Question: please help me with these Question 41 (Mandatory) (0.6 points) Tim's Fix It Shop, Inc., is asking a price of $50 million to be purchased

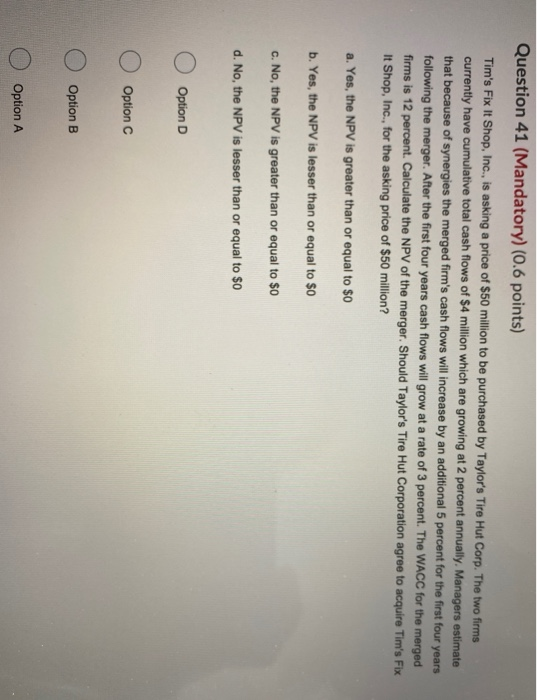

Question 41 (Mandatory) (0.6 points) Tim's Fix It Shop, Inc., is asking a price of $50 million to be purchased by Taylor's Tire Hut Corp. The two firms currently have cumulative total cash flows of $4 million which are growing at 2 percent annually. Managers estimate that because of synergies the merged firm's cash flows will increase by an additional 5 percent for the first four years following the merger. After the first four years cash flows will grow at a rate of 3 percent. The WACC for the merged firms is 12 percent. Calculate the NPV of the merger. Should Taylor's Tire Hut Corporation agree to acquire Tim's Fix It Shop, Inc., for the asking price of $50 million? a. Yes, the NPV is greater than or equal to $0 b. Yes, the NPV is lesser than or equal to $0 c. No, the NPV is greater than or equal to $0 d. No, the NPV is lesser than or equal to $0 O O Option D O Option C O O Option B O Option A Question 43 (Mandatory) (0.6 points) Which of the following is NOT a source of value-enhancing synergy in a merger? o Increased marketing presence 0 Tax considerations o Revenue enhancement o O Cost reduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts