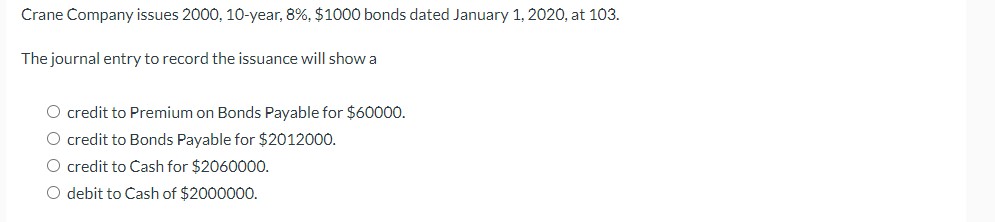

Question: Please help me with these Crane Company issues 2000, 10-year, 8%, $1000 bonds dated January 1, 2020, at 103. The journal entry to record the

Please help me with these

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock