Question: please help me with these asap Question 27 (Mandatory) (1.5 points) Your company is considering a new project that will require $2,000,000 of new equipment

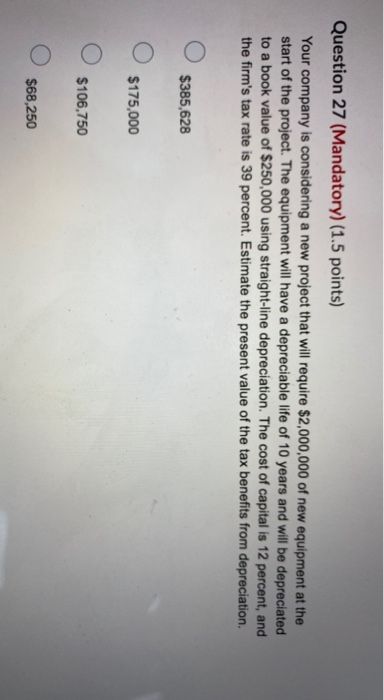

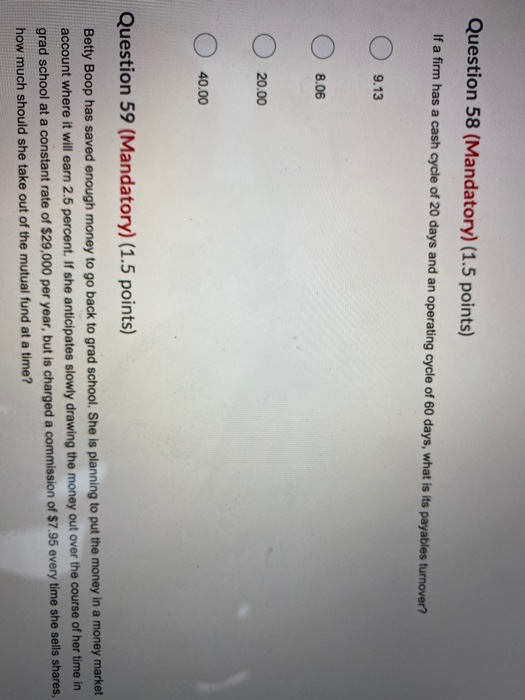

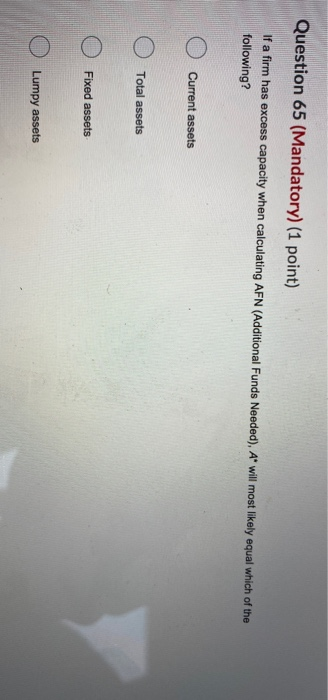

Question 27 (Mandatory) (1.5 points) Your company is considering a new project that will require $2,000,000 of new equipment at the start of the project. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of $250,000 using straight-line depreciation. The cost of capital is 12 percent, and the firm's tax rate is 39 percent. Estimate the present value of the tax benefits from depreciation. $385,628 $175,000 O $106,750 $68,250 Question 58 (Mandatory) (1.5 points) If a firm has a cash cycle of 20 days and an operating cycle of 60 days, what is its payables turnover? 09.13 08.06 O oo 20.00 40.00 Question 59 (Mandatory) (1.5 points) Betty Boop has saved enough money to go back to grad school. She is planning to put the money in a money market account where it will earn 2.5 percent. If she anticipates slowly drawing the money out over the course of her time in grad school at a constant rate of $29,000 per year, but is charged a commission of $7.95 every time she sells shares how much should she take out of the mutual fund at a time? Question 65 (Mandatory) (1 point) If a firm has excess capacity when calculating AFN (Additional Funds Needed), A* will most likely equal which of the following? O Current assets O Total assets O Fixed assets O Lumpy assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts