Question: please help me with these, thank you! Question 36 (Mandatory) (1 point) Which of these is a capital budgeting technique that generates decision rules and

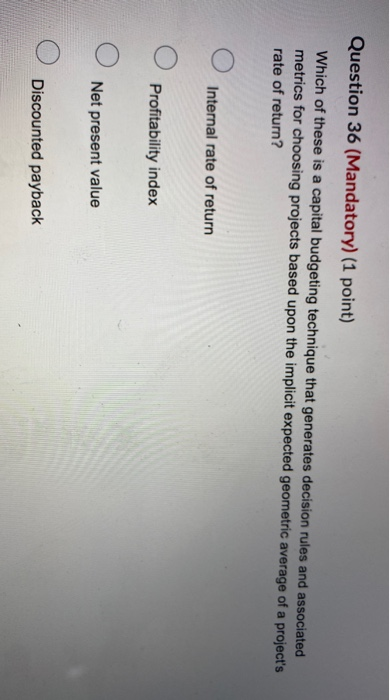

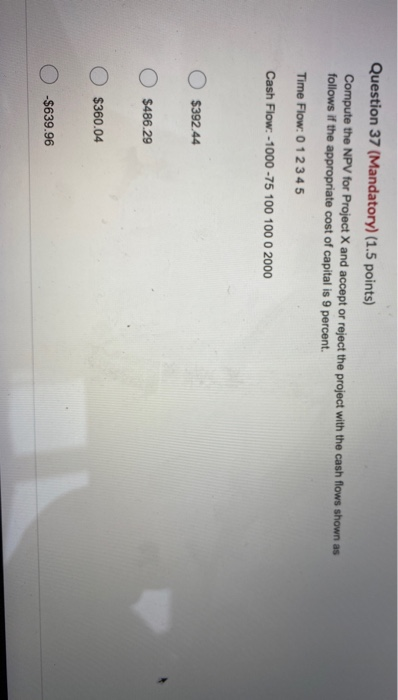

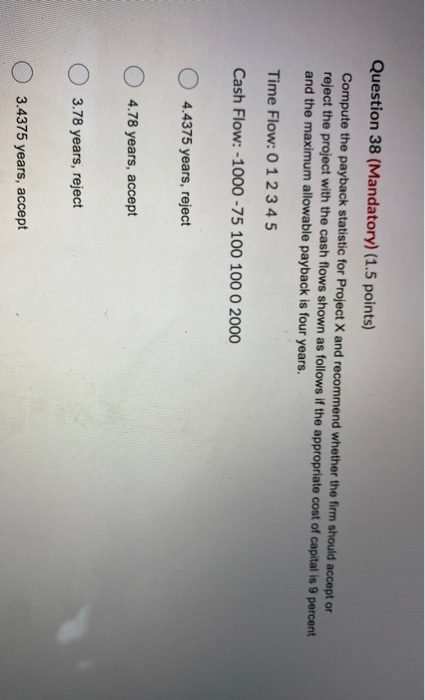

Question 36 (Mandatory) (1 point) Which of these is a capital budgeting technique that generates decision rules and associated metrics for choosing projects based upon the implicit expected geometric average of a project's rate of return? Internal rate of return Profitability index Net present value Discounted payback Question 37 (Mandatory) (1.5 points) Compute the NPV for Project X and accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 9 percent. Time Flow: 0 1 2 3 4 5 Cash Flow: -1000 -75 100 100 0 2000 $392.44 0 8486.29 $360.04 O $639.96 Question 38 (Mandatory) (1.5 points) Compute the payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 9 percent and the maximum allowable payback is four years. Time Flow: 0 1 2 3 4 5 Cash Flow: -1000 -75 100 100 0 2000 O 4.4375 years, reject 4.78 years, accept 3.78 years, reject O 3.4375 years, accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts