Question: please help me with these 2. thank you! i will rate the best. George has been employed by SEC Corp. for the last 212 years.

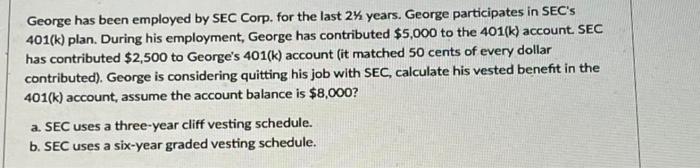

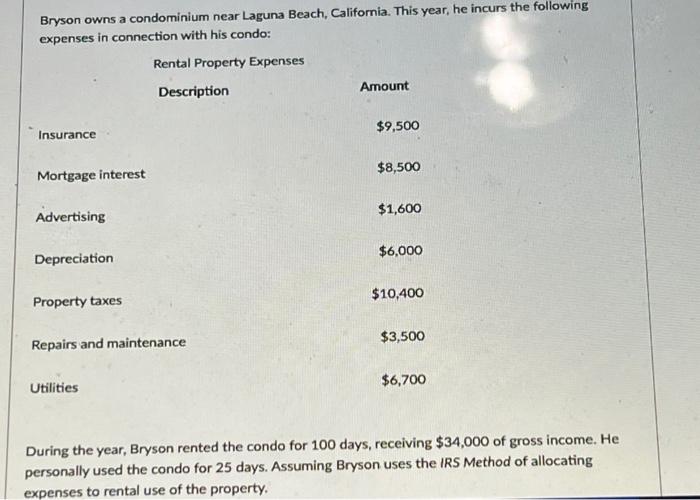

George has been employed by SEC Corp. for the last 212 years. George participates in SEC's 401(k) plan. During his employment, George has contributed $5,000 to the 401(k) account. SEC has contributed $2,500 to George's 401(k) account (it matched 50 cents of every dollar contributed). George is considering quitting his job with SEC, calculate his vested benefit in the 401(k) account, assume the account balance is $8,000 ? a. SEC uses a three-year cliff vesting schedule. b. SEC uses a six-year graded vesting schedule. Bryson owns a condominium near Laguna Beach, California. This year, he incurs the following expenses in connection with his condo: During the year, Bryson rented the condo for 100 days, receiving $34,000 of gross income. He personally used the condo for 25 days. Assuming Bryson uses the IRS Method of allocating expenses to rental use of the property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts