Question: please help me with this accounting excel assignment. please indicate how to get the answers as well so i can learn from them. thank you

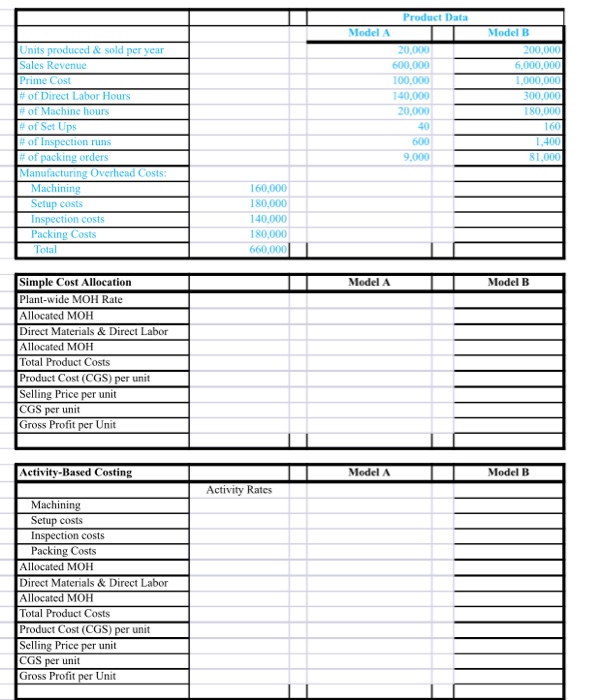

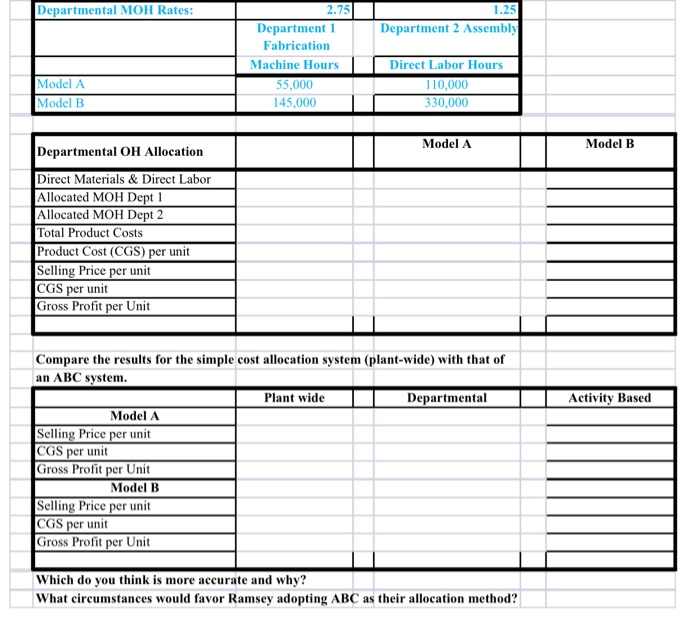

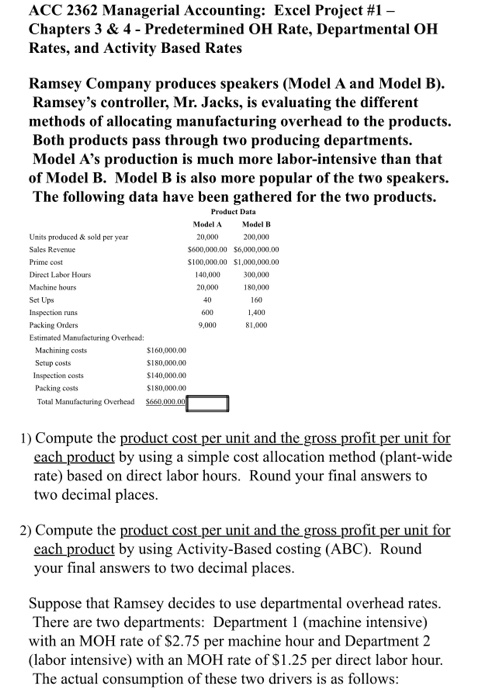

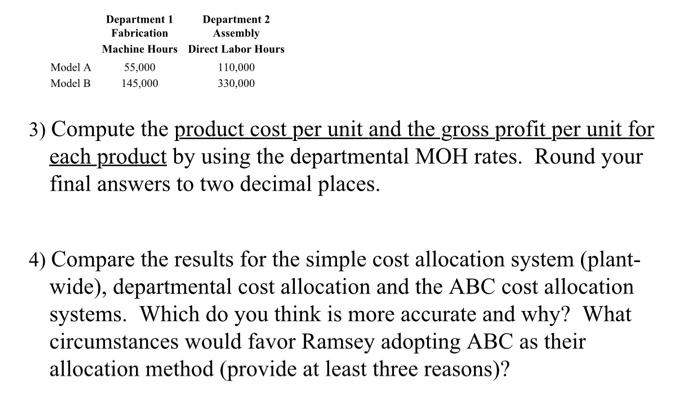

Units produced & sold per year Sales Revenue Prime Cost # of Direct Labor Hours # of Machine hours of Set Ups of Inspection runs of packing orders Manufacturing Overhead Costs: Machining Setup costs Inspection costs Packing Costs Total Product Data Model A 20.000 600,000 100,000 140,000 20,000 40 600 9.000 Model B 200,000 6,000,000 1,000,000 300,000 180,000 160 1,400 81.000 160,000 180,000 140,000 180,000 660,000 Model A Model B Simple Cost Allocation Plant-wide MOH Rate Allocated MOH Direct Materials & Direct Labor Allocated MOH Total Product Costs Product Cost (CGS) per unit Selling Price per unit CGS per unit Gross Profit per Unit Activity-Based Costing Model A Model B Activity Rates Machining Setup costs Inspection costs Packing Costs Allocated MOH Direct Materials & Direct Labor Allocated MOH Total Product Costs Product Cost (CGS) per unit Selling Price per unit CGS per unit Gross Profit per Unit Departmental MOH Rates: 1.25 Department 2 Assembly 2.75 Department 1 Fabrication Machine Hours 55,000 145,000 Model A Model B Direct Labor Hours 110,000 330,000 Model A Model B Departmental OH Allocation Direct Materials & Direct Labor Allocated MOH Dept 1 Allocated MOH Dept 2 Total Product Costs Product Cost (CGS) per unit Selling Price per unit CGS per unit Gross Profit per Unit Activity Based Compare the results for the simple cost allocation system (plant-wide) with that of an ABC system. Plant wide Departmental Model A Selling Price per unit CGS per unit Gross Profit per Unit Model B Selling Price per unit CGS per unit Gross Profit per Unit Which do you think is more accurate and why? What circumstances would favor Ramsey adopting ABC as their allocation method? ACC 2362 Managerial Accounting: Excel Project #1 Chapters 3 & 4 - Predetermined OH Rate, Departmental OH Rates, and Activity Based Rates Ramsey Company produces speakers (Model A and Model B). Ramsey's controller, Mr. Jacks, is evaluating the different methods of allocating manufacturing overhead to the products. Both products pass through two producing departments. Model A's production is much more labor-intensive than that of Model B. Model B is also more popular of the two speakers. The following data have been gathered for the two products. Product Data Model A Model B Units produced & sold per year 20,000 200,000 Sales Revue 5600,000.00 $6,000,000.00 Prime cost $100,000.00 $1,000,000.00 Direct Labor Hours 140,000 300,000 Machine hours 20,000 180,000 Set Ups 40 160 Inspection runs 600 1,400 Packing Orders 9,000 81.000 Estimated Manufacturing Overhead: Machining costs $160,000.00 Setup costs $180,000,00 Inspection costs $140,000.00 Packing costs $180,000.00 Total Manufacturing Overhead $60,000.00 1) Compute the product cost per unit and the gross profit per unit for each product by using a simple cost allocation method (plant-wide rate) based on direct labor hours. Round your final answers to two decimal places. 2) Compute the product cost per unit and the gross profit per unit for each product by using Activity-Based costing (ABC). Round your final answers to two decimal places. Suppose that Ramsey decides to use departmental overhead rates. There are two departments: Department 1 (machine intensive) with an MOH rate of $2.75 per machine hour and Department 2 (labor intensive) with an MOH rate of $1.25 per direct labor hour. The actual consumption of these two drivers is as follows: Department 1 Department 2 Fabrication Assembly Machine Hours Direct Labor Hours 55,000 110,000 145,000 330,000 Model A Model B 3) Compute the product cost per unit and the gross profit per unit for each product by using the departmental MOH rates. Round your final answers to two decimal places. 4) Compare the results for the simple cost allocation system (plant- wide), departmental cost allocation and the ABC cost allocation systems. Which do you think is more accurate and why? What circumstances would favor Ramsey adopting ABC as their allocation method (provide at least three reasons)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts