Question: Please help me with these question, thank you! Brief Exercise 10-03 Wildhorse Company is constructing a building. Construction began on February 1 and was completed

Please help me with these question, thank you!

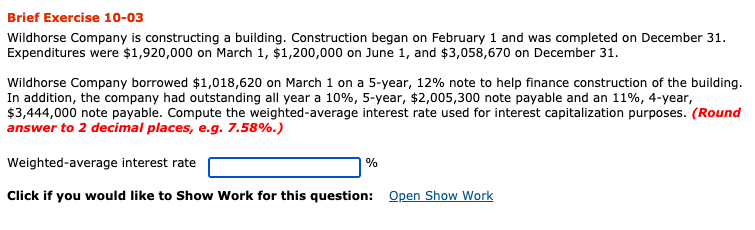

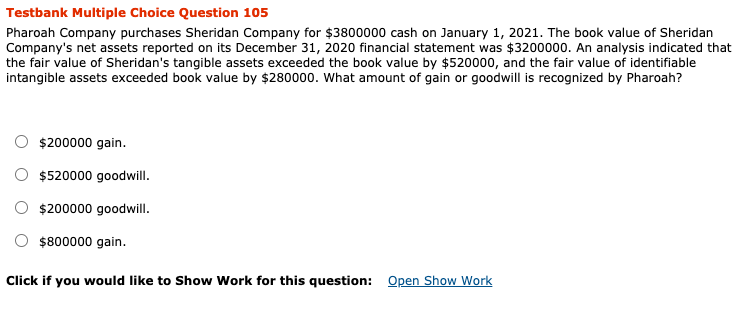

Brief Exercise 10-03 Wildhorse Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,920,000 on March 1, $1,200,000 on June 1, and $3,058,670 on December 31. Wildhorse Company borrowed $1,018,620 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 5-year, $2,005,300 note payable and an 11%, 4-year, $3,444,000 note payable. Compute the weighted average interest rate used for interest capitalization purposes. (Round answer to 2 decimal places, e.g. 7.58%.) Weighted average interest rate % Click if you would like to Show Work for this question: Open Show Work Testbank Multiple Choice Question 105 Pharoah Company purchases Sheridan Company for $3800000 cash on January 1, 2021. The book value of Sheridan Company's net assets reported on its December 31, 2020 financial statement was $3200000. An analysis indicated that the fair value of Sheridan's tangible assets exceeded the book value by $520000, and the fair value of identifiable intangible assets exceeded book value by $280000. What amount of gain or goodwill is recognized by Pharoah? $200000 gain. $520000 goodwill. $200000 goodwill. $800000 gain. Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts