Question: Please help me with these questions and answer them completely. Thank you very much! Question 3 You are speculating on appreciation of the . You

Please help me with these questions and answer them completely. Thank you very much!

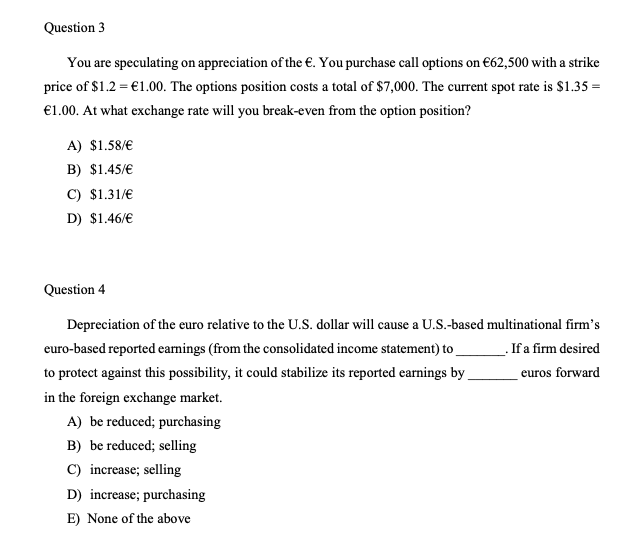

Question 3 You are speculating on appreciation of the . You purchase call options on 62,500 with a strike price of $1.2 = 1.00. The options position costs a total of $7,000. The current spot rate is $1.35 = 1.00. At what exchange rate will you break-even from the option position? A) $1.58/ B) $1.45/ C) $1.31/ D) $1.46/ Question 4 Depreciation of the euro relative to the U.S. dollar will cause a U.S.-based multinational firm's euro-based reported earnings (from the consolidated income statement) to _. If a firm desired to protect against this possibility, it could stabilize its reported earnings by euros forward in the foreign exchange market. A) be reduced; purchasing B) be reduced; selling C) increase; selling D) increase; purchasing E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts