Question: Please help me with these questions I really need help. I will financial statement and the questions please give me the answers Questions 1. What

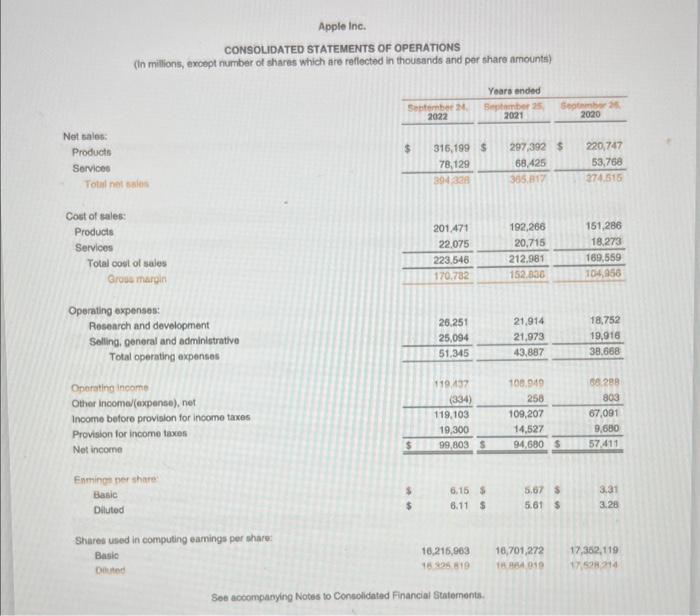

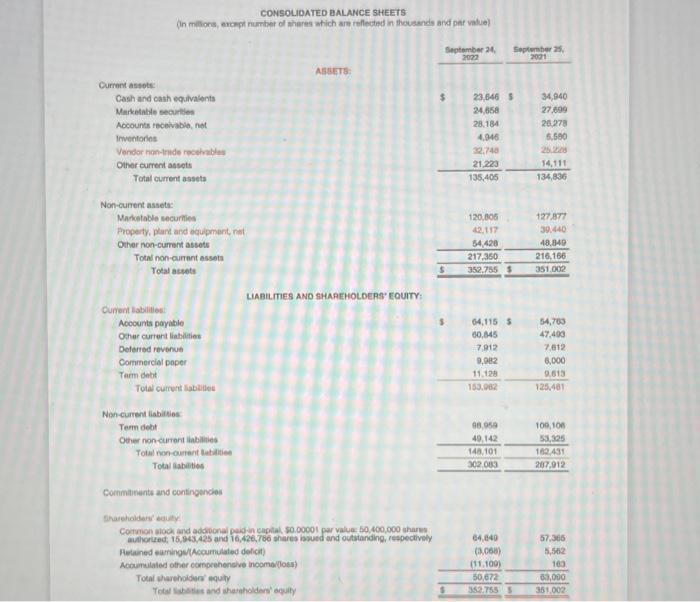

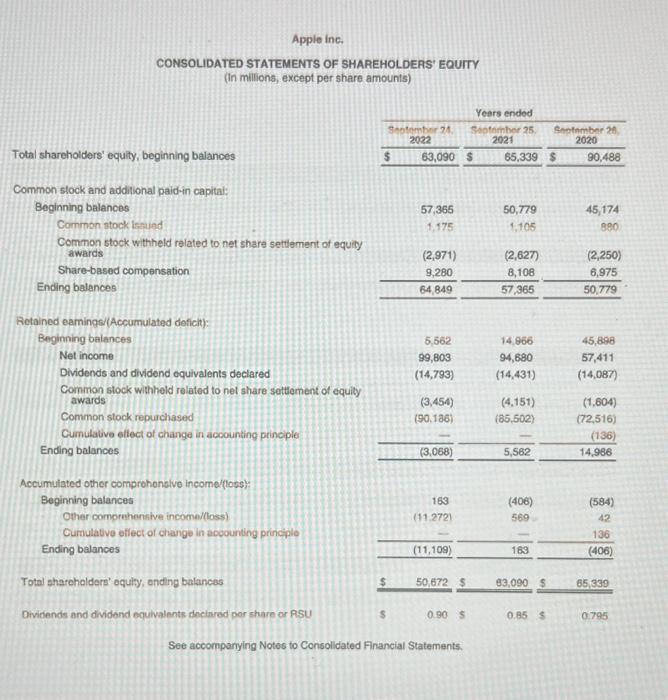

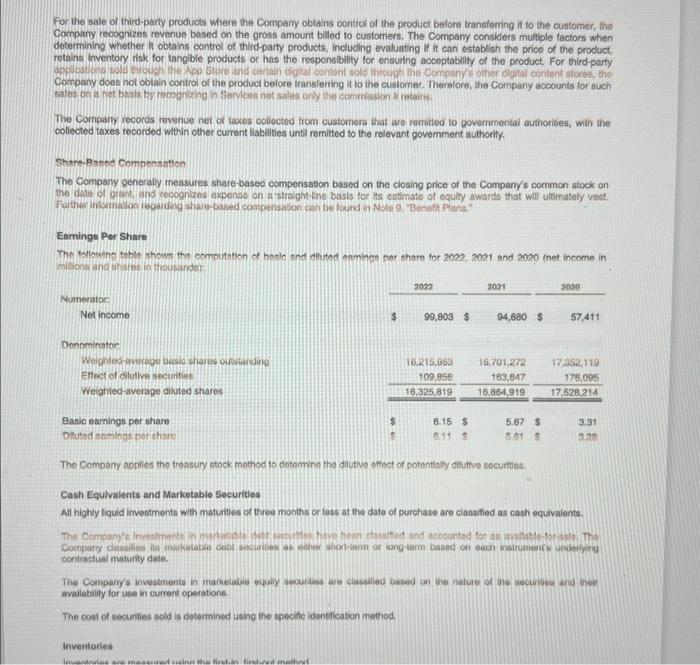

Apple Inc. CONSOLIOATED BALANCE SHEETS (in millons, encopt number of theres stich are reflected in thousends and par value) Apple inc. CONSOLIDATED STATEMENTS OF SHAREHOLDEAS' EQUTY (in millions, except per share amounts) Total sharehoiders' equity, beginning balances Common slock and additional paid-in capital: Beginning balances Common stock issined Common stock w thheld related to net share settement of equity awards Share-based compensation Ending balances \begin{tabular}{rrr} 57,365 & 50,779 & 45,174 \\ 1,175 & 1,705 & 880 \\ (2,971) & (2,627) & (2,250) \\ 9,280 & 8,108 & 6,975 \\ \hline 64,849 & 57,365 \\ \hline \end{tabular} Retained earnings(Accumulated defick): Beginning balances Net income Dividends and dividend oquivalents declared Common stock withheld related to nel share sattlement of equity awards Common stock repurchased Cumulaive ellect of change in accounting principle Ending balances \begin{tabular}{rrr} 5,562 & 14,966 & 45,896 \\ 99,803 & 94,680 & 57,411 \\ (14,793) & (14,431) & (14,087) \\ (3,454) & (4,151) & (1,604) \\ (90,136) & (85,502) & (72,516) \\ (3,068) & - & (136) \\ \hline \end{tabular} Aceumulated other comprohonelve income/(loss): Beginning balances Other comprehersive income/l(oss) Curnulative eflect of change in acoounting principle Ending balances \begin{tabular}{rrr} 163 & (406) & (584) \\ (11.272) & 569 & 42 \\ - & - & 136 \\ \hline(11,109) & 163 \\ \hline \end{tabular} Total sharcholders' equily, anding balances Dividends and dividend equivalents decived per share or RSU See accompanying Notes to Consolidated Financial Statements. For the sale of third-party products where the Company oblaing control of the product belore transfering it to the customer, the Compary recognizes revenue based on the gross amount billed to customers. The Company considers multiple factors when determining whether it oblains control of thild-party products, inclucing evaluating if it can establish the price of the product, relains inventory risk for tangble products or has the responsiblity for ensuing acceptablity of the product. For third-party Conpany does not obtain control of the produci betore Iransfering it to the customet. Therefore, the Company accounts for such sialos on a net besis by tecognlzing in Services not salei only the commission if retains. The company recoras revenue net of taxes oollocted from customers that aro remuited to govemmental authorites, with the collected taxes recorded within other cument llabilities until remitted to the relevant govemment authority. Shore-Baned Compentation The Company generally measures share-based compensation based on the closing price of the Company's cornmon stock on the date of grant, and recognizes cxpende on a stralght-ene basis for the cotimate of oqulty awards that will utfimately vost. Fortheri inichnason regardog atiaie-based compensason can be found in Note 9. "Benefit Plans." Earmings Per Share The follewnne toble shown the computation of borlo end dilited euminge per thare for 2022, 2021 and 2020 inet income in morient and sharop in thousandtor: The Company aoplios the traseury stock mothod to dotomine the dilutive ofticct of potentintly ditutivo securtiles. Cash Equlvalents and Markotable Securities All highly liquid investments with maturities of three months or loss at the date of purchase are classified as cash equivalents. contractual maturily dale. The Company's investments in markelable equily geoundies are clasolied based on the nature of the securctes and their availability for use in current operatione. The oost of securities sold is determinod using the specinc identification method, Inventories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts