Question: Please help me with the question below: Sage Construction Company changed from the cost-recovery to the percentage-of-completion method of accounting for long-term construction contracts during

Please help me with the question below:

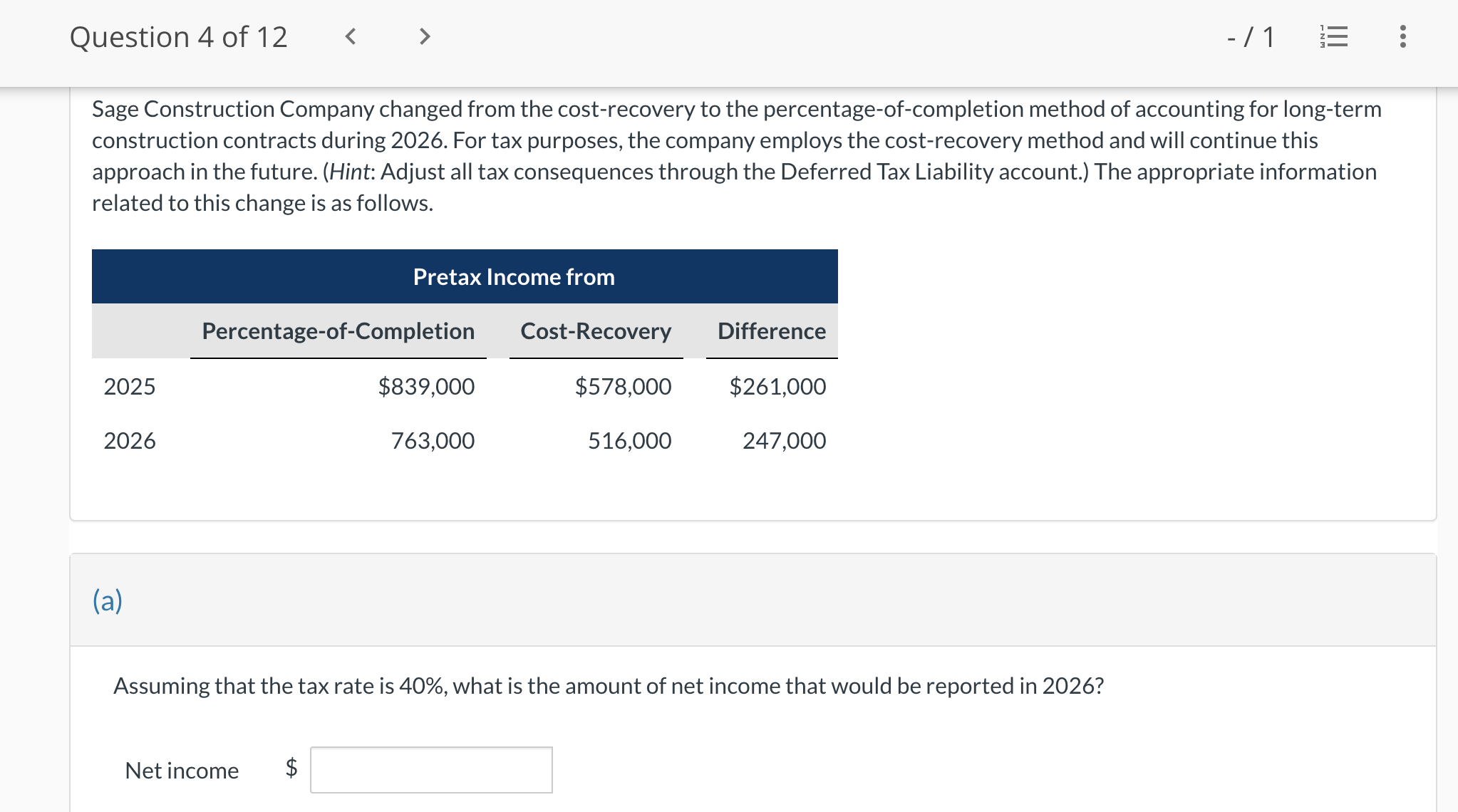

Sage Construction Company changed from the cost-recovery to the percentage-of-completion method of accounting for long-term construction contracts during 2026. For tax purposes, the company employs the cost-recovery method and will continue this approach in the future. (Hint: Adjust all tax consequences through the Deferred Tax Liability account.) The appropriate information related to this change is as follows. (a) Assuming that the tax rate is 40%, what is the amount of net income that would be reported in 2026? Net income $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock