Question: Please help me with this accounting question Question 15 1 pts Assuming a FICA tax rate of 7.65% on the first $117,000 in wages, 1.45%

Please help me with this accounting question

Please help me with this accounting question

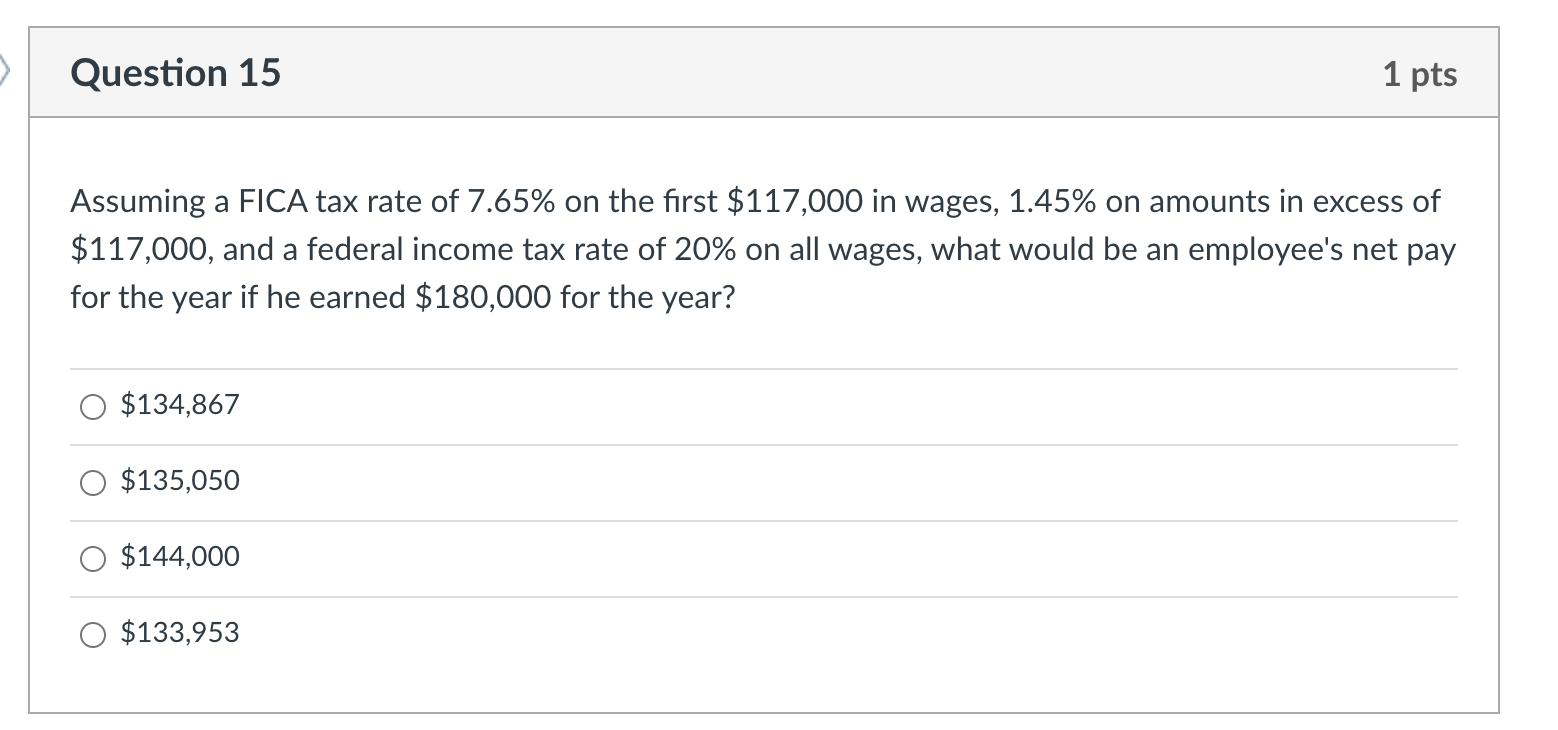

Question 15 1 pts Assuming a FICA tax rate of 7.65% on the first $117,000 in wages, 1.45% on amounts in excess of $117,000, and a federal income tax rate of 20% on all wages, what would be an employee's net pay for the year if he earned $180,000 for the year? O $134,867 O $135,050 O $144,000 O $133,953

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts