Question: please help me with this asap, will upvote if you are a right, thank you, question 3 only thank you D Question 3 6 pts

please help me with this asap, will upvote if you are a right, thank you, question 3 only thank you

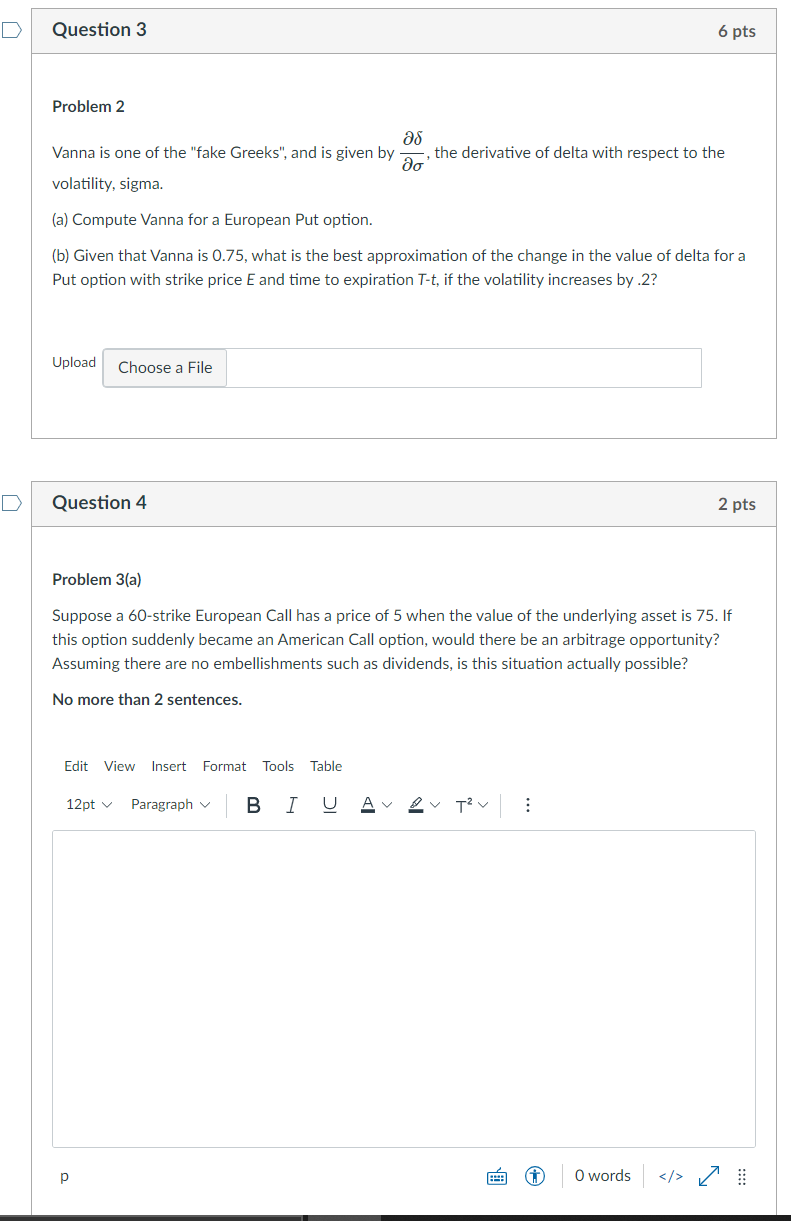

D Question 3 6 pts Problem 2 the derivative of delta with respect to the Vanna is one of the "fake Greeks", and is given by volatility, sigma. (a) Compute Vanna for a European Put option. (b) Given that Vanna is 0.75, what is the best approximation of the change in the value of delta for a Put option with strike price E and time to expiration T-t, if the volatility increases by 2? Upload Choose a File D Question 4 2 pts Problem 3(a) Suppose a 60-strike European Call has a price of 5 when the value of the underlying asset is 75. If this option suddenly became an American Call option, would there be an arbitrage opportunity? Assuming there are no embellishments such as dividends, is this situation actually possible? No more than 2 sentences. Edit View Insert Format Tools Table 12ptv Paragraph B I U ALT?v : 0 O words > o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts