Question: Please help me with the second and third question! An index consists of the following securities. If the index divisor is 3.0, what is the

Please help me with the second and third question!

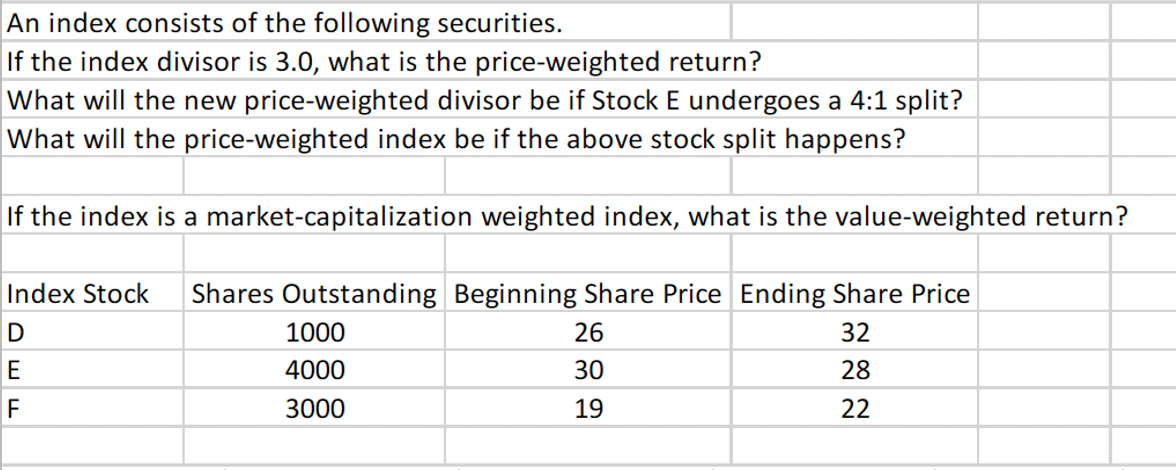

An index consists of the following securities. If the index divisor is 3.0, what is the price-weighted return? What will the new price-weighted divisor be if Stock E undergoes a 4:1 split? What will the price-weighted index be if the above stock split happens? If the index is a market-capitalization weighted index, what is the value-weighted return? \begin{tabular}{|l|c|c|c} \hline & & & \\ \hline Index Stock & Shares Outstanding & Beginning Share Price & Ending Share Price \\ \hline D & 1000 & 26 & 32 \\ \hline E & 4000 & 30 & 28 \\ \hline F & 3000 & 19 & 22 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts