Question: Please help me with the problem. thank you in advance! The asset and liability balances of Stuart enterprises, as obtained from the comparative balance sheet

Please help me with the problem. thank you in advance!

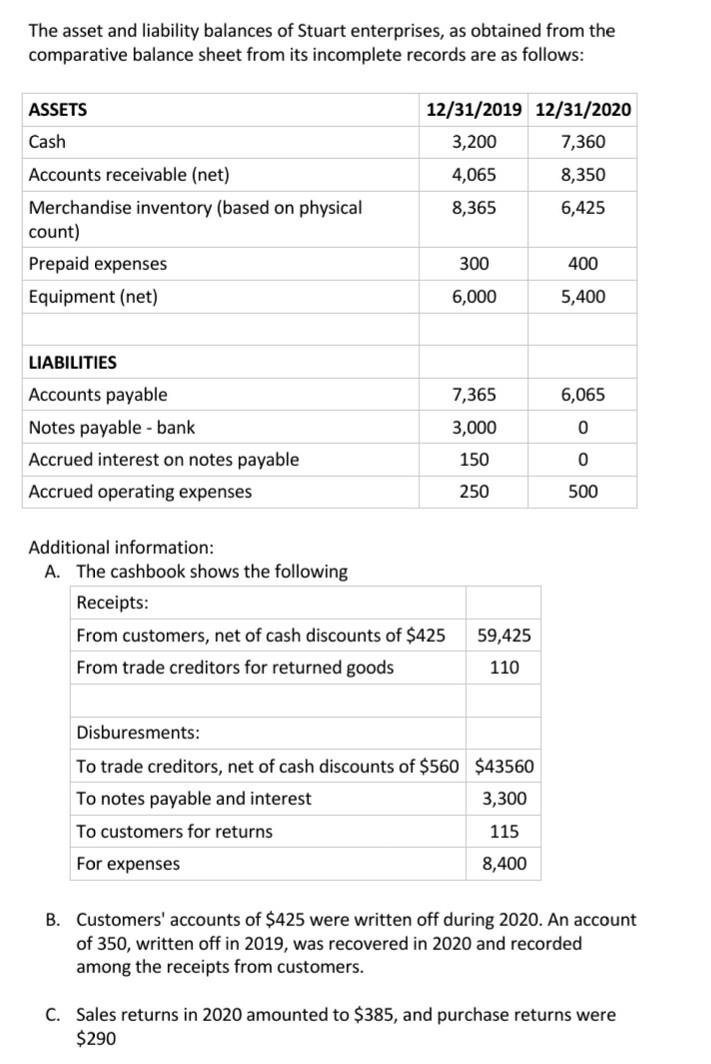

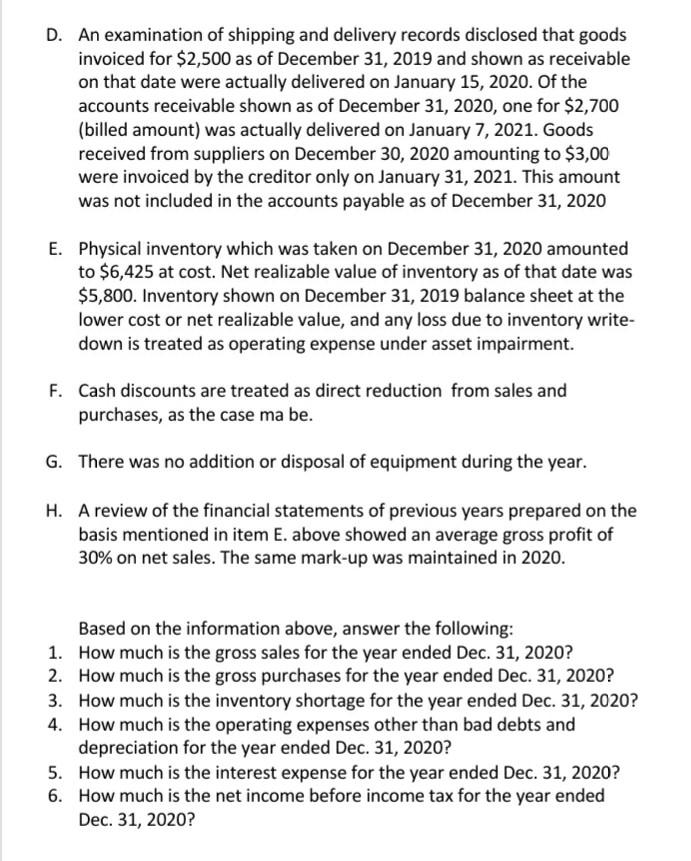

The asset and liability balances of Stuart enterprises, as obtained from the comparative balance sheet from its incomplete records are as follows: ASSETS Cash 12/31/2019 12/31/2020 3,200 7,360 4,065 8,350 8,365 6,425 Accounts receivable (net) Merchandise inventory (based on physical count) Prepaid expenses Equipment (net) 300 400 6,000 5,400 LIABILITIES 7,365 6,065 3,000 0 Accounts payable Notes payable - bank Accrued interest on notes payable Accrued operating expenses 150 0 250 500 Additional information: A. The cashbook shows the following Receipts: From customers, net of cash discounts of $425 From trade creditors for returned goods 59,425 110 Disburesments: To trade creditors, net of cash discounts of $560 $43560 To notes payable and interest 3,300 To customers for returns 115 For expenses 8,400 B. Customers' accounts of $425 were written off during 2020. An account of 350, written off in 2019, was recovered in 2020 and recorded among the receipts from customers. C. Sales returns in 2020 amounted to $385, and purchase returns were $290 D. An examination of shipping and delivery records disclosed that goods invoiced for $2,500 as of December 31, 2019 and shown as receivable on that date were actually delivered on January 15, 2020. Of the accounts receivable shown as of December 31, 2020, one for $2,700 (billed amount) was actually delivered on January 7, 2021. Goods received from suppliers on December 30, 2020 amounting to $3,00 were invoiced by the creditor only on January 31, 2021. This amount was not included in the accounts payable as of December 31, 2020 E. Physical inventory which was taken on December 31, 2020 amounted to $6,425 at cost. Net realizable value of inventory as of that date was $5,800. Inventory shown on December 31, 2019 balance sheet at the lower cost or net realizable value, and any loss due to inventory write- down is treated as operating expense under asset impairment. F. Cash discounts are treated as direct reduction from sales and purchases, as the case ma be. G. There was no addition or disposal of equipment during the year. H. A review of the financial statements of previous years prepared on the basis mentioned in item E. above showed an average gross profit of 30% on net sales. The same mark-up was maintained in 2020. Based on the information above, answer the following: 1. How much is the gross sales for the year ended Dec. 31, 2020? 2. How much is the gross purchases for the year ended Dec. 31, 2020? 3. How much is the inventory shortage for the year ended Dec. 31, 2020? 4. How much is the operating expenses other than bad debts and depreciation for the year ended Dec. 31, 2020? 5. How much is the interest expense for the year ended Dec. 31, 2020? 6. How much is the net income before income tax for the year ended Dec. 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts