.14 34.00 25.71 0.50 16.54 0.85 1.65 318 654.18 319 Scott, W 0.85 1.65 609.00 780.00 48.36 11.31 19.00 23.95 0.47 15.41 50.00 320V Wickman, S. 1.65 V 807.69 50.08 11.71 69.00 24,80 0.48 15.95 50.00 584.02 1.65 321 Foley, L 37.86 0.74 76.46 1,233.16 0.85 981.37 17.88 62.00 24.35 30.00 46.05 0.90 1.65V Olney, M. 0.85 322 1,157.17 1,500.00 93.00 21.75 69.00 29.63 80.00 $597.68 $139.77 609.00 $295.96 $5.78 $190.39 $440.00 $ Totals $ 6.80 16.50 7,337.92 Prepare the journal entries as of January 12 to record the payroll and the payroll taxes for the week ending January 8 Debit Credit Date Account 20--Jan. 12 Wages and Salaries Expense 9,639.80 FICA Taxes Payable-OASDI 597.68 FICA Taxes Payable-HI 139.77 Employees FIT Payable 609.00 Employees SIT Payable 295.96 Employees SUTA Payable 5.78 Employees CIT Payable 190.39 Simple Deductions Payable 440.00 Group Insurance Premiums Collected 6.80 Health Insurance Premiums Collected 16.50 Salaries Payable 7,337.92 To record payroll. 1,149.89 X 20 Jan. 12 Payroll Taxes Expense FICA Taxes Payable-OASDI 597.67 FICA Taxes Payable-HI 139.78 FUTA Taxes Payable 57.84 SUTA Taxes Payable 354.60 X To record payroll taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts