Question: Please help me with this, I kept getting the last two rows and the last question wrong The following selected transactions were taken from the

Please help me with this, I kept getting the last two rows and the last question wrong

The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31:

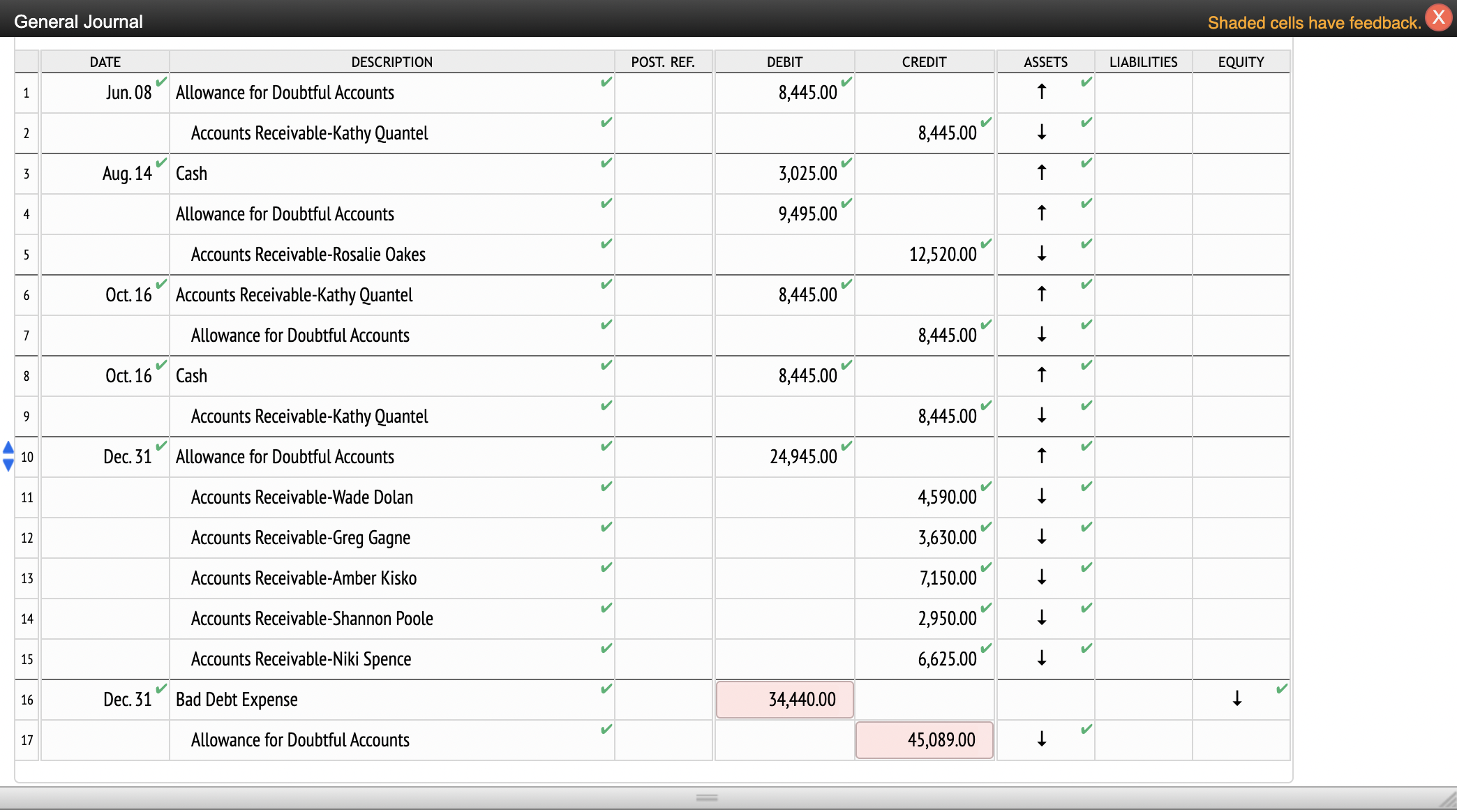

| June | 8 | Wrote off account of Kathy Quantel, $8,445. | |

| Aug. | 14 | Received $3,025 as partial payment on the $12,520 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. | |

| Oct. | 16 | Received the $8,445 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt. | |

| Dec. | 31 | Wrote off the following accounts as uncollectible (record as one journal entry): | |

| Wade Dolan | $4,590 | ||

| Greg Gagne | 3,630 | ||

| Amber Kisko | 7,150 | ||

| Shannon Poole | 2,950 | ||

| Niki Spence | 6,625 | ||

| 31 | If necessary, record the year-end adjusting entry for uncollectible accounts. |

Rustic Tables Company prepared the following aging schedule for its accounts receivable:

| Aging Class (Number of Days Past Due) | Receivables Balance on December 31 | Estimated Percent of Uncollectible Accounts |

| 030 days | $323,300 | 1% |

| 3160 days | 112,800 | 3 |

| 6190 days | 23,100 | 12 |

| 91120 days | 17,600 | 35 |

| More than 120 days | 42,000 | 70 |

| Total receivables | $518,800 |

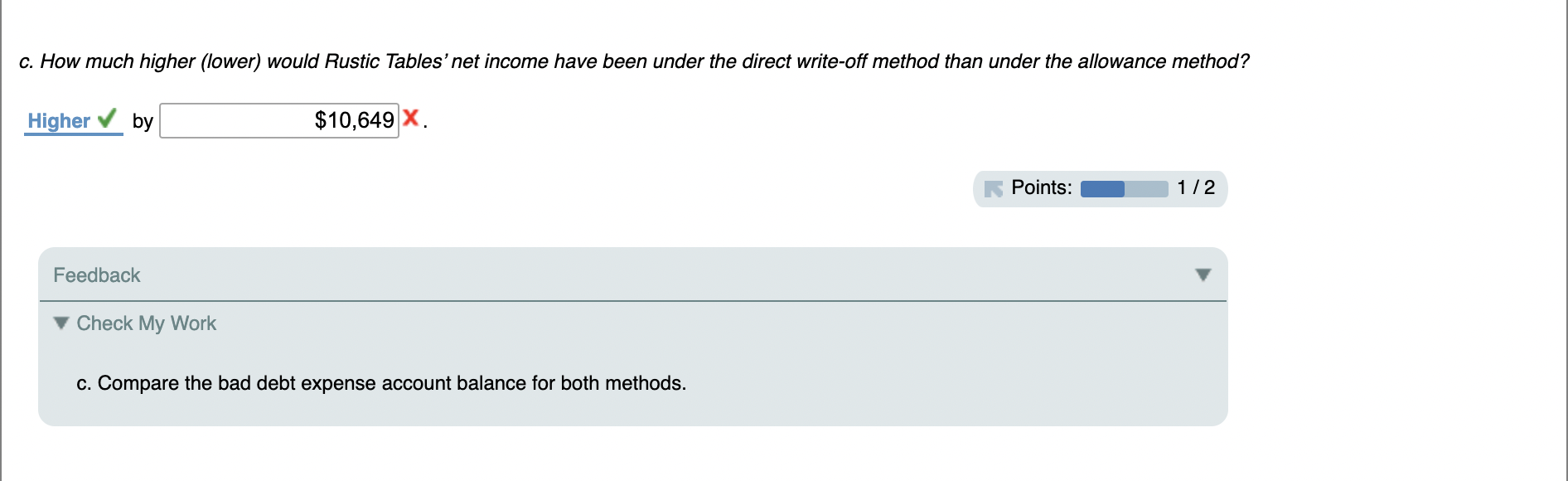

General Journal Shaded cells have feedback. c. How much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance method? by K. Feedback Check My Work c. Compare the bad debt expense account balance for both methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts