Question: Please help me with this practice question for my assignment, please explain each step in detail. Do not copy previously answered questions I believe there

Please help me with this practice question for my assignment, please explain each step in detail. Do not copy previously answered questions I believe there are errors in their calculation. After trying for myself I still cant get the suggested solution answer.

Please help me with this practice question for my assignment, please explain each step in detail. Do not copy previously answered questions I believe there are errors in their calculation. After trying for myself I still cant get the suggested solution answer.

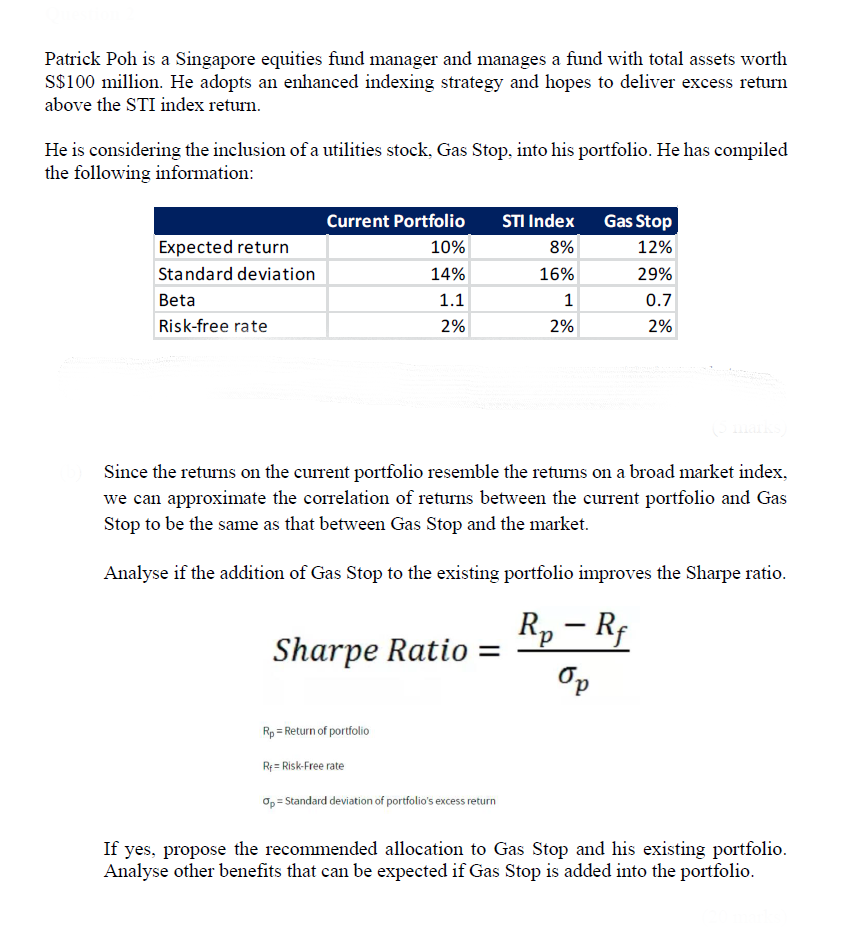

Patrick Poh is a Singapore equities fund manager and manages a fund with total assets worth S$100 million. He adopts an enhanced indexing strategy and hopes to deliver excess return above the STI index return. He is considering the inclusion of a utilities stock, Gas Stop, into his portfolio. He has compiled the following information: Expected return Standard deviation Beta Risk-free rate Current Portfolio 10% 14% 1.1 STI Index 8% 16% 1 2% Gas Stop 12% 29% 0.7 2% 2% Since the returns on the current portfolio resemble the returns on a broad market index, we can approximate the correlation of returns between the current portfolio and Gas Stop to be the same as that between Gas Stop and the market. Analyse if the addition of Gas Stop to the existing portfolio improves the Sharpe ratio. Rp -RI Sharpe Ratio = Rp = Return of portfolio Rp = Risk-Free rate Op = Standard deviation of portfolio's excess return If yes, propose the recommended allocation to Gas Stop and his existing portfolio. Analyse other benefits that can be expected if Gas Stop is added into the portfolio. Patrick Poh is a Singapore equities fund manager and manages a fund with total assets worth S$100 million. He adopts an enhanced indexing strategy and hopes to deliver excess return above the STI index return. He is considering the inclusion of a utilities stock, Gas Stop, into his portfolio. He has compiled the following information: Expected return Standard deviation Beta Risk-free rate Current Portfolio 10% 14% 1.1 STI Index 8% 16% 1 2% Gas Stop 12% 29% 0.7 2% 2% Since the returns on the current portfolio resemble the returns on a broad market index, we can approximate the correlation of returns between the current portfolio and Gas Stop to be the same as that between Gas Stop and the market. Analyse if the addition of Gas Stop to the existing portfolio improves the Sharpe ratio. Rp -RI Sharpe Ratio = Rp = Return of portfolio Rp = Risk-Free rate Op = Standard deviation of portfolio's excess return If yes, propose the recommended allocation to Gas Stop and his existing portfolio. Analyse other benefits that can be expected if Gas Stop is added into the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts