Question: please help me with this one Coltran Industries purchased a vehicle for $23,000 on April 1, 2019. The service life was estimated at 5 years

please help me with this one

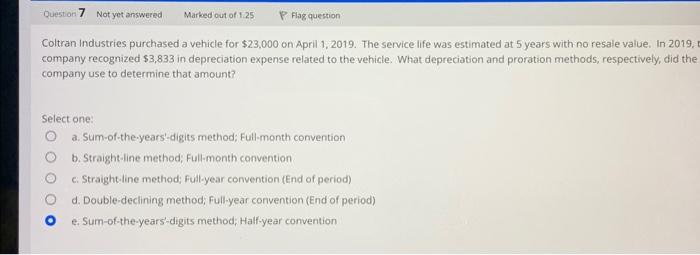

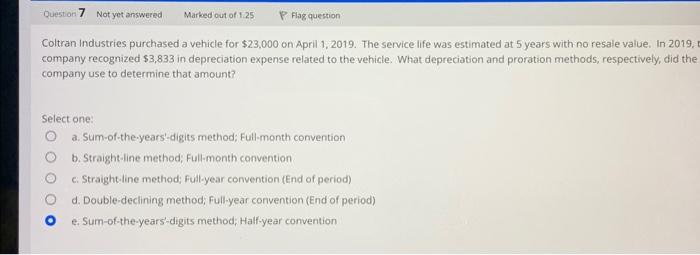

Coltran Industries purchased a vehicle for $23,000 on April 1, 2019. The service life was estimated at 5 years with no resale value, In 2019 , company recognized $3,833 in depreciation expense related to the vehicle. What depreciation and proration methods, respectively, did the company use to determine that amount? Select one: a. Sum-of-the-years'-digits method; Full-month convention b. Straight-line method; Full-month convention c. Straight-line method; Full-year convention (End of period) d. Double-declining method; Full-year convention (End of period) e. Sum-of-the-years-digits method; Half-year convention

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock