Question: Please help me with these! Note: Don't copy the answer on the internet, you can base your answer on the internet but don't copy it.

Please help me with these!

Note: Don't copy the answer on the internet, you can base your answer on the internet but don't copy it.

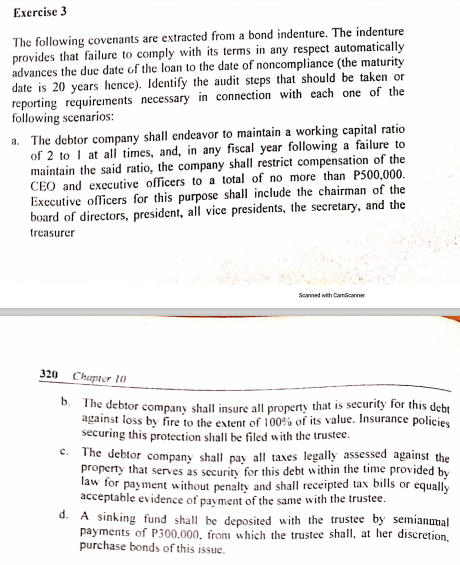

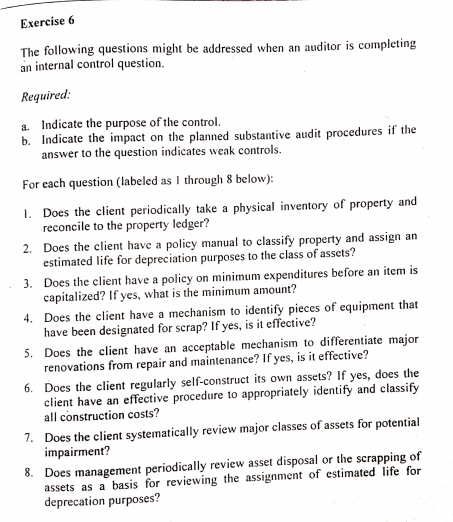

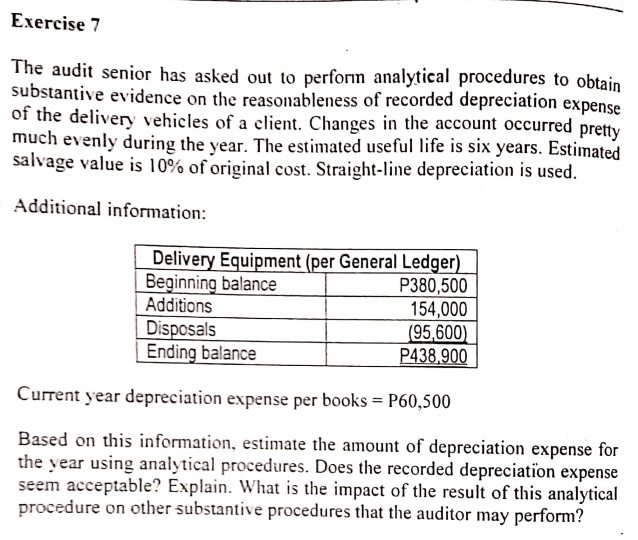

Exercise 3 The following covenants are extracted from a bond indenture. The indenture provides that failure to comply with its terms in any respect automatically advances the due date of the loan to the date of noncompliance (the maturity date is 20 years hence). Identify the audit steps that should be taken or reporting requirements necessary in connection with each one of the following scenarios: a. The debtor company shall endeavor to maintain a working capital ratio of 2 to I at all times, and, in any fiscal year following a failure to maintain the said ratio, the company shall restrict compensation of the CEO and executive officers to a total of no more than P500,000. Exccutive officers for this purpose shall include the chairman of the board of directors, president, all vice presidents, the secretary, and the treasurer scanned with Cursauna 320 Chapter 10 b. The debtor company shall insure all property that is security for this debt against loss by fire to the extent of 100% of its value. Insurance policies securing this protection shall be filed with the trustee. c. The debtor company shall pay all taxes legally assessed against the property that serves as security for this debt within the time provided by law for payment without penalty and shall receipted tax bills or equally acceptable evidence of payment of the same with the trustee. d. A sinking fund shall be deposited with the trustee by semianual payments of P300.000. from which the trustee shall, at her discretion. purchase bonds of this issue.lF-_._.---- " Eserci 5 The flim'tine EIHBSH'JIIS might be addressed when an auditor is completing an internal control question. Required: 3. Indicate the purpose oftl'te control. b. indicate the impact on the planned substantive audit procedures 11' the answer to the question indicates weal. controls. For each question [labeled as I tmug'l'l it below]: i. Does the client periodically taltc a physical inventory of properly and reconcile to the property ledger? 2. Does the client have a policy manual. to classify property and assign an estimated life for depreciation purposes to the class of assets? 3. Does the client have a policy on minimum expenditures before an item is capitalized? Il'ycs. what is the minimum amount? Il. Does the client have a mechanism to identify pieces of equipment have been designated for scrap? If yes1 is it el'Fectiye? 5. Does the client have an acceptable mechanism to differentiate major renovations -ont repair and maintenance? If' yes. is it elTectiue? r-constrttct its cunt assets? ll'yes. does the appropriately identify and classify that 45. Does the client regularly sel client have an effective procedure to all construction costs? ?- Does the client systematically review major cia impainnertt? 3. Does management periodically assets as a basis for revie'tl'ils deprecation purposes? sses of assets f'cr potential review asset disposal or the scrapping of the assignment of estimated life for Exercise 7 The audit senior has asked out to perform analytical procedures to obtain substantive evidence on the reasonableness of recorded depreciation expense of the delivery vehicles of a client. Changes in the account occurred pretty much evenly during the year. The estimated useful life is six years. Estimated salvage value is 10% of original cost. Straight-line depreciation is used. Additional information: Delivery Equipment (per General Ledger) Beginning balance P380,500 Additions 154,000 Disposals (95,600) Ending balance P438,900 Current year depreciation expense per books = P60,500 Based on this information, estimate the amount of depreciation expense for the year using analytical procedures. Does the recorded depreciation expense seem acceptable? Explain. What is the impact of the result of this analytical procedure on other substantive procedures that the auditor may perform