Question: Please help me with this financial math problem. I don't know about delta hedging uu G1. You buy 1000 six months ATM call options on

Please help me with this financial math problem. I don't know about delta hedging

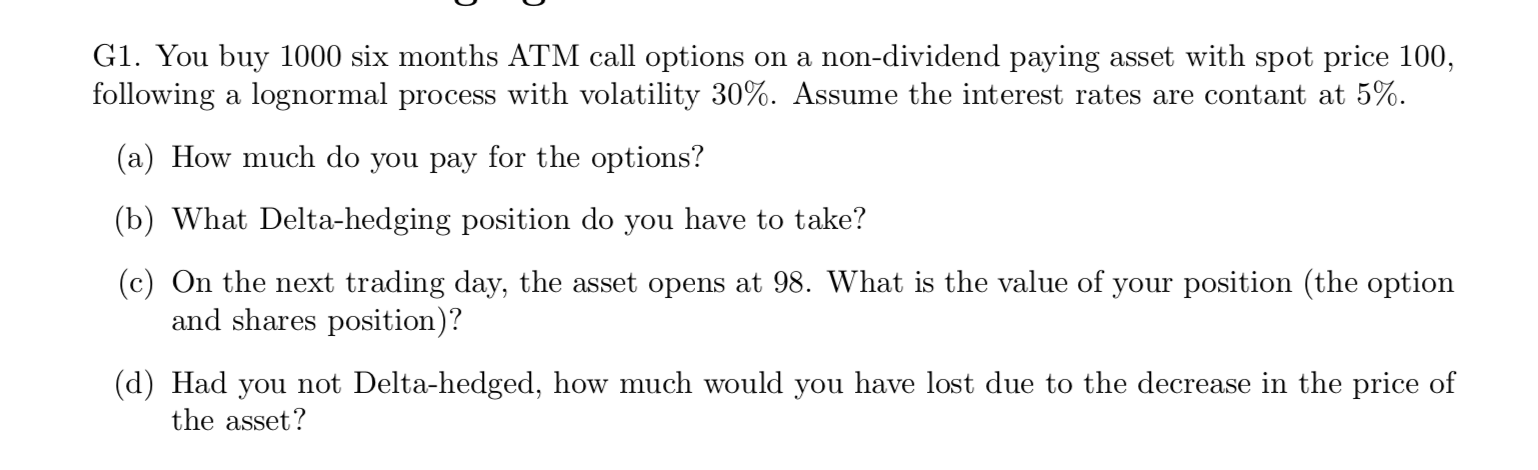

uu G1. You buy 1000 six months ATM call options on a nondividend paying asset with spot price 100, following a lognormal process with volatility 30%. Assume the interest rates are contant at 5%. (a) How much do you pay for the options? (1)) What Deltahedging position do you have to take? (c) On the next trading day, the asset opens at 98. What is the value of your position (the option and shares position)? ((1) Had you not Deltahedged, how much would you have lost due to the decrease in the price of the asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts