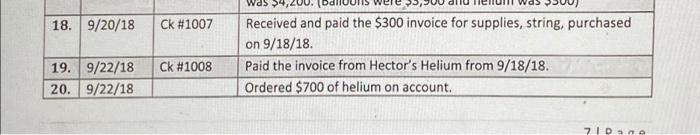

Question: please help me with these two questions Was > 18. 9/20/18 Ck #1007 Received and paid the $300 invoice for supplies, string, purchased on 9/18/18.

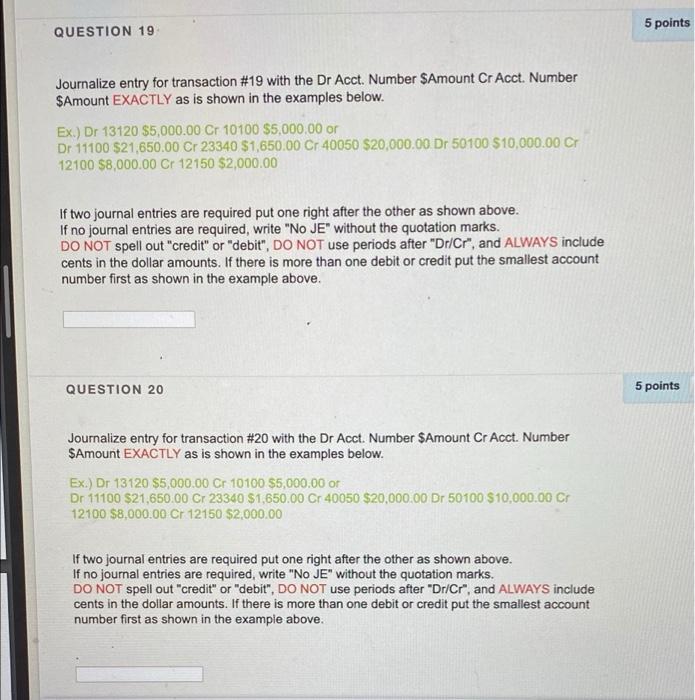

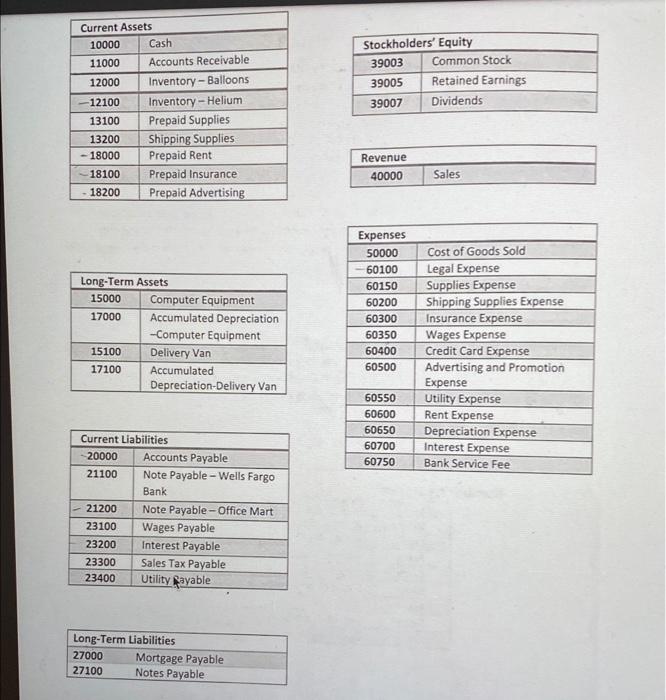

Was > 18. 9/20/18 Ck #1007 Received and paid the $300 invoice for supplies, string, purchased on 9/18/18. Paid the invoice from Hector's Helium from 9/18/18. Ordered $700 of helium on account. Ck #1008 19. 9/22/18 20. 9/22/18 7 ID 5 points QUESTION 19 Journalize entry for transaction #19 with the Dr Acct. Number $Amount Cr Acct. Number $Amount EXACTLY as is shown in the examples below. Ex.) Dr 13120 $5,000.00 Cr 10100 $5,000.00 or Dr 11100 $21,650,00 Cr 23340 $1,650.00 Cr 40050 $20,000.00 Dr 50100 $10,000.00 CM 12100 $8,000.00 Cr 12150 $2,000.00 If two journal entries are required put one right after the other as shown above. If no journal entries are required, write "No JE" without the quotation marks. DO NOT spell out "credit" or "debit", DO NOT use periods after "Dr/Cr", and ALWAYS include cents in the dollar amounts. If there is more than one debit or credit put the smallest account number first as shown in the example above. QUESTION 20 5 points Journalize entry for transaction #20 with the Dr Acct. Number $Amount Cr Acct. Number $Amount EXACTLY as is shown in the examples below. Ex.) Dr 13120 $5,000.00 Cr 10100 $5,000.00 or Dr 11100 $21,650.00 Cr 23340 $1,650.00 Cr 40050 $20,000.00 Dr 50100 $10,000.00 CS 12100 $8,000.00 Cr 12150 $2,000.00 If two journal entries are required put one right after the other as shown above. If no journal entries are required, write "No JE" without the quotation marks. DO NOT spell out "credit" or "debit", DO NOT use periods after "Dr/Cr", and ALWAYS include cents in the dollar amounts. If there is more than one debit or credit put the smallest account number first as shown in the example above. Stockholders' Equity 39003 Common Stock 39005 Retained Earnings 39007 Dividends Current Assets 10000 Cash 11000 Accounts Receivable 12000 Inventory - Balloons 12100 Inventory - Helium 13100 Prepaid Supplies 13200 Shipping Supplies - 18000 Prepaid Rent 18100 Prepaid Insurance 18200 Prepaid Advertising Revenue 40000 Sales Long-Term Assets 15000 Computer Equipment 17000 Accumulated Depreciation -Computer Equipment 15100 Delivery Van 17100 Accumulated Depreciation-Delivery Van Expenses 50000 60100 60150 60200 60300 60350 60400 60500 Cost of Goods Sold Legal Expense Supplies Expense Shipping Supplies Expense Insurance Expense Wages Expense Credit Card Expense Advertising and Promotion Expense Utility Expense Rent Expense Depreciation Expense Interest Expense Bank Service Fee 60550 60600 60650 60700 60750 Current Liabilities 20000 Accounts Payable 21100 Note Payable-Wells Fargo Bank 21200 Note Payable-Office Mart 23100 Wages Payable 23200 Interest Payable 23300 Sales Tax Payable 23400 Utility Rayable Long-Term Liabilities 27000 Mortgage Payable 27100 Notes Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts