Question: Please help me with the questions e answer Parsons, Inc. is a publicly owned company. The following information is excerpted from a recent balance sheet.

Please help me with the questions

e answer

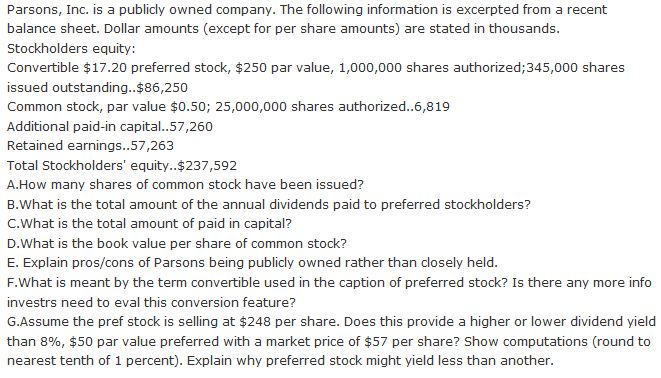

Parsons, Inc. is a publicly owned company. The following information is excerpted from a recent balance sheet. Dollar amounts (except for per share amounts) are stated in thousands. Stockholders equity: Convertible $17.20 preferred stock, $250 par value, 1,000,000 shares authorized;345,000 shares issued outstanding..$86,250 Common stock, par value $0.50; 25,000,000 shares authorized..6,819 Additional paid-in capital..57,260 Retained earnings..57,263 Total Stockholders' equity..$237,592 How many shares of common stock have been issued? What is the total amount of the annual dividends paid to preferred stockholders? What is the total amount of paid in capital? D.Wh3t is the book value per share of common stock? Explain pros/cons of Parsons being publicly owned rather than closely held. What is meant by the term convertible used in the caption of preferred stock? Is there any more info investrs need to eval this conversion feature? G.Assume the pref stock is selling at $248 per share. Does this provide a higher or lower dividend yield than 8%, $50 par value preferred with 3 market price of $57 per share? Show computations (round to nearest tenth of 1 percent). Explain why preferred stock might yield less than another. Parsons, Inc. is a publicly owned company. The following information is excerpted from a recent balance sheet. Dollar amounts (except for per share amounts) are stated in thousands. Stockholders equity: Convertible $17.20 preferred stock, $250 par value, 1,000,000 shares authorized;345,000 shares issued outstanding..$86,250 Common stock, par value $0.50; 25,000,000 shares authorized..6,819 Additional paid-in capital..57,260 Retained earnings..57,263 Total Stockholders' equity..$237,592 How many shares of common stock have been issued? What is the total amount of the annual dividends paid to preferred stockholders? What is the total amount of paid in capital? D.Wh3t is the book value per share of common stock? Explain pros/cons of Parsons being publicly owned rather than closely held. What is meant by the term convertible used in the caption of preferred stock? Is there any more info investrs need to eval this conversion feature? G.Assume the pref stock is selling at $248 per share. Does this provide a higher or lower dividend yield than 8%, $50 par value preferred with 3 market price of $57 per share? Show computations (round to nearest tenth of 1 percent). Explain why preferred stock might yield less than another

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts