Question: please help me with this multiple part question and i will guve a positive rating! the 4th picture is from a previous similar question that

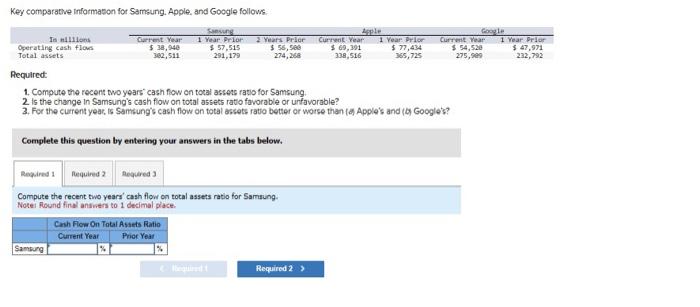

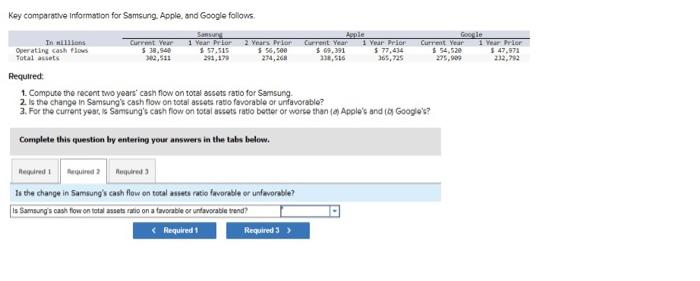

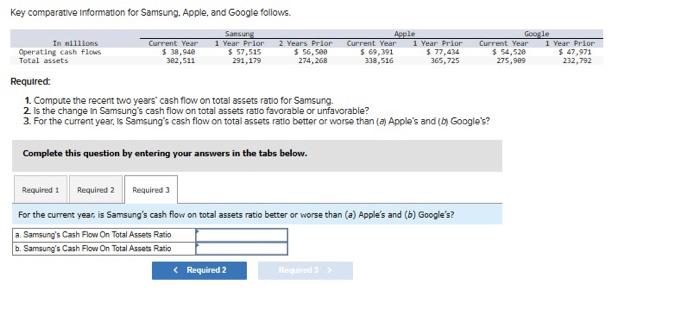

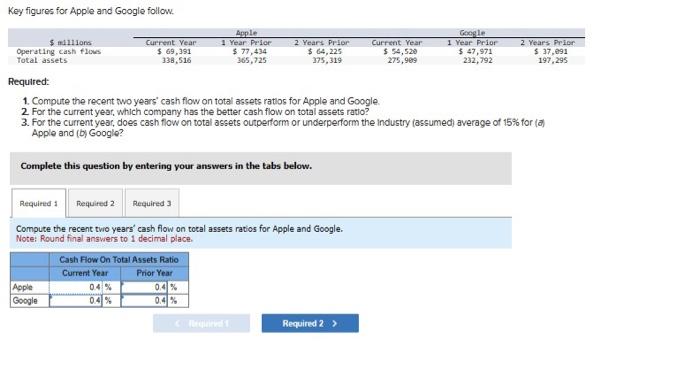

Key comparabve informason for Samsung. Apple. and Google follove. Pequired: 1. Compute the recent two years cash fow on total assess rasio for Samsung. 2 is the change in Samsung's cash flow on total assets ratio favorable or unfavorable? 3. For the current year, is Sambung's cash flow on total assete ratoo better or worse than (as Apple's and (c) Gocgle's? Complete this question by entering your answers in the tabs below. Campute the recent two years' cash flow on total assets ratio for Samsung. Notei found firal andiners to 1 decimal place. Key comparatve information for Ssmsung Apple, and Google follows. Required: 1. Compute the recent wo years cash flow on total assets ravo for Samsung. 2. Is the change in Samsung's cash flow on total assets rato foverable or urfavorable? 3. For the current yeac is Sameung's cash flow on total asets ratto bether or worse than (a) Apple's and (og Google's? Complete this question by entering your answers in the tabs below. Ws the change in Samsung's cash flow on tocal asiete ratio favorable or unf evoreble? is Samsung's cash fow on lotal assets abio on a tavorable oe untaverabie tend? Key comparatve infomation for Samsung. Apple, and Google follows. Required 1. Compute the recent two years" cash flow on total aseets ratio for Samsung. 2 is the change in Samsung's cash flow on total assets ratio favorable or urfavorable? 3. For the current year, is Samsung's cash flow on total assets ratio better or worse than (a) Apple's and (b) Google's? Complete this question by entering your answers in the tabs below. For the current year, is Samsung's cash flow on total assets ratio better or worse than (a) Apple's and (b) Goople's? Key figures for Apple and Google follow. Required: 1. Compute the recent two years' cash flow on total assets ratios for Apple and Google. 2. For the current year, which company has the better cash flow on total assets ratio? 3. For the current year, does cash flow on total assets outpertorm or underperform the industry (assumed) average of 15% for (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Compute the recent two years' cash flow on tocal assets ratios for Apple and Google. Note: Round final answers to 1 decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts