Question: please help me with this kindly QUESTION TWO Historical performance information on the capital market and a mutual fund Yearwal und Mutual fine Return on

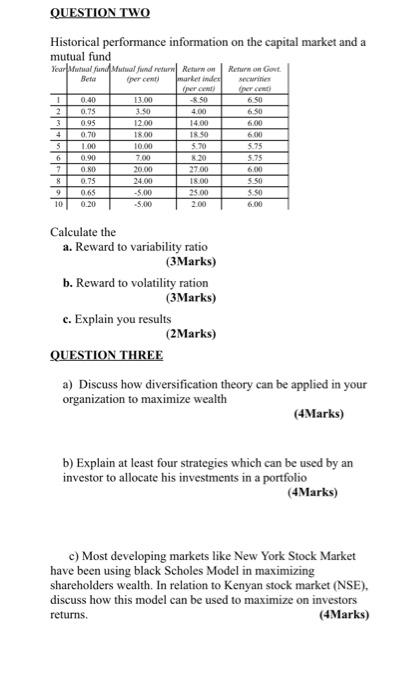

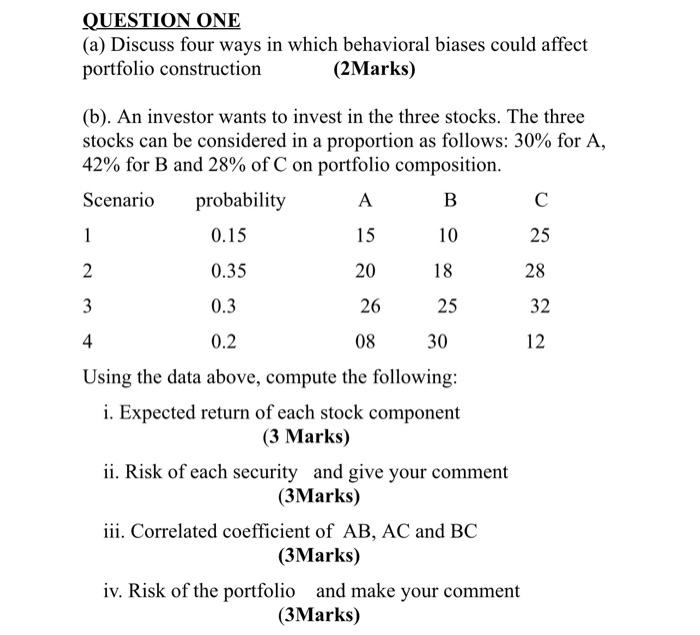

QUESTION TWO Historical performance information on the capital market and a mutual fund Yearwal und Mutual fine Return on Return on Govt. Beta (c marketinde Cherc 1 13.00 wines 0.40 SO 6.50 2 3 4 5 6 7 8 9 10 0.75 0.95 070 1.00 0.90 O.RO 0.75 0.65 0.20 350 12.00 1800 10.00 700 20.00 24.00 -5.00 -5.00 4.00 1400 IR SO 5.70 8:20 27 00 18.00 25.00 2.00 6 50 6.00 6.00 5.75 5.75 6.00 5.50 5.50 6.00 Calculate the a. Reward to variability ratio (3Marks) b. Reward to volatility ration (3Marks) c. Explain you results (2Marks) QUESTION THREE a) Discuss how diversification theory can be applied in your organization to maximize wealth (4Marks) b) Explain at least four strategies which can be used by an investor to allocate his investments in a portfolio (4Marks) c) Most developing markets like New York Stock Market have been using black Scholes Model in maximizing shareholders wealth. In relation to Kenyan stock market (NSE). discuss how this model can be used to maximize on investors returns (4Marks) QUESTION ONE (a) Discuss four ways in which behavioral biases could affect portfolio construction (2Marks) (b). An investor wants to invest in the three stocks. The three stocks can be considered in a proportion as follows: 30% for A, 42% for B and 28% of C on portfolio composition. Scenario probability A B C 1 0.15 15 10 25 2 0.35 20 18 28 3 0.3 26 32 25 30 4 0.2 08 12 Using the data above, compute the following: i. Expected return of each stock component (3 Marks) ii. Risk of each security and give your comment (3Marks) iii. Correlated coefficient of AB, AC and BC (3Marks) iv. Risk of the portfolio and make your comment (3Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts