Question: please help me with the steps . i know the correct answer and dont use AI . i can tell its AI . so please

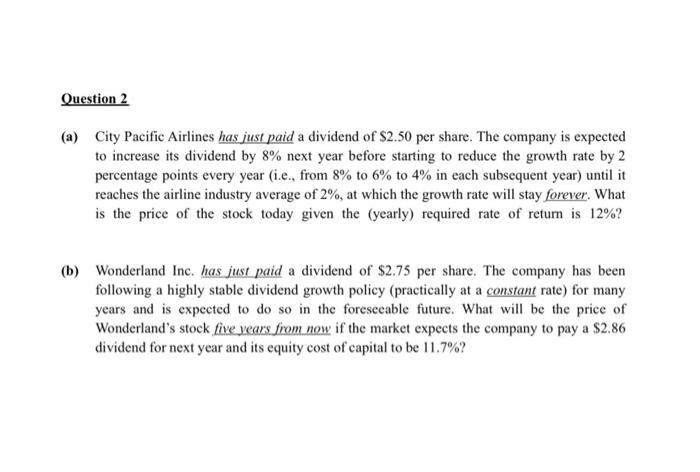

(a) City Pacific Airlines has just paid a dividend of $2.50 per share. The company is expected to increase its dividend by 8% next year before starting to reduce the growth rate by 2 percentage points every year (i.e., from 8% to 6% to 4% in each subsequent year) until it reaches the airline industry average of 2%, at which the growth rate will stay forever. What is the price of the stock today given the (yearly) required rate of return is 12% ? (b) Wonderland Inc. has just paid a dividend of $2.75 per share. The company has been following a highly stable dividend growth policy (practically at a constant rate) for many years and is expected to do so in the foreseeable future. What will be the price of Wonderland's stock five years from now if the market expects the company to pay a $2.86 dividend for next year and its equity cost of capital to be 11.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts