Question: please help me with this practice question. its all one question. take ur time. Bridget Krumb, Inc. purchased inventory costing $110,000 and sold 85% of

please help me with this practice question. its all one question. take ur time.

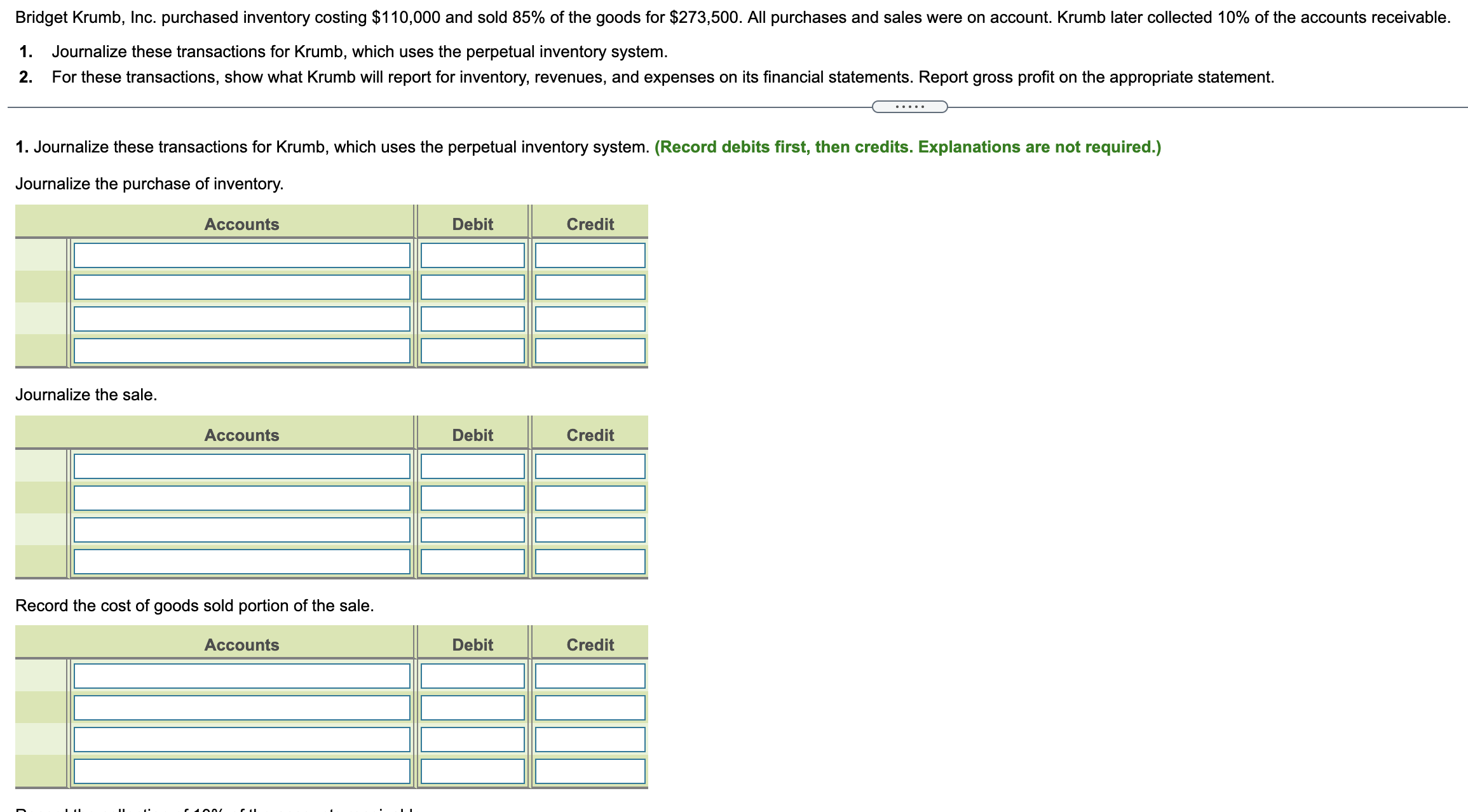

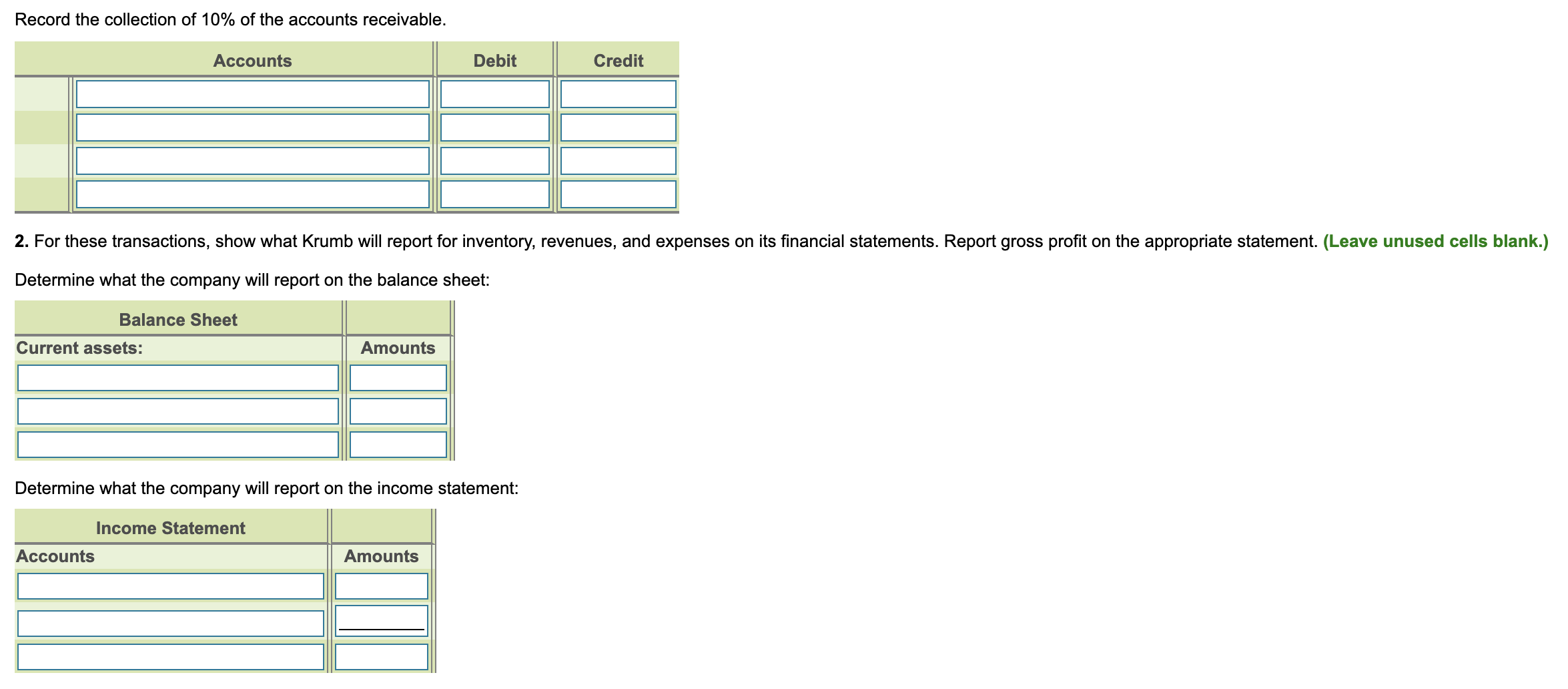

Bridget Krumb, Inc. purchased inventory costing $110,000 and sold 85% of the goods for $273,500. All purchases and sales were on account. Krumb later collected 10% of the accounts receivable. 1. Joumalize these transactions for Krumb, which uses the perpetual inventory system. 2. For these transactions, show what Krumb will report for inventory, revenues, and expenses on its nancial statements. Report gross prot on the appropriate statement. 1. Joumalize these transactions for Krumb, which uses the perpetual inventory system. (Record debits first, then credits. Explanations are not required.) Journalize the purchase of inventory. Accounts Debit Credit Journalize the sale. Accounts Debit Credit Record the cost of goods sold portion of the sale. Accounts Debit Credit Record the collection of 10% of the accounts receivable. Accounts Debit Credit 2. For these transactions, show what Krumb will report for inventory, revenues, and expenses on its nancial statements. Report gross prot on the appropriate statement. (Leave unused cells blank.) Determine what the company will report on the balance sheet: Balance Sheet Current assets: Accounts Amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts